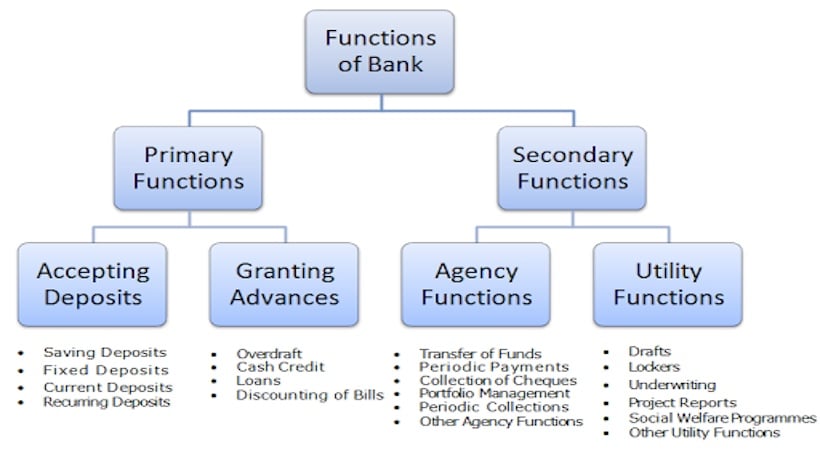

Functions of Bank: In bank jobs interviews normally questions are asked about various functions of banks. So today I am listing down all the important functions of a bank.The functions of a bank can be summarised as follows :

Functions of Bank

Banks operate by borrowing funds-usually by accepting deposits or by borrowing in the money markets. Banks borrow from individuals, businesses, financial institutions, and governments with surplus funds (savings). The most common uses of these funds are to make real estate and commercial and industrial loans.

(a) Receipt of deposits : A bank receives deposits from individuals, firms, and other institutions. Deposits constitute the main resources of a bank. Such deposits may be of different types. Deposits which are withdrawable on demand are called demand or current deposits, others are called time deposits. Savings deposits are those from which withdrawals are not restricted as regards the amount and the period. Deposits withdrawable after the expiry of an agreed period are known as fixed deposits. Interest paid by banks is different for each kind of deposit – highest for fixed deposits and lowest or even nil for current deposits.’

(b) Lending of money : Banks lend money mainly for industrial and commercial purposes. This lending may take the form of cash credits, overdrafts, loans and advances, or discounting of bills of exchange. Interest charged by banks on such lending varies according to the amount and period involved, social priority-nature of security offered, the standing of the borrower, etc.

(c) Agency services : A bank renders various services to consumers, such as : (i) collection of bills, promissory notes and cheques; (ii) collection of dividends, interests, premiums, etc.; (iii) purchase and sale of shares and securities; (iv) acting as trustee or executor when so nominated; and (v) making regular payments such as insurance premiums.

(d) General services : A modern bank performs many services of general nature to the public, e.g. (i) issue of letters of credit, travellers cheques, bank drafts, circular notes; etc. (ii) safe keeping of valuables in safe deposit vaults; (iii) supplying trade information and statistics; conducting economic surveys; and (iv) preparation of feasibility studies, project reports, etc. Banks in some foreign countries also underwrite issue of shares and make loans for long-term purposes.

With development in technology, new methods of banking have been evolved. Now people have the benefit of banking anytime and anywhere. Important tools of modern banking are Automatic Telling Machine (ATM), Real Time Gross Settlement (RTGS) and the National Electronic Funds Transfer (NEFT).

An automated or automatic teller machine (ATM) also known as an automated banking machine (ABM) is a computerized telecommunications device that enables the clients of a financial institution to perform financial transactions without the need for a cashier, human clerk or bank teller. Banks issue ATM card to its customers which, generally, is a plastic card with magnetic strip. Using ATM and ATM card, customers can access their bank accounts in order to make cash withdrawals and check their account balances.

Nowadays, transactions which are bulk and repetitive in nature are routed through electronic clearing service (ECS). India has two main electronic funds settlement systems for one to one transactions: the Real Time Gross Settlement (RTGS) and the National Electronic Funds Transfer (NEFT) systems.

Real Time Gross Settlement (RTGS): RTGS system is a funds transfer mechanism where transfer of money takes place from one bank to another on a ‘real time’ and on ‘gross’ basis. This is the fastest possible money transfer system through the banking channel. Settlement in ‘real time’ means payment transaction is not subjected to any waiting period. The transactions are settled as soon as they are processed. In India, the Reserve Bank of India (India’s Central Bank) maintains this payment network.

Core Banking enabled banks and branches are assigned an Indian Financial System Code (IFSC) for RTGS and NEFT purposes. This is an eleven digit alphanumeric code and unique to each branch of bank. The first four letters indicate the identity of the bank and remaining seven numerals indicate a single branch. This code is provided on the cheque books, which are required for transactions along with recipient’s account number.

National Electronic Fund Transfer (NEFT): The National Electronic Fund Transfer (NEFT) system is a nation-wide system that facilitates individuals, firms and corporates to electronically transfer funds from any bank branch to any individual, firm or corporate having an account with any other bank branch in the country. NEFT requires Indian financial system code (IFSC) to perform a transaction.

Recommended