Axis Bank Sukanya Samriddhi Account 2023: Axis Bank is the third largest private sector bank in India. Sukanya Samriddhi Account is a Government of India backed saving scheme targeted at the parents of girl children. The scheme encourages parents to build a fund for the future education and marriage expenses for their female child. The bank offers financial services to customers from large and mid-sized corporates, MSME, agriculture and retail businesses.

It is headquartered at Ahmedabad and has over 2402 branches across India. Axis Bank offers treasury options, retail banking, corporate banking, NRI services, Business Banking, Investment Banking, lending to small and medium enterprises, agriculture banking, advisory services and ping pay services to customers.

Reserve Bank of India has authorised Axis Bank to open Sukanya Samriddhi Account (SSA). This small saving scheme was launched by the Prime Minister, Narendra Modi. This scheme is designed to encourage saving to meet the financial needs like education and marriage of a girl child.

Factors Sukanya Samriddhi Yojana

The factors that affect the working of Sukanya Samriddhi Yojana are as follows:

- The account can be opened for a girl child in India from the time of her birth till the child turns 10 years.

- The minimum deposit is Rs.1,000 while opening the account. If you wish to revive the account, you have to pay a penalty of Rs.50 along with the minimum subscription amount that has to be paid annually. You can use the Sukanya Samriddhi Yojana calculator for calculating how much monthly amount you want to put in your Sukanya Samriddhi Account.

- A single account can be opened for a child.

- The interest rates differ from year to year.

- Premature withdrawal is allowed when the child turns 18.

Process of opening Sukanya Samriddhi Account

The account has to be opened by the girl child’s parent or legal guardian. You will need to fill in the Sukanya Samriddhi Yojana application form and submit it with Axis bank with the child’s birth certificate and parent’s or legal guardian’s address and photo ID proof. On successful opening of the account, you will receive a passbook that contains details of date of birth of the child, opening date, account number, address and name with the details of the preliminary amount deposited. The passbook has to be submitted while depositing or receiving interest or at the time of maturity.

Benefits of Axis Bank Sukanya Samriddhi Account

The benefits of having a Axis Sukanya Samriddhi account are as follows:

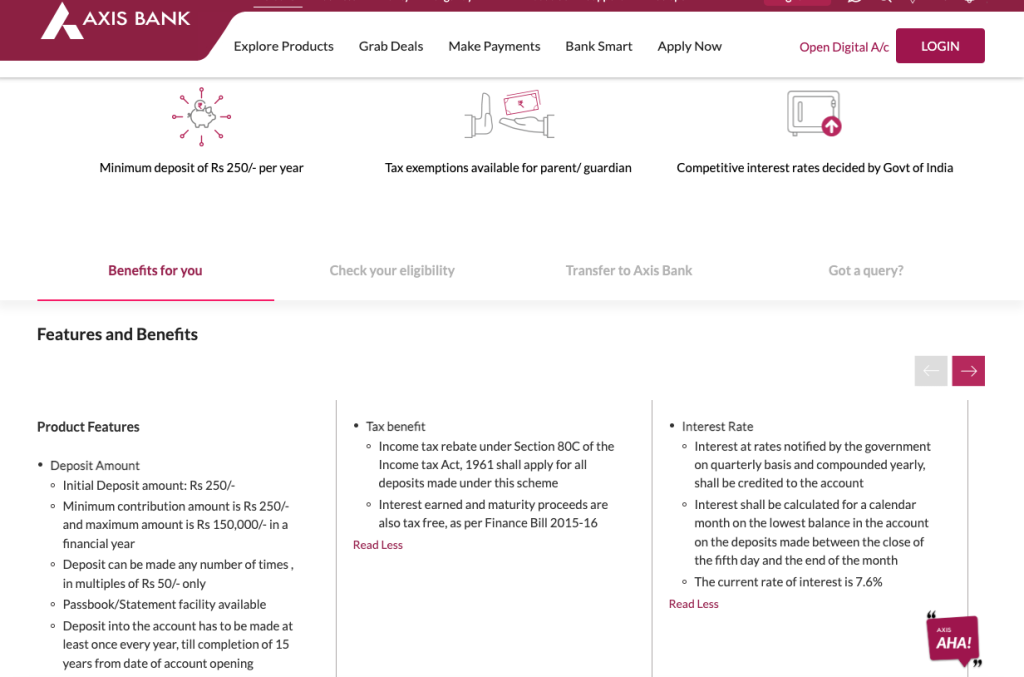

- You get a higher rate of interest when compared to the other small savings schemes. The interest rate offered for the current year is 7.6 percent per annum. The government will declare the applicable rate of interest every year. This interest is compounded and credited every year.

- Contributions made to the Sukanya Samriddhi account and interest earned are exempt from tax under Section 80C of the Income Tax Act, 1961. This exemption is also allowed at the time of withdrawal.

- The account matures in 21 years from the date of opening the account or on the date when the child marries. The account will stop operating after the marriage.

- When the girl child turns 18, one pre mature withdrawal is allowed. This withdrawal is allowed if she wishes to pursue further education or decides to get married.

- Premature withdrawal is allowed to the extent of 50 percent of the balance in the account at the end of the preceding financial year.

- Deposits in Axis Bank Sukanya Samriddhi Account are to be made till the completion of 14 years from the date of opening the account.

- The accrued interest will be paid to the girl child at maturity.

- If the account is not closed after maturity, you will earn interest on the amount available in the account till the date the account is closed.

- The account can be opened with Rs.1,000 as initial deposit and it is subject to a maximum limit of Rs.1.5 lakhs in a financial year.

- You need to deposit at least Rs.1,000 every year to keep the account active.

- The girl child can operate the account after she turns 10.

- The account can be easily transferred anywhere in India.

Documentation

- SSY Account Opening Form

- Birth Certificate of girl child

- Identity proof (as per RBI KYC guidelines)

- Residence proof (as per RBI KYC guidelines)

Features of Axis Bank Sukanya Samriddhi Account

The features of the Axis Bank Sukanya Samriddhi Account are as follows:

- The account can be opened by the parent or legal guardian on behalf of a girl child.

- Only two accounts can be opened and in case of twins, 3 accounts can be opened.

- The minimum deposit is Rs.1,000 subject to a maximum deposit of Rs.1.5 lakhs in a year.

- The deposit tenure is 21 years from the date of opening the account.

- Deposits can be made for up to 14 years from the date of opening the account.

- The interest rate offered is 7.6 percent.

- You will be eligible for tax rebate under Section 80C of the Income Tax Act, 1961.

- Premature closure is allowed in the event the depositor dies.

- The account can be revived, by paying Rs.50 towards the end of the year along with a specified minimum amount for that year.

- The deposits can be made through cash, cheque or demand draft.

- When the girl child turns 18, up to 50 percent of the balance can be withdrawn for meeting the expenses of higher education or towards her marriage.

What are the documents required for opening SSY account with Axis Bank?

Ans : For customers having relationship with Axis Bank which is greater than 2 years, the following documents are required:

- Sukanya Samriddhi Yojana Scheme Account Opening Form

- Passport size photograph

- Birth Certificate of girl child

- Identity proof – as per RBI KYC policy

- Residence proof – as per RBI KYC policy

Frequently Asked Questions

How do I apply for Sukanya Samriddhi Yojana (SSY) account through Axis Bank?

Ans : To apply for Sukanya Samriddhi Yojana scheme, the guardian is required to fill the Account Opening Form on behalf of the minor girl child and submit it at any Axis Bank branch with the KYC documents.

What is the eligibility for investing under SSY scheme?

Ans : The account can be opened by the natural or legal guardian in the name of a girl child from the birth of the girl child till she attains the age of 10 years A depositor can open and operate only one account in the name of a girl child Natural or legal guardian of a girl child can be allowed to open the account for two girl children only. The third account in the name of the girl child can be opened in the event of birth of twin girls as second birth or if the first birth itself results into three girl children.

Can SSY account be transferred to Axis Bank? What is the process for transferring SSY account?

Ans : Customers can transfer their existing SSY account held with other bank/ Post Office to Axis Bank SSY transfer process – Customer needs to submit SSY Transfer Request at existing bank/ Post Office mentioning the address of Axis Bank branch The existing bank/Post Office shall arrange to send the original documents such as a certified copy of the account statement, the Account Opening Application, specimen signature, etc. to the Axis Bank branch address, along with a cheque/ DD for the outstanding balance in the SSY account. Once the transfer documents are received at Axis Bank branch, the customer is required to submit new SSY Account Opening Form along with fresh set of KYC documents.

What is the minimum and maximum amount that can be invested in SSY account?

Ans : The minimum deposit amount is Rs. 1,000 per annum and the maximum amount is Rs. 1,50,000 per annum.

What happens if the account holder fails to deposit any amount in one or more Financial Years?

Ans : Penalty of Rs. 50 will be levied per year of default, if the customer does not deposit the minimum deposit amount of Rs. 1,000 in a financial year.

What is the Interest earned in SSY account?

Ans : As notified by Ministry of Finance, the rate of interest for FY 2020-2021 in SSY account is 7.6%, which is compounded annually. The interest rate is as governed by Ministry of Finance from time to time.

Can Loan facility be availed in SSY account?

Ans : No, loan facility cannot be availed.

Can partial withdrawal be availed in SSY account?

Ans : Yes, partial withdrawal facility can be availed only when the account holder (i.e the girl child) attains the age of 18 years.

Can SSY account be closed before maturity?

Ans : No, premature closure is not allowed in SSY account.

When does a SSY account mature?

Ans : The SSY account matures after completion of 21 years from the date of account opening.

Recommended