Bank of India Credit Card: Bank of India Offer Various types of Credit Cards. Compare and apply for the Bank of India Bank Credit Cards in India. Check eligibility, offers and rewards points on various types of BOI Credit Card. Bank of India offers its credit cards to his customers to full fill every need like – Shopping, Traveling Holidays, International Usages and for Daily Need.

Bank of India cards are issued in alliance with VISA and MasterCard, both companies are the top-rated internationally known Card providers and customers can use both cards in most of countries. These cards are higher acceptability and fidelity for Bank of India cards and is globally recognized. In this article you may find complete information for Bank of India Credit Cards…

Bank of India Credit Card is not only usable for Shopping or lifestyle purpose, but our farmers are also use these cards very easily by using Kishan Credit Card. The various types of credit cards offered by Bank of India are

- Bank of India Visa Gold Card

- Bank of India Visa Platinum Privilege Card

- Bank of India VisaGold Card InternationalCard

- Bank of India TAJ Premium Card

- Bank of India India Card

- Bank of India Credit Card for Pensioners

- Bank of India Navy Classic

- Bank of India Navy Gold

- Bank of India Krishi Vikas Card

- Bank of India – Kisan Credit Card

Features of Bank of India Credit Cards: BOI offers Exceptional Convenience and financial benefits on other latest credit card offers

- Choice of branch billing or direct

- lowest service charges

- No processing fees (No entrance fees)

- 51 Days of Interest Free Period

- Cash Withdraw is easy

- Easy Pay Schemes (BOI Also Offer EMI)

- Add On credit card

- Bank of India Unique Security Plan

- BOI Star Token

- Access BOI Credit Card via BOI Net Banking

Important Features of BOI Credit Cards

| Visa Gold Card | (Valid in India, Nepal & Bhutan)

|

| VisaGold Card InternationalCard | (For Domestic & International)

|

| Visa Platinum Privilege Card | (For Domestic and International)

|

| TAJ Premium Card |

|

| India Card | (Valid in India, Nepal & Bhutan)

|

| Credit Card for Pensioners |

|

| Bank Of India Krishi Vikas Card |

Documents Required

|

Bank of India Credit Card Payment Options

Bank of India offers lot of payment option to its credit card holders to make the make the payment for all types of BOI credit card as per their most suited options, check all options from below….

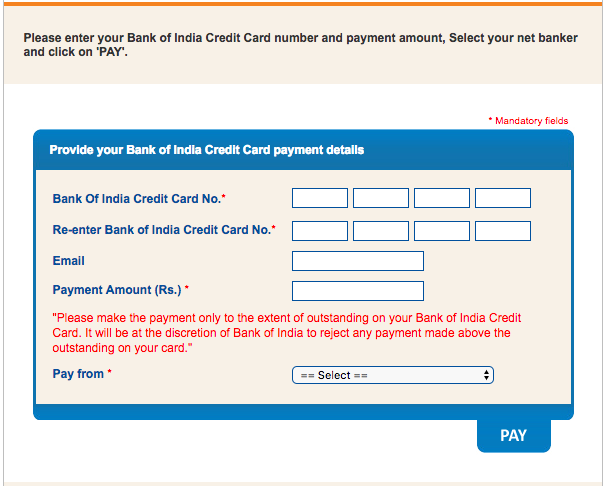

Online Credit Card Bill payment through Bank of India Official Website – All the customers who have Bank of India Credit Card can make the payment for their credit card outstanding using by using BOI Official website. This services is available to all the customers who have valid BOI Credit Card…you may make payment by using any bank internet banking, check detailed procedure from below….

Bank of India Direct Billing Credit Card customers can now make their Credit Card payments online in a secure and convenient manner from other Banks Internet banking account

- Bank of india Credit Card holder have to visit BOI’s website – www.bankofindia.com

- Now you may see “Credit Card Payment Option” under “Ancillary Services” box…Please click on “Credit Card Bill Payment”

- Now you may reach at Credit Card Payment page, click on the Proceed link provided on the disclaimer page. Click Here to Access this page directly

- Provide the card details and relevant personal details where required.

- Select the Bank and branch through which card holders intend to Pay.

- Post Confirmation of the details, the page would be redirected to the payee Banks payment page/s.

- Card holders have to authenticate and duly authorize the payment by providing their credentials on the payee Bank’s website.

- On successful verification and approval, the bank account will be instantaneously debited and card holder shall receive a success message towards payment along with a reference number.

- The payment shall get reflected in the Credit Card Account within 3 working days from the date of payment.

Another Bank of India Credit Card Payment Option

- BOI Credit Card Payment via Cheque / Draft Payment – National Automated Clearing House (NACH) saves you the effort of issuing cheque every month towards the payment of your BOI Card dues. You need to authorize BOI Card to deduct the amount directly from your bank account every month and your card account will be credited on the payment due date. Bank of India Card holder may issue cheque / draft payable to your Bank of India 16 digit Credit Card No. Card holders are advised to mention their name and contact number on the reverse of the cheque/draft.

- BOI Credit Card Payment via Cash Payment – Bank of India credit Cardholders can make overdue payments by cash, quoting their 16 digit credit card no., at any of the Bank of India branches in India and their cash will be deposited into respective credit card account. Extra charges may be applicable for such payments.

- BOI Credit Card Payment via Direct debit facility: All the Bank of India credit cards customers who are also have Bank of India saving account can make payment directly for their Bank of India credit card online by authorizing the bank to debit their account with Bank of India. Bank of India Offer Auto Payment Option for make Credit Card Payment. When you authorized the bank of india for auto debit then The Bank will debit their account to the extent of the Minimum Payment Due Amount or the total due amount on the Payment due date in favor of the Bank of India credit card. For using this option, customer has to sign a standing instruction form with the bank branch where he is holding his savings account.

- BOI Credit Card Payment via NEFT: Pay your BOI Card dues online, using National Electronic Funds Transfer (NEFT), a quick, simple and secure way to pay your BOI Card Bill. Make payments anytime, at your convenience from any bank account that offers the NEFT facility. BOI Credit Card holder can make the payment for their bank of India credit card through remittance for their Bank of India credit cards directly to Card Division by NEFT (National Electronic Fund Transfer). For this purpose card holder will have to add Bank of India credit card as Third party beneficiary by using the BOI Net banking. While remitting the funds, Card holders shall provide the following details to the sending Bank to enable Bank of India Card Division to account the remittances made to the respective Card account.

Required Details for Make BOI Credit Card Payment

| Beneficiary Name | Card holder’s full name as on Card |

| Account Number | BOI 16 credit card number(16 Digit) |

| IFSC (Indian Financial Sector Code) of Card Division | BKID0000101 |

| Bank Name | Bank of India |

| Bank of India Credit Card Office Address | Mumbai Main Branch, 4th Floor, 70/80 MG Road, Mumbai 400 021 |

| Amount | Amount of payment |

Recommended