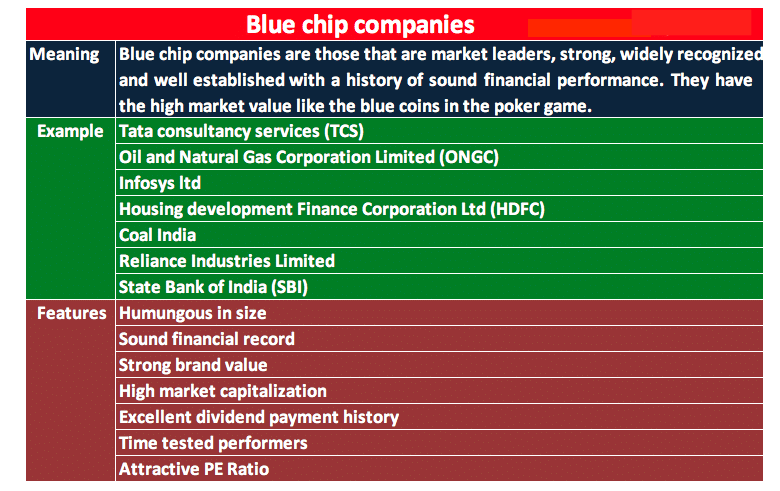

Blue chip companies: The term blue chip has been coined from the family card game ‘poker’ in which blue colored chips carry the highest value. Similarly, blue chip companies are those that are strong, widely recognized and well established with a history of sound financial performance. They have the high market value like the blue coins in the poker game. They are often the market leaders in respective industries. They are known for withstanding the adverse market conditions with their strong fundamentals. Blue chip firms do not depend much on debt for their financial needs.

Leading blue chip companies in India: TCS, Reliance Industries Limited, State Bank of India, Oil and Natural Gas Corporation Limited (ONGC), Infosys, Housing development Finance Corporation Ltd (HDFC) and Coal India etc.

Features of Blue chip companies

1. Humungous size:

The sales volume and business operations of blue chip companies is enormous in size. In their industry, they are the market leaders with very good sales record. One can compare the sales trend of these companies to evaluate how big they are.

2. Solid profitability records:

Blue chip companies hold a good record of profitability in their past years. They continue to outperform most of the players in their industry.

3. Strong brand value:

Blue chip firms carry a high reputation and goodwill. They are very trusted brands in the market enjoying an almost unbeatable competitive advantage and strong business models.

4. High market capitalization:

In terms of full market capitalization (market price x Total number of shares outstanding), blue chip companies always find their place in the top of the list.

5. Excellent dividend payment history:

Though dividend payment history is not a yardstick to determine a stock as blue chip, Blue chip companies display an excellent record of stable dividend payments. They continue to pay dividend even at bad times showing their consistent performance to the investors.

6. Time tested:

Blue chip companies display an excellent record of surviving the most adverse market conditions. They are time tested and enduring.

7. Attractive PE Ratio:

PE ratio is a tool that is obtained by dividing the market price of a stock by its earning per share. PE Ratio indicates the sum of the money one has to pay for earning a rupee. Lower the PE ratio better is the stock. Blue chip companies always have an attractive PE ratio as their earnings are stable and raising.

Blue-chip index:

In the stock market there are many stock indices that consist of only blue chip companies. They track the performance of blue chip companies in respective stock exchanges. Given the size and operations of the blue chip firms, they perform in line with the economic conditions. Thus, the performance of these firms is an index of the industry’s performance in the economy. Remember hearing “IT slow down continues” in the financial news when Infosys, TCS or WIPRO are down in their performance owing to the economic conditions that have an adverse effect on these stocks? That’s because this.

Bottom Line:

Though blue chip firms are fundamentally strong, financially solid and well established in the market, at times they might be badly hit by the economy. Remember how GE has lost its magic touch when the Wall Street crisis hit very badly in the year 2008. So, one has to assess the things enumerated above along with the current affairs going in the company before going ahead to invest in their money.

Recommended Articles