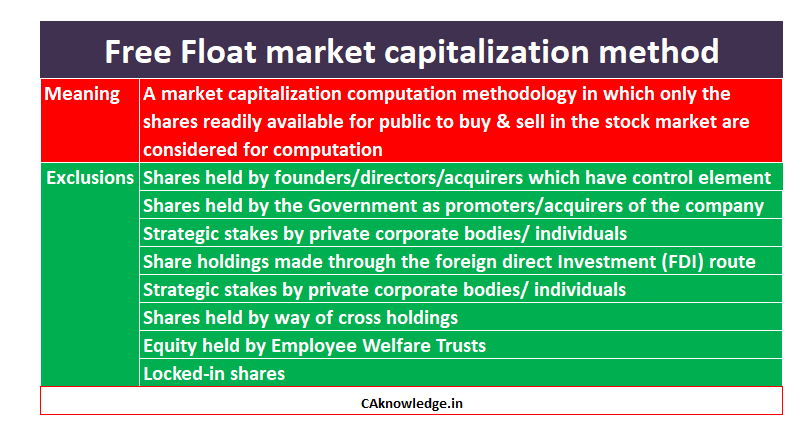

Free float market capitalization: The free float is a measure of the stocks of a company which are actually available in the market for public to buy and sell. Generally the shares held by the promoters are not available for the public to trade in the stock market, thus Free Float Market Capitalization method does not consider these shareholdings while computing the market capitalization of the company.

The main goal in Free Float calculation is to distinguish between strategic shareholders (promoters etc.), whose holdings depend on concerns such as exercising the control rather than the economic fortunes of the company, and those holders (public) whose investments depend on the stock’s price and their evaluation of a company’s future prospects. This method is widely used in computation of stock indices across the world.

Exclusions while calculating free-float market capitalization:

Following shareholdings are generally excluded while calculating free-float market capitalization:

- Shares held by founders/directors/acquirers which have control element

- Shares held by persons/ bodies with Controlling Interest

- Shares held by the Government as promoters/acquirers of the company.

- Share holdings made through the foreign direct Investment (FDI) route

- Strategic stakes by private corporate bodies/ individuals

- Cross holdings: Equity held by associate/group companies such as holding & subsidiary companies hold shares of each other/ one in another etc.

- Equity held by Employee Welfare Trusts

- Locked-in shares and shares which would not be sold in the open market in normal course

Free-float factor:

Free-float factor is a multiple with which the total market capitalization of a company is adjusted to arrive at the Free-float market capitalization. It is a factor that is arrived after excluding the float which is not free (listed out in above exclusions).

Example:

Shareholding pattern of VRP Ltd., having total 50, 00,000 shares of Rs.10 each is as below:

| Category | No of Shares held | % of holding |

| Promoters | 20,00,000 | 40 |

| Shares held by FDI route | 1,00,000 | 2 |

| Employee welfare trust | 50,000 | 1 |

| Controlling interest | 50,000 | 1 |

| Total | 22,00,000 | 44 |

Free-float factor = (100-44)/100 = 0.56. If we multiply this factor with the total market capitalization which is arrived by multiplying the total number of shares (100%) with existing market place, we would get free float market capitalization.

How free float affects the trading in market?

If the free float of a company is larger, the volatility of the company’s shares in the stock market would be lower and vice-versa. This is because the Companies with a smaller free float are likely to see more share price volatility as its entire trading is carried out by fewer traders moving the price significantly.

Advantages of free-float methodology:

1. Realistic market trends:

A Free-float method reflects the market trends more rationally as it considers only those shares that are available for trading in the market.

2. Stock indices that are calculated using Free-float Methodology make the index more broad-based by reducing the concentration of top few companies in Index.

3. Elimination of undue influence of lock-in stocks:

In case of free float method, shareholdings that are not available in the market for trading are eliminated while calculating the market capitalization. Thus, the undue advantage enjoyed by the companies with large market capitalization and low free-float is eliminated. In case of full market capitalization method, inclusion of companies with larger free float with those having lesser free float but more market capitalization would distort the overall index construction.

4. Free float methodology is widely used in all the developed economies. That, it best serves the foreign institutional investors to monitor the index in a standard methodology.

Recommended Articles