Black Money and Imposition of Tax Act 2015 – An Overview, Check Details for Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015- An Overview. The Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (the Act) was enacted on 26 May 2015 and has become operative from 1 July 2015. The provisions of the Act provide the procedures to deal with the undisclosed foreign income and Assets, imposition of tax thereon and other matters connected therewith or incidental thereto.

The law has laid down the meaning of undisclosed foreign income and asset & undisclosed assets located outside India, valuation of such assets and computation of tax and penalty thereon. Now you can scroll down below n check more details regarding “Black Money and Imposition of Tax Act 2015 – An Overview”

Black Money and Imposition of Tax Act 2015

Meaning of Undisclosed Foreign Income and Assets & Undisclosed Assets located outside India

According to section 2(12) of the Act “undisclosed foreign income and asset” means the total amount of undisclosed income of an assessee from a source located outside India and the value of an undisclosed asset located outside India referred to in section 4, and computed in the manner laid down in section 5. It includes the income which has not been disclosed in the return of income furnished with the department and earned from the source located outside India or no return has been filed for such income.

Further, as per section 2(11) of the Act “undisclosed asset located outside India” means an asset (including financial interest in any entity) located outside India, held by the assessee in his name or in respect of which he is a beneficial owner, and he has no explanation about the source of investment in such asset or the explanation given by him is in the opinion of the Assessing Officer unsatisfactory.

This means that if an assessee owns any asset located outside India and he does not have satisfactory explanation regarding the source of money from which the asset was purchased, then, that asset would be an undisclosed asset located outside India. Overseas assets will include immovable property, jewellery and precious stones, archaeological collections and paintings, shares and securities, shares in unlisted firms abroad and overseas bank account

Computation of total Undisclosed Foreign Income and Assets

According to section 3(2) of the Act “The value of an undisclosed asset” means the fair market value of an asset (including financial interest in any entry) determined in such manner as may be prescribed.”

Further section 5 deals with the computation of the total Undisclosed Foreign Income and Assets of any previous year. As per this section,

- An assessee will not be allowed deduction in respect of any expenditure or allowance or set off of any loss, whether or not it is allowable in accordance with the provisions of the Income-tax Act.

- The income which has been assessed to tax for any assessment year under the Income-tax Act prior to the assessment year to which this Act applies; or which is assessable or has been assessed to tax for any assessment year under this Act, shall be reduced from the value of the undisclosed asset located outside India.

- However, the assessee has to furnish evidence to the satisfaction of the A.O that the asset has been acquired from the income which has been assessed or is assessable, as the case may be, to tax

- The assessee will get the proportionate deduction of the income that has been assessed earlier from the fair market value of the asset acquired earlier

Illustration

A house property located outside India was acquired by an assessee in the previous year 2009-10 for fifty lakh rupees. Out of the investment of fifty lakh rupees, twenty lakh rupees was assessed to tax in the total income of the previous year 2009-10 and earlier years. Such undisclosed asset comes to the notice of the Assessing Officer in the year 2017-18. If the value of the asset in the year 2017-18 is one crore rupees, the amount chargeable to tax shall be

A-B=C where

A=R1 crore, B= R(100 x 20/50) lakh= R40 lakh, C=R(100-40) lakh=R60 lakh.

But in case of an overseas bank account, the value will be the sum of all deposits made in the account since its opening. It does not include the value amount withdrawn earlier from the account

However, where a declaration of such account has been made under Chapter VI and the value of the account has been changed to tax and penalty under that chapter, the value of an account with a bank shall be the sum of all the deposits made in the account with the bank since the date.

Tax and Penalties on such income

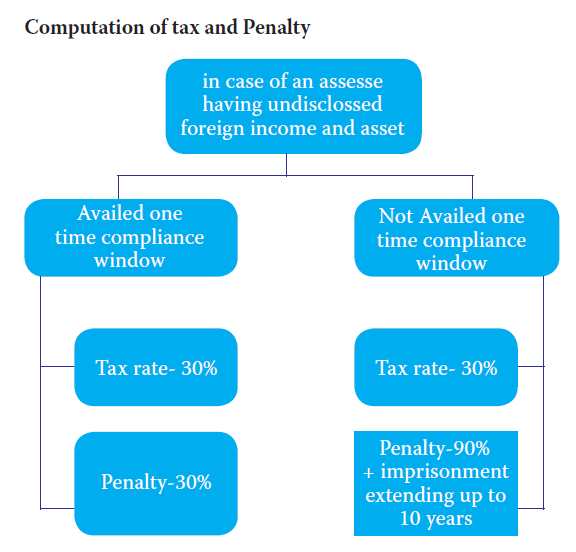

“There shall be charged on every assessee for every assessment year commencing on or after the 1st day of April, 2016, subject to the provisions of this Act, a tax in respect of his total undisclosed foreign income and asset of the previous year at the rate of thirty per cent of such undisclosed income and asset” as per section 3(1) of the Act.

Further according to section 41 “the assessee shall pay by way of penalty, in addition to tax, if any, payable by him, a sum equal to three times the tax”. That means the assessee have to pay the additional penalty of 90% on undisclosed income and asset.

In addition to penalty the person in default will also have to face the imprisonment for a time frame ranging from 3-10 years for willful attempt to evade payment of tax, penalty or interest under the Act.

But if the assessee has availed the opportunity of One Time Compliance Window (discussed later) and disclosed the foreign assets owned by him then the additional penalty will be reduced to 30% and will not be subject to prosecution.

Computation of tax and Penalty

One time compliance window

Vide a circular (Circular No. 12 of 2015 Dated 2nd of July, 2015) the Central Board of Direct Taxes (CBDT) has explained the modus operandi of the onetime compliance window scheme, which can be availed by foreign asset holders to make a voluntary declaration under section 59 of the Act in respect of the undisclosed foreign income and assets located outside India.

The declaration is to be made in such form and shall be verified in such manner as may be prescribed. The form prescribed for this purpose is Form 6 which has been duly notified.

Who can make the declaration:-

- A declaration can be made in respect of undisclosed foreign assets of a person who is a resident other than not ordinarily resident in India within the meaning of clause (6) of section 6 of the Income-tax Act.

The declaration shall include:-

- The details of any undisclosed asset located outside India and acquired from income chargeable to tax under the Income-tax Act for any assessment year prior to the assessment year 2016-17 for which he had, either failed to furnish a return under section 139 of the Income-tax Act, or failed to disclose such income in a return furnished before the date of commencement of the Act.

- Or such income that had escaped assessment by reason of the omission or failure on the part of such person to make a return under the Income-tax Act or to disclose fully and truly all material facts necessary for the assessment or otherwise.

- The person making declaration under the provision of chapter would be liable to pay tax @30 percent of value of such undisclosed asset in addition, he would be liable to pay penalty @100 % of such tax(i.e 30% of the value of the asset as on the date of commencement of the act).

Further as per the circular, Declaration is not eligible in certain cases:-

- Where a notice under section 142 or section 143(2) or section 148 or section 153A or section 153C of the Incometax Act has been issued in respect of such assessment year and the proceeding is pending before the Assessing Officer.

- Where a search has been conducted under section 132 or requisition has been made under section 132A or a survey has been carried out under section 133A of the Income-tax Act in a previous year and the time for issuance of a notice under section 143 (2) or section 153A or section 153C for the relevant assessment year has not expired.

- Where any information has been received by the competent authority under an agreement entered into by the Central Government under section 90 or section 90A of the Incometax Act in respect of such undisclosed asset

Time limits for declaration and making payment

- The scheme was available for short period of 90-days from 1-July-2015 to 30-September-2015. However, declaring such income also will not suffice, the declarant has to pay up the tax and penalty thereon by 31 December 2015 otherwise the declaration shall be invalid. The declaration shall also be void where it has been made by misrepresentation or suppression of facts or information. Where the declaration is held void due to either of the reasons, it shall be deemed never to have been made. Accordingly, all provisions of the Act, including penalties and prosecution shall apply.

Where a valid declaration has been made, the following consequences will follow:

- The amount of undisclosed investment in the asset declared shall not be included in the total income of the declarant under the Income-tax Act for any assessment year; if declarant has made payment of tax and penalty referred in Section 60 and 61 by the date specified in Section 63.

- The contents of the declaration shall not be admissible in evidence against the declarant in any penalty or prosecution proceedings under the Income-tax Act, the Wealth Tax Act, the Foreign Exchange Management Act, the Companies Act or the Customs Act; means the declarant will get immunity against the said five Acts only and not under any other law.

- The value of asset declared in the declaration shall not be chargeable to Wealth Tax for any assessment year or years

- Declaration of undisclosed foreign asset will not affect the finality of completed assessments. The declarant will not be entitled to claim re-assessment of any earlier year or revision of any order or any benefit or set off or relief in any appeal or proceedings under the Act or under Income-tax Act in respect of declared undisclosed asset located outside India or any tax paid thereon

Conclusion

Government has tried to come up with a legislation to tackle the problem of black money and to cover all the possible aspects. Due to the ambiguous nature of the provisions of the Act government has also released the two sets of FAQs Vide Circulars No 13/2015 dated 6th July 2015 and 3rd September 2015 to clarify the issues arising out of provisions of the Act. The aim of the new legislation is to bring back money stashed abroad and utilize the same for the development of the nation. It is hoped that the government would achieve its intended objective and the new law would be effective in detecting tax evasion via stashing black money abroad.

Recommended Articles