Canceling a Cheque in 2023: Various Reasons and How to Cancel Check: This article is specially written to make you aware of the uses of the cancelled cheque and when it is required and to whom it should be given, as it forms an important part as a proof. The cancelled cheque should be given to only specified persons only. Full details of the same is mentioned here and to make sure that you do not give to some unknown person.

Canceling a Cheque

Why Cancelled Cheque?

The main reason behind the cancellation of the cheque is that it would hold as proof. There may be many reasons for cancellation of the cheque, few of which are mentioned here:

- If your cheque has been stolen or lost somewhere and the name on the cheque is not written than anyone can insert there name and get the payment, in such situation you just need to give the cancelled cheque to the bank and tell the bank personnel to stop the payment. The same can be done when you have given cheque to someone and afterwards you come to know that he was cheating you. You can do the same procedure.

- For opening a Demat Account, you would require a blank cheque to be given for the proof that what are your bank details and all the other relevant details mentioned on the cheque.

- For KYC norms, the mutual fund companies or the bank itself may also require the cancelled cheque from the customer to be given.

- Electronic Clearance Services, which is used to deduct the money from your account automatically would require a cancelled cheque. It is mostly required in mutual funds.

- It would be required for the Equated Monthly Installment, or the Loan to be required from any bank, you would require the cancelled cheque.

- For New Bank Account opening also, you would require a cancelled cheque to be required and given to the bank in which such account is opened. The account to be opened may be current or savings, in every case cancelled cheque is required.

- For the New insurance policy to be issued, you would require a cancelled cheque to be given to the insurance company as a proof. In case of renewal of the policy from the same insurance company would not require cancelled cheque.

How to cancel a Cheque?

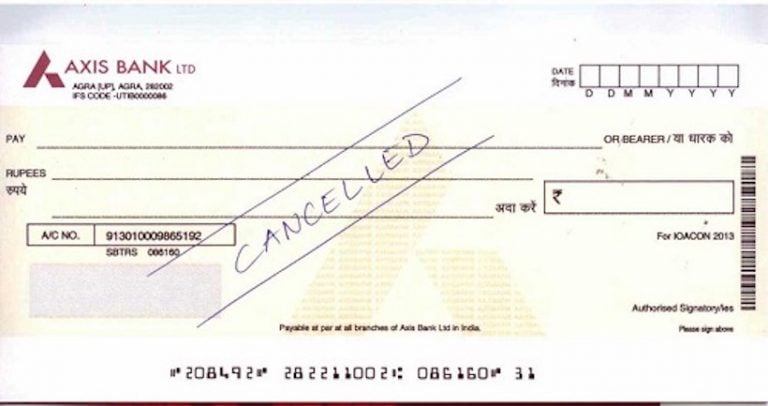

There is only one way to cancel a cheque. You just need to draw two lines and in between write cancelled, so that it can be identified as cancelled cheque. After doing that it would be deemed to be the cancelled one and the status of the cheque would be void.

Must Read –