Crossing of Cheque: The open cheques are presented by the payee to banker on whom they are drawn and are paid over the counter. It is obvious that an open cheque is liable to great risk in the course of circulation. It may be stolen or lost and the finder can get it cashed, unless the drawer has already countermanded payment. In order to avoid the losses incurred by open cheques getting into the hands of wrong parties the custom of crossing was introduced. read more on Crossing of Cheque from below…

Meaning of Cross Cheque :

A crossing is a direction to the paying banker to pay the money generally to a banker or a particular banker and not to pay to holder across the counter. A banker paying a crossed cheque over the counter does so at his own peril if the party receiving the payment turns out to be not entitled to get payment. The object of crossing is to secure payment to a banker so that it could be traced to the person receiving the amount of the cheque. The crossing is made to warn the banker but not to stop negotiability of the cheque. To restrain negotiability addition of words “Not Negotiable” or “Account Payee Only” is necessary.

Crossed Cheque :

When two parallel lines are drawn on the top left side of the cheque, it is called crossed cheque. The lines should be conspicuous. The lines may or may not contain the words ‘& Co’. When a cheque is crossed, the payment is not made across the counter but the amount is credited to the payee’s account. He can then withdraw the amount from his account. A crossed cheque is an express instruction to the banker not to make cash payment.

This is the safest type of cheque. This is called general crossing. Sometimes, name of a specific bank and branch is written between the lines. It means the cheque must be presented through that bank only. This is called special crossing. In such case, the amount is paid to the specific bank which in turn credits the amount to the payee’s account. The words ‘not negotiable’ between the lines destroy the negotiability of the cheque..

Types of Crossing of Cheque :

Crossing of cheques is of different types. They can be given as follows:

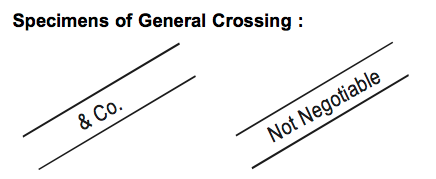

a) General Crossing : A cheque is crossed generally when :

i) It has two transverse parallel lines marked across its face; or

ii) It bears an abbreviation ” & Co” between the two parallel lines; or

iii) It bears the words “not negotiable” between the two parallel lines.

This crossing is a direction to the drawee banker to pay the sum only through a banker. The banker on whom it is drawn cannot pay it otherwise than to a banker. It is to be noted that such crossing does not affect negotiability of instrument. It does not restrict transferability of a cheque.

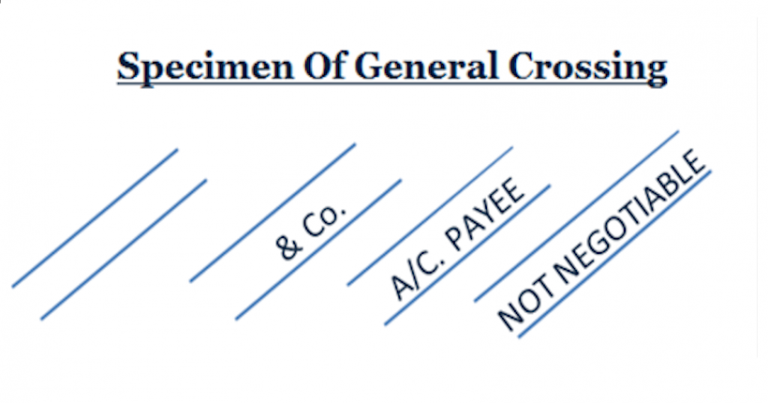

Specimens of General Crossing :

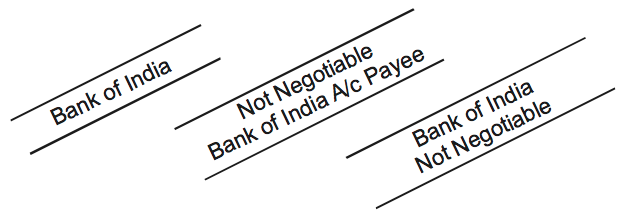

b) Special Crossing :

When a cheque is crossed by two parallel lines and the name of the banker is written between the two parallel lines it is called special crossing. There may be words “not negotiable” written between these two lines. The banker on whom it is drawn shall not pay it otherwise than to the banker to whom it is crossed or his agent for collection. It will be paid only when presented by the banker.

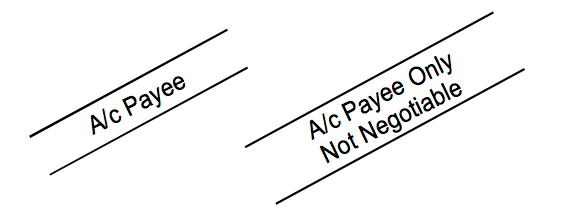

c) Not Negotiable Crossing :

Often cheques are crossed with two parallel transverse lines. The words “A/c payee” or “A/c payee only” are written between these two lines. It means that the proceeds of the cheque are to be credited to the account of the payee only. This kind of crossing is also called ‘Restrictive crossing”.

Recommended Articles