Axis Bank Launched Axis Pay UPI App on Official Play Store Account, BHIM Axis Pay 2022. Download Axis Pay unified payment interface app. Check Complete details for How to Use Axis Bank UPI App. Here’s a quick guide to everything you need to know about the UPI.

Must – Axis Bank Balance Enquiry Number

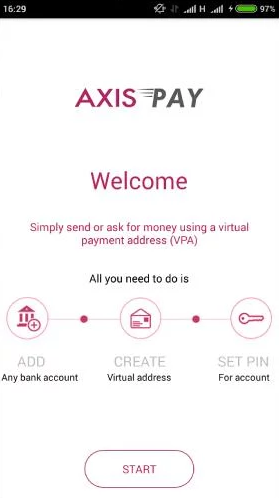

Axis Bank presents Axis Pay – A Unified Payments Interface(UPI) application that lets you transfer funds from any bank account using a Virtual Payment Address (VPA). No need to remember beneficiary details like account number, IFSC etc. Send or Ask for money using a Virtual Payment Address.

A Virtual Payment Address (VPA) is a unique identifier that you set and link to your bank account. (Example: yourname@axisbank ). Once linked, just quote your VPA instead of account number and IFSC to make or receive payments. Unified Payments Interface (UPI) is a payment system by NPCI that allows the transfer of funds between accounts in a convenient manner.

Axis Pay UPI App

By Using Axis Pay App you can Make payments easier using Virtual Payment Address(VPA) Pay & collect Payments Very Easily.

| Axis Pay UPI App | Click Here to Download Axis Pay UPI Apk (Direct Link Play Store) |

Steps to Download Axis Bank UPI App

- Step 1 – Visit on Play Store Site – https://play.google.com

- Step 2 – Now in Search Box, Please write Axis Bank UPI App

- Next Step 3 – Now you can see various Apps on Search Page, Please click on “Axis Pay ” (Axis Pay is Official UPI App of Axis Bank)

- Step 4 – Now Please click on “Install” Button

- Step 5 – Now Your app is successfully installed, Your App is Ready to Use for UPI Transactions

Click Here to Download Axis Bank UPI Apk (Direct Link)

Details For Axis Bank UPI Android App

| App Name | Axis Pay UPI App |

| Bank Name | Axis Bank |

| Last Updated | February 28, 2022 |

| Downloads | 5,000,000+ |

| Version of App | 2.7.7 |

| Download Link | Click Here |

How to Use Axis Pay Bank UPI App

- Every Customer will need to have a bank account and a smart phone to use Axis Pay UPI App

- Now Please Download Axis Pay UPI UPI app from Play Store or Using Above Procedure

- Now Install Axis Bank UPI App in Your Smartphone

- After Install UPI APP, Please Open your app

- Now your App is asking for Send a SMS for Confirm your mobile number

- After Confirmation of your Mobile Number, Axis Pay UPI App is started and Show all Menus of Axis Pay App

- Now Please Create your account on Axis Bank UPI App by Entering Following details – Name, Email, Gender, Mobile number, DOB etc..

- Now you will require to set your unique Virtual ID and Generate MPIN by using your Debit Card

- Your Axis Bank UPI App is ready to pay, collect and Check your bank balance

How Axis Pay UPI App is Working

- To send money to someone, you need to know only their UPI ID – a virtual identity like an email address. This could be your name, or your phone number, so for example, if your phone number is 1234567890, then your virtual address could be 1234567890@axisbank (if your bank is Axis Bank) or 1234567890@sbi (if you’re an State bank of India customer), and so on.

- By Using UPI app not need of knowing the recipient’s name, their bank account number, and IFSC code (or bank branch).

- UPI is built on top of the IMPS, which you may have used to transfer money between bank account. Like IMPS, UPI is immediate, and works 24×7, through the year, unlike NEFT or RTGS services, which have specific working hours.

- The UPI can also be used for shopping online – instead of entering your debit card number, expiry date, and CVV code, followed by waiting for the OTP, you’d just enter your UPI ID, and get an alert on your phone to verify the transaction.

Features of Axis Pay UPI App

- Axis Bank or Non Axis Bank customers can send money or ask for money using the Axis Pay app, without knowing their bank account details

- Transfer funds to a Virtual Payment Address(VPA) or to an Account Number

- Add beneficiary instantly by just using Virtual Payment Address (VPA). No need to remember or enter the bank account number and IFSC

- Check balance of linked bank accounts

- Fund transfers are instant, 24*7, 365 days and absolutely free of cost and take place in a completely safe and secure way

Following are the transaction sets supported

- User profile registration

- Bank accounts creation

- Payment address creation

- Authentication

- Authorization

- MPIN generation

What are the requirements for using UPI?

You should have the following:

- An android phone with internet service

- An operative bank account in any Bank

- The mobile number being registered with UPI, must be linked to the bank account.

- Active debit card relating to this account for creating mPIN.

How do I register in the Axis Pay UPI application?

- Create your profile.

- Add bank account.

- Create Virtual Id for linked account.

- Set MPIN for selected account by using Debit Card.

Recommended Articles