ICICI Credit Card Status 2023, Check ICICI Credit Card Application Status Online. Get a complete guide on How to Apply and Check ICICI Bank Credit Card Application Status Online 2023. Hello Friends In this article we provide complete details for how to check ICICI Bank Credit Card via Online mode and how we can approve ICICI Credit Credit Card. Now check out a detailed guide for how to check ICICI Bank Credit Card Status online or using Customer Caren helpline number…

Types of ICICI Credit Cards

- ICICI Bank Coral Visa Credit Card,

- ICICI Bank Platinum Chip Credit Card

- ICICI JetPrivilege ICICI Bank World,

- ICICI Bank Coral Contactless Credit Card

- ICICI Bank HPCL Coral Credit Card,

- ICICI Bank Unifare Mumbai Metro Credit card,

- ICICI Bank Ferrari Platinum Credit Card

- ICICI Bank Sapphiro Visa Credit Card

- ICICI Bank Rubyx Visa Credit Card

- ICICI Bank VISA Signature Credit Card

- ICICI Bank British Airways Classic Credit Card

- And Many More……

Steps to Check ICICI Credit Card Status online

- Step 1 – Visit on ICICI Credit Card Official Website https://www.icicibank.com/

- Step 2 – After Visit on official ICICI Credit Card Website, Please click on “Credit Card” Menu

- Step 3 – Now you may reach at official ICICI Credit Card Page, please scroll down this page and you may see “Track Application” Link, Please click on above link…

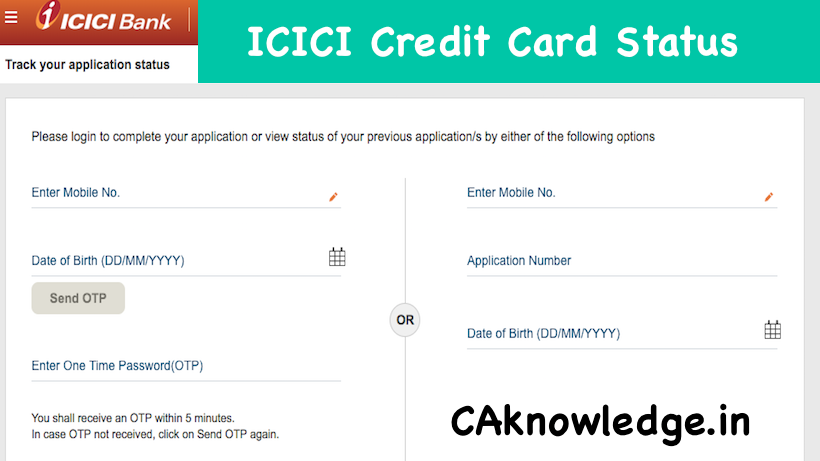

- Step 4 – Now you may reach at official tracking page, you may directly reach at this page by using following link “https://loan.icicibank.com/asset-portal/my-applications-login“

- Step 5 – Now Please Enter your Application Number, Mobile Number or Date of Birth and then click on “Track Status” Button

- Step 6 – Now you credit card status is appeared in your computer or mobile screen

Please Note – If you credit card is rejected or not approved then please don’t apply Again for ICICI Credit Card till Next 6 Months

How to Approve ICICI Credit Card Instantly

If you want to approve your ICICI credit card instantly, then please submit following documents…

- Submit Last 2 Year ITR Copy More then Rs 2,50,000

- Provide Postpaid Mobile Bill or Landline Bill

- If you have any other bank credit card, then please provide last 3 statements of your credit card

- PAN Card Copy

- And Other ID Proof and Address Proof

Important Question’s Related to your ICICI Credit Card

Q. I have applied for a ICICI Credit Card – would like to know the status?

Click here to check the status of your ICICI credit card application. You are required to input the 16 digit Application reference number and Mobile number or Date of Birth (DDMMYYYY)

Q. I have not received my Credit Card?

Generally, your ICICI Credit Card is delivered within 21 working days of submitting your application. If you have registered your mobile number with us, you will receive timely alerts informing you about the status and details of the dispatch of your ICICI Credit Card.

If you have received the alert on Airway Bill number (courier reference) on your mobile number provided in Credit card application form.

You can track the status of the shipment using the Airway Bill number by visiting the courier websites.

Q. I had applied for an ICICI Card 3 months back and now when I try to apply again, I am not able to do so.

In the normal course, you should be able to apply after 3 months of your previous application. There are some exceptional circumstances in which you may not be able to re-apply for longer.

Q. When is late payment charge levied?

Late Payment charges will be applicable if Minimum Amount Due is not paid by the payment due date, Clear funds need to be credited to ICICI Bank Card account on or before the payment due date, to avoid Late Payment charges. Late payment charges are applicable as:

| Statement Balance | Late Payment Charges |

|---|---|

| Less than Rs.100 – Nil | Nil |

| Rs.100 to Rs.500 | Rs.100/- |

| Rs.501 to Rs.1,0000 | Rs.500/- |

| Rs.10,001 and above | Rs.750/- |

Over-limit charges*

2.50% on the over-limit amount (subject to a minimum of Rs 500)

*Over-Limit Fee: Bank may approve certain transactions attempted by the Card Member which can breach the credit limit, as a service gesture. Please note that if the outstanding amount exceeds the credit limit, an over-limit fee of 2.5% of the over-limit amount (subject to a minimum of Rs 500) will be levied. The over-limit status may also happen because of fees or interest charges.

Goods and Services Tax (GST)

Effective 01 July 2017, the Goods and Services Tax (GST) will be applicable instead of Service Tax. GST may be applicable from time-to-time, presently the GST rate for banking and financial services is at 18% (applicable on all fees, interest, surcharge and other charges).

If you have any other query regarding “ICICI Credit Card Status” then please tell us via below comment box…

Recommended Articles