Canara Bank NEFT Form 2023: Inter Bank Transfer enables electronic transfer of funds from the account of the remitter in one Bank to the account of the beneficiary maintained with any other Bank branch. With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach further than before.

What is NEFT?

This system of fund transfer operates on a Deferred Net Settlement basis. Fund transfer transactions are settled in batches. Presently, NEFT operates in hourly batches from 8 am to 7 pm on week days and 8 am to 1 pm on Saturdays.

- Click here to know more details for NEFT or Check NEFT FAQ’s

Who can avail Canara Bank NEFT facility

Individuals, firms or corporates maintaining accounts with a bank branch can transfer funds using NEFT. Even such individuals who do not have a bank account (walk-in customers) can also deposit cash at the NEFT enabled branches with instructions to transfer funds using NEFT. However, such cash remittances will be restricted to a maximum of Rs. 50,000/- per transaction. Such customers have to furnish full details including complete address, telephone number, etc.NEFT, thus, facilitates originators or remitters to initiate funds transfer transactions even without having a bank account.

- Customers of the branch where they are having Savings/Current Accounts

- Walking customers for below Rs. 50,000.

In what way it is beneficial to the Customers

Customer can remit funds to the account of another bank branch and The funds are transferred instantaneously at nominal charges

Canara Bank NEFT Form

Minimum and Maximum Amount for Transfer

- Minimum: Rs.1

- Maximum: No Limit

Canara Bank NEFT Charges

| Mode of Transaction | Charges |

|---|---|

| Online modes (i.e. internet banking, Mobile app) | No Charges |

| Through branches | |

| Up to ₹ 10,000 | ₹ 2.25 + Applicable GST |

| Above ₹ 10,000 and upto ₹ 1 lakh | ₹ 4.75 + Applicable GST |

| Above ₹ 1 lakh and upto ₹ 2 lakh | ₹ 14.75 + Applicable GST |

| Above ₹ 2 lakh and upto ₹ 10 lakh | ₹ 24.75 + Applicable GST |

How to Send Payment via NEFT

There are two ways to send payment via NEFT and one of them is 1. NEFT via Online Internet Banking and 2nd is 2. NEFT via Bank Branch..

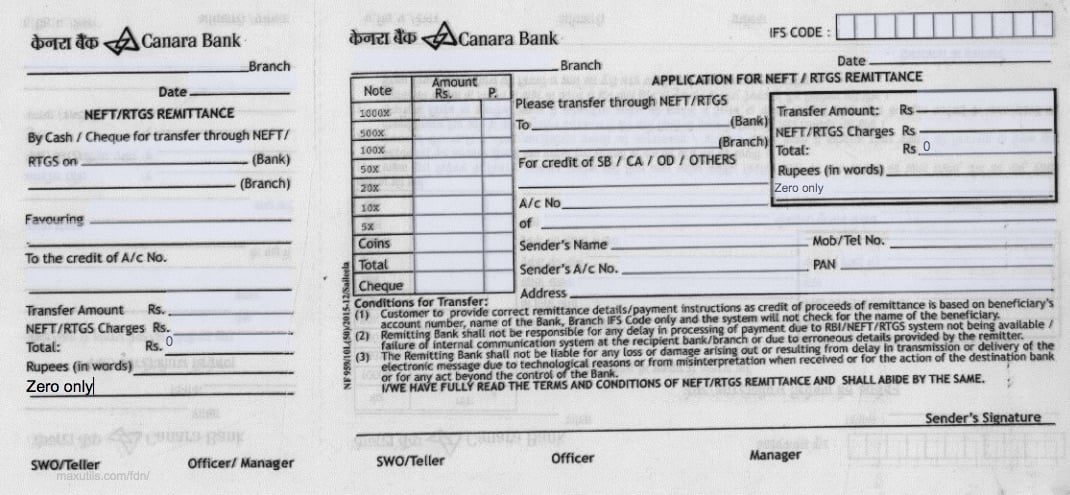

NEFT via Bank Branch : If you want to make NEFT via offline mode i.e from Bank Branch then you need to visit your nearest Canara Bank Branch and Request for NEFT Form or Slip and Fill all the require details asked in NEFT Form and submit to Cashier, Now you bank brach send payment to another person within 2 working hours

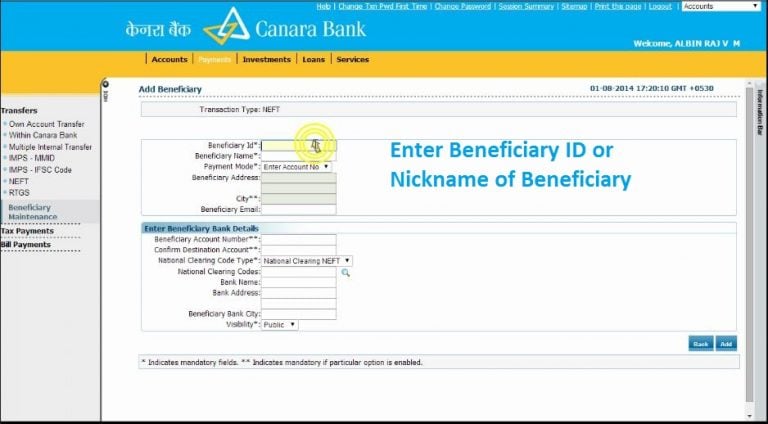

NEFT Via Internet Banking : You may also send money via NEFT by using your Canara Bank Internet Banking Service, for using Internet banking, you need to login at Canara Bank Website and then you will require to add new Beneficiary and then you are able to make payment via NEFT. Online NEFT is enabled for all customers of Canara Bank (Internet Banking) with full transaction right. If you would like to avail Canara Bank NEFT Facility then please download the application form or visit to your Canara Bank Brach and submit the duly filled form to your base branch. If you are already a Canara Bank Connect customer with “view right” and would like to avail full transaction right, please resubmit your application form (can download from above URL) to you base branch.

- Login to Canara Bank Retail NetBanking

- On the left hand side navigation bar, click on “Other Bank Transfer – NEFT” under the Funds Transfer section.

- Fill in all details like transfer amount, destination account number, IFSC Code, beneficiary name & payment details. After these details are filled in correctly, a unique transaction confirmation number would be generated. This number is to be quoted for any query related to this particular transaction.

What the customer must have for remittance

- Amount to be remitted

- Remitting customer’s account number which is to be debited

- Name and IFS Code of the beneficiary bank

- Name of the beneficiary customer

- Account number of the beneficiary customer

- Sender to receiver information, if any

- Mobile number / email id (for NEFT to receive credit confirmation)

How to get the IFSC of the branch

Indian Financial System Code (IFSC) means a unique code of 11 digits of NEFT/RTGS enabled Branches. Normally, this code will be printed on the cheque books OR it may be obtained from the branch where the account is maintained. It is also available on the RBI website. In case the IFSC of the beneficiary bank is not known, the same can be obtained by selecting the Bank and Branch while registering the beneficiary.

- It is available on the cheque leaf supplied by the bank

- Can also get from the branch

When is the amount credited in the beneficiary account?

- Canara Bank NEFT is open 24×7, 365 days.

- Transactions, once confirmed will be immediately debited from the source account and taken up for processing. Transactions initiated before the cut off time shall be processed on the same day.

- All transactions initiated outside the NEFT hours and on NEFT holidays will be processed (for onward transfer to beneficiary bank) only on the next working day. Please ensure that there are sufficient funds in your account to process the transaction. In case you are retrying, please check the status of your previous transaction

- Please note that once the amount is debited and processed from Canara Bank, the credit into the beneficiary account is completely dependent on the destination bank

Cut off time for remittance through Canara Bank NEFT

From December 16 , NEFT facility for online transactions has started getting 24 hours seven days a week. According to a statement from the Reserve Bank, transactions under NEFT can be done every day including holidays. With this, you can transfer online up to Rs 2 lakhs at a time.

So Now you can make NEFT Transfer Anytime 24 Hours

Importance Account Number

Outward : While remitting the funds, Account Number of the beneficiary is to be mentioned correctly in the voucher (to whom the remittance is intended to ).

Inward : While seeking remittance from other bank Customers it is mandatory to quote your 15 Digit Finacle Account Number compulsorily.

What is the difference between RTGS and NEFT?

NEFT is an electronic fund transfer system that operates on a Deferred Net Settlement (DNS) basis which settles transactions in batches. In DNS, the settlement takes place with all transactions received till the particular cut-off time. These transactions are netted (payable and receivables) in NEFT whereas in RTGS the transactions are settled individually. For example, currently, NEFT operates in hourly batches – there are twelve settlements from 8 am to 7 pm .

Any transaction initiated after a designated settlement time would have to wait till the next designated settlement time Contrary to this, in the RTGS transactions are processed continuously throughout the RTGS business hours .Any RTGS Transaction done after business hours will be rejected at RBI on the same day. However NEFT Credit sent after the working hours will be settled in the next NEFT business day.

The RTGS system is primarily meant for large value transactions. The minimum amount to be remitted through RTGS is Rs. 2 lakh. There is no upper ceiling for RTGS transactions. For NEFT transaction there is no lower and upper value limit.

What is the Benefits of Canara Bank NEFT

- Canara Bank NEFT is Available to all – All our Net banking (existing & new) users are eligible to utilize this on-line facility.

- Canara Bank NEFT Facility is simple, convenient, quick and secure – Users can transfer funds to the beneficiaries in other banks in a simple, convenient and seamless manner. Funds transfer to other banks is faster, secure and safe

- Customers can use Canara Bank NEFT Anytime, anywhere… Simple and easy to operate – from home / office anytime, anywhere, Save time and energy

- Get more for less – Canara Bank NEFT cost less than the conventional modes of remittance such as DD/MT

Can I Stopped NEFT Payment be initiated?

No. Once the transaction is put through, payment cannot be stopped

Important Instructions for Canara Bank NEFT

- The actual time taken to credit the account depends on the time taken by the Payee’s Bank to process the payment

- The money will reach the Payee’s bank within the time stipulated by the Reserve Bank of India

Whom do I can contact, in case of non-credit or delay in credit to the beneficiary account?

Ans: you can contact our branch and NEFT customer facilitations Centre:

CANARA BANK,

4th Floor,Canara Building,

Adi Marzban Road,Ballard Estate,

Mumbai- 400 038

Tel: 022-22690581 /022-22691157

Fax:022-2269675

Email : neftcb0136@canarabank.com/ csmcity@canarabank.com

Recommended Articles

- Balance enquiry number of all Banks

- Types of loans

- Bank Holidays in India

- Sukanya Samriddhi Yojana

- Sovereign Gold Bond Scheme

- Sukanya Samridhi Yojana

- Post Office Monthly Income Scheme Account

- Senior citizens savings scheme

- Jan Aushadhi Scheme

- Revised interest rates for Small Savings Schemes

- National Pension Scheme

- Pradhan Mantri Mudra Yojana