Jana Bank Net Banking 2023: Jana Small Finance Bank Internet Banking is a convenient & faster way to access your account & manage your day-to-day banking transactions anytime, anywhere, 24X7 at your own comfort, without visiting branches waiting in queues. It’s secure and simple to operate.

Net Banking and Mobile Banking are the facilities which enable you to perform banking transactions at your choice of place and time. You can access Net Banking via personal computer or laptop and Mobile Banking via mobile or tab, subject to the availability of an internet connection. Moreover, you can access it with a VPN for banking turned on if you are currently abroad.

Special features of Jana Net Banking

Jana Small Finance Bank’s Internet Banking provides you a host of benefits like:

- Dashboard view of all your relationships with Jana Small Finance Bank – like your accounts, deposits, loans, and your credit cards.

- See your transactions history.

- Open/close deposit instantly.

- Make online payments for utility bills and insurance premiums (coming soon).

- Shop on various websites and pay using Internet Banking (coming soon).

- Transfer money to your own accounts and to other bank accounts.

- Re-charge your prepaid mobile / DTH and data card.

- Request, track status/stop payment of issued cheques and of cheques that are in clearing.

- Update your profile picture, email-ID, and contact details.

To know more, please visit nearest branch of Jana Small Finance Bank.

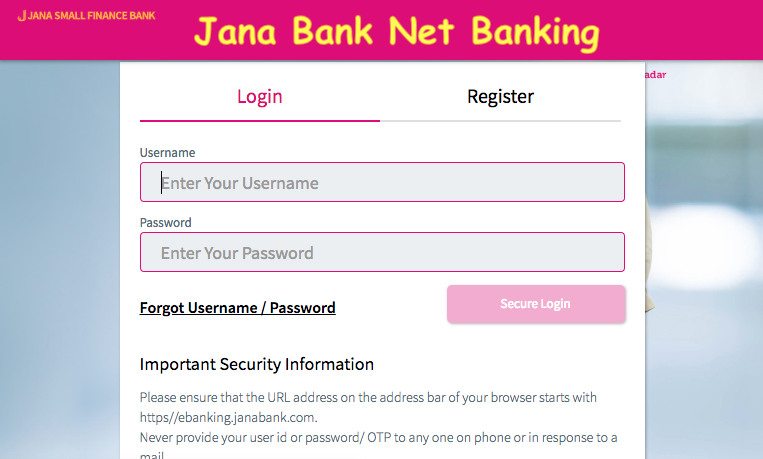

Jana Net Banking Login and Register

- Click here to login at Jana Bank Net Banking

- Click here to register at Jana Bank Net Banking

Important Requirements

What do I need to use the Net Banking and Mobile Banking services?

Internet Banking service is available to Savings and Current account holders. In all cases, the customer/mandate holder should have the authority to operate the account with full permission.

For accessing the Net Banking services, you will need a browser like Internet Explorer, Google Chrome, or Mozilla Firefox or Apple Safari.

For accessing the Mobile Banking services, you have to install Jana Small Finance Bank Mobile Banking application on your android based phone from Play Store.

Will all my accounts / relationship details appear under a single user ID in Internet Banking?

Yes, if you are an individual and holding a Current Account/ Savings Account/ Jana Card/ Loan Account with Jana Small Finance Bank, all the relationship with same URN will be visible in Internet Banking.

Q6. What services can I avail on Net Banking and Mobile Banking?

Jana Small Finance Bank Internet Banking gives you accessibility to your account/s – anytime, anywhere, 24X7 – at your comfort. You can manage all your daily transactions online. You can view statements, order cheque books, do fund transfers, pay your bills & even shop online.

- Account Details: You can view your bank account details, account balance and download statements. You can also view your Deposits, Loan & Card Account Details at one place.

- Funds Transfer: Transfer funds to your own Jana Small Finance Bank accounts, other Jana Small Finance Bank accounts or Other Bank accounts seamlessly.

- Request Services: You can place requests for Cheque book, Stop Cheque Payment, Change Card Pin and Block/Hotlisiting of Debit Card, place request for new products etc.

- Value Added Services: Pay Utility bills (coming soon) Recharge Mobile, e-statement etc., expense management module.

Jana Net Banking Login

Q1. How do I get access to Net Banking or Mobile Banking services for the first time?

Mentioned below are the stepwise details for registering to the Net Banking or Mobile Banking facilities.

- Click on ‘Register’ option on main screen of Internet Banking screen.

- Keep your URN number, Account Number, Registered Mobile number and your debit card with you handy and click on ‘Continue’.

- Enter the URN Number, first four letters of your name & DOB in format DDMMYY.

- Enter the 16 digit debit card number, the ATM PIN and the expiry date.

- Accept the terms and conditions and click ‘Submit’.

- Enter a login password of your choice keeping the rules in mind and re-enter it to confirm the password. Enter the transaction password and confirm it.

- You will receive an OTP on the registered mobile number.

- Enter the received OTP code and click on ‘Submit’.

- The process is complete and you can now log in using the Login Id and Password on the main screen.

Q2. How can I change my Net Banking or Mobile Banking login password?

You can retrieve you Login Id by entering you URN Number or 16 digit Debit Card Number and Name/DOB in format DDMMYY.

Q4. What happens if I forget my Net Banking or Mobile Banking login password?

- You can generate both your login and transaction password online in case you have forgotten it.

- You will need your 16 digit ATM/Debit Card Number and ATM PIN

- Status Inquiry

- Configure/ Update Email ID

- Stop Cheque

- Cheque Book Request

- Change Card Pin

- Cheques Status

- Block Card

- Get new products

You can call Jana Small Finance Bank contact centre at 18002080

Jana Bank Net Banking Fund Transfer

Q1: What is Funds Transfer?

Funds transfer means the transfer of money from one bank to another bank or within the same bank under the RBI guidelines.

Q2. Which type of funds transfer can I do through Net Banking or Mobile Banking?

You can do the following types of Fund Transfer:

- Fund Transfer between your own linked accounts.

- Fund Transfer to any Other Jana Small Finance Bank account.

- Fund Transfer to Other Bank’s Account (IMPS/NEFT/RTGS).

What details do I need to provide in order to effect a transfer to Other Bank Accounts?

To carry out a transfer you need to first register the payee online. For registering a payee keep the following information handy:

- Name of the beneficiary bank, and the name of the beneficiary customer.

- Beneficiary account number.

- IFSC code of the receiving branch.

- Account number from where the funds will be debited.

- Amount to be remitted.

- Sender to receiver information, if there is one.

Q6. How can I do Funds Transfer transaction (NEFT, RTGS or IMPS) through Net Banking or Mobile Banking?

Login to Internet Banking on www.janabank.com

Addition of Jana Small Finance Bank Beneficiary

- Go to ‘Fund Transfer’ and click on ‘Funds Transfer’

- Select the option ‘Jana Bank Account’

- Click on ‘add payee ’

- Enter the URN, Beneficiary Nick Name and Account Number/Mobile Number. Click on Confirm. The name of the beneficiary will be displayed on the screen. Validate if the correct beneficiary is being registered

- Enter the OTP to complete registration

- Your beneficiary is now registered

Addition of Other Bank Beneficiary

- Go to Fund Transfer

- Select the option ‘Other Bank Account’

- Click on ‘Add New Payee’

- Enter the Beneficiary Nick Name, Account Number, IFSC code and bank details. The name of the beneficiary will be displayed on the screen. Validate if the correct beneficiary is being registered

- Enter the OTP to complete registration

- Your beneficiary is now registered

Note: Funds transfer to any new beneficiary will be enabled only after 10 minutes post activation.

Q7. What is IFSC Code?

The Indian Financial System Code (IFSC) is an RBI issued code to uniquely identify every bank’s all branches that are participating in NEFT, RTGS and IMPS system. While selecting the payee’s branch, please make sure that the IFSC code mentioned against the branch is the same as the IFSC code of the branch you want your funds to be transferred to

Q8. What are the transaction limits post beneficiary addition?

| Type | Minimum | Maximum |

| RTGS | INR 2 Lakhs | INR 10 Lakhs |

| NEFT | No Minimum amount | INR 10 Lakhs |

| IMPS | INR 1 | INR 10 Lakhs |

Q9. Are there any charges levied for Funds Transfer?

Currently, there is no charge for using the funds transfer facility.

Q10. What are the Funds Transfer transaction timings?

- The cut off time for NEFT is set as per the last batch processed by Jana Small Finance Bank. This cut off time is currently set at 18:45 p.m. on week-days and 12:45 p.m. on Saturdays.

- For IMPS there’s no cut-off time, funds can be transferred 24×7

Can I initiate fund transfer on bank holidays?

Yes, Fund transfer can be initiated on holidays. Fund transfer thorough IMPS will happen immediately but Requests for NEFT transactions are accepted on Holidays & Sundays (Sundays and holidays as defined by RBI) but the actual debit and the transaction is completed only in the next working day.

Recommended