HDFC Bank RTGS 2023: The RTGS system is primarily meant for large-value transactions. The minimum amount to be remitted through RTGS is Rs 2 lakh. The maximum limit is Rs 10 lakh per day. RTGS (Real Time Gross Settlement) is the fastest possible money transfer system through the banking channel. Because settlements are made in real-time, transactions are not subject to any waiting periods… Now check out more details for HDFC Bank RTGS From below…

What is RTGS?

Real Time Gross Settlement (RTGS) is a nation-wide payment system facilitating one-to-one funds transfer. Under this Scheme, individuals can electronically transfer funds from any bank branch to any individual having an account with any other bank branch in the country participating in the Scheme

- Click here to know more details for RTGS or Check RTGS FAQ’s

Benefits of HDFC RTGS funds transfer

- HDFC Provide Speed transfers in real-time

- Wider boundaries – no geographical limitations within India

- Convenient – Transfer of funds from your home or office

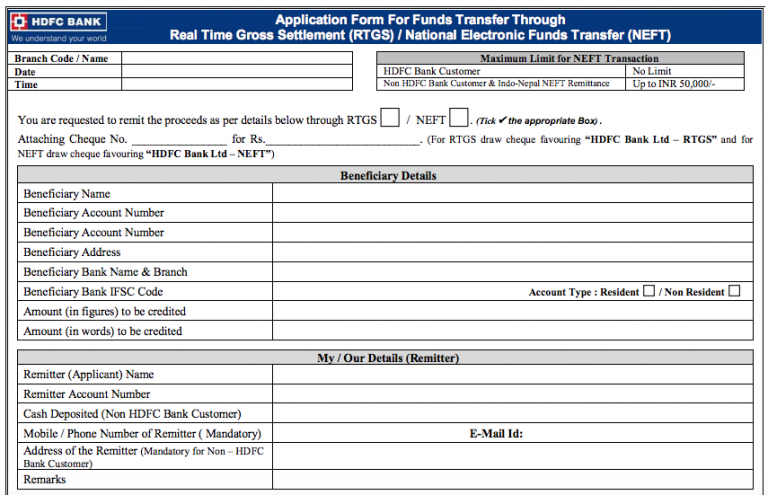

HDFC Bank RTGS Form

HDFC Bank NEFT Form in PDF Format (Official)

Click Here to Download HDFC Bank RTGS, NEFT Form (In Excel)

Minimum and Maximum Amount for Transfer

- Minimum – Rs. 2 Lakh

- Maximum – No upper ceiling for RTGS transactions through Branch But for RTGS transactions done through NetBanking, the maximum amount of funds that can be transferred per Customer ID per day is Rs. 25 Lakh

HDFC Bank RTGS Charges

| Mode of Transaction | Charges |

| Online modes (i.e. internet banking, Mobile app) | No Charges |

| Through branches | |

| ₹2 lakh up to ₹5 lakh: | ₹ 25 + taxes |

| ₹5 lakh + | ₹ 50 + taxes |

RTGS Transaction timings:

- Online Transaction Timings: Available 24 Hours

- Transaction through Branches – As per Branch working Hours

What is the process of RTGS Funds Transfer?

There are two ways to send payment via RTGS and one of them is 1. RTGS via Online Internet Banking and 2nd is RTGS via Bank Branch.

RTGS via Bank Branch: If you want to make RTGS via offline mode i.e from Bank Branch then you need to visit your nearest HDFC Bank Branch and Request for RTGS Form or Slip and Fill all the required details asked in RTGS Form and submit to Cashier, Now you bank branch send payment to another person in real-time.

RTGS Via Internet Banking :

For RTGS you will need to begin by adding a beneficiary. Then you can go on to make a funds transfer.

For online transaction, both the NetBanking and Third Party Funds Transfer facilities should be enabled. (If you’re not yet registered, just fill the form at your closest HDFC Bank branch).

Steps to add beneficiary for RTGS-

- Step 1 – Log into HDFC Bank NetBanking using your Customer ID and Password

- Step 2 – Go to Funds Transfer tab

- Step 3 – Click ‘Add a Beneficiary’, and then select Beneficiary Type ‘Transfer to other bank’

- Step 4 – Enter the beneficiary account details or Credit card number

- Step 5 – Select the Beneficiary’s IFSC, using the bank and branch name

- Step 6 – Click ‘Add’, then ‘Confirm’

- Step 7 – Authenticate yourself at the secure access step, and wait for your confirmation message

Steps to make your RTGS funds transfer –

- Step 1 – Go toFunds Transfer tab, and select ‘Transfer to other bank (RTGS)’

- Step 2 – Select account, beneficiary, and enter the relevant details

- Step 3 – Accept the Terms and Conditions

- Step 4 – Review the details, and, if all is correct, confirm to complete the process

Please Note:

- The beneficiary will be activated in 30 minutes (due to security reasons). The Beneficiary can be viewed in the “View Beneficiary” option of the Enquire Section.

- Post activation of a beneficiary, RTGS transactions are possible only post 24 hours.

- An added beneficiary, to whom no funds are transferred for more than 24 months, is treated as a new beneficiary in all respects.

- A maximum of 7 beneficiaries can be added/modified/deleted in a period of 24 hours.

What information is required when using the RTGS funds transfer service?

When using RTGS Funds Transfer, there are a few essential details to provide:

- Amount to be remitted

- Remitting customer’s account number which is to be debited

- Name of the beneficiary bank and branch

- Name of the beneficiary customer

- Account number of the beneficiary customer

- Sender to receiver information, if any

- The IFSC number of the receiving branch

When does the beneficiary get the credit for an RTGS Transaction?

Under normal circumstances the beneficiary branches are expected to receive the funds in real time as soon as funds are transferred by the remitting bank. The beneficiary bank has to credit the beneficiary’s account within 30 minutes of receiving the funds transfer message.

If an RTGS transaction is not credited to the beneficiary account, does the remitter get back the money?

Yes. If the beneficiary’s bank is unable to credit the beneficiary’s account for any reason, the former will return the money to the remitting bank within 1 hour. Once the amount is received by the remitting bank, it is credited to the remitter’s account by the branch concerned.

What is the difference between RTGS and NEFT?

- Both RTGS (Real Time Gross Settlement) & NEFT are facilitated by RBI for doing online funds transfer between various member banks.

- Effective 15th November 2010, as per RBI guidelines, RTGS (Real Time Gross Settlement) is available only for transactions of Rs.2,00,000/- and above. For any transaction below Rs.2,00,000/- NEFT should be used

What is the Benefits of HDFC Bank RTGS

- HDFC Bank RTGS is Available to all – All our Net banking (existing & new) users are eligible to utilize this on-line facility.

- HDFC Bank RTGS Facility is simple, convenient, quick and secure – Users can transfer funds to the beneficiaries in other banks in a simple, convenient and seamless manner. Funds transfer to other banks is faster, secure and safe

- Customers can use HDFC Bank RTGS Anytime, anywhere… Simple and easy to operate – from home / office anytime, anywhere, Save time and energy

- Get more for less – HDFC Bank RTGS cost less than the conventional modes of remittance such as DD/MT

Recommended Articles