Karnataka Bank UPI App, Download Karnataka BHIM KBL UPI App From Play Store – Direct Link. There are many queries related to Karnataka Bank UPI Android App like – How to download Karnataka Bank UPI App, what is the UPI, and what does it mean to you?, How UPI Payment System Work, Here’s a quick guide to everything you need to know about the UPI App.

BHIM KBL UPI (Secure Mobile App for Rapid Transactionz)

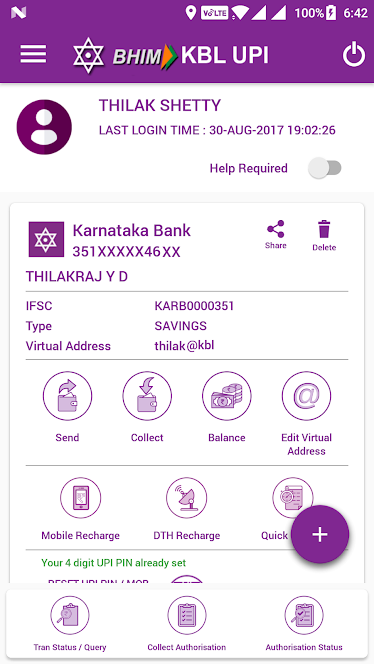

Mobile application built on UPI Platform for universal app transaction, which facilitates customers to add own and other Bank accounts linked to his/her registered mobile number. Customers can initiate payment ( push ) and collect ( pull ) fund transfer request based on virtual ID, Aadhar number , Bank account number with IFSC code, Mobile number with MMID.

Click Here to Download All Banks UPI App

BHIM KBL UPI

By Using Karnataka Bank App you can Make payments easier using Virtual Payment Address(VPA) Pay & collect Payments Very Easily. Karnataka Bank Launched his UPI Apk, Many other banks already launched UPI App and BHIM KBL UPI launched his UPI App.

| Karnataka Bank UPI App | Click Here to Download Karnataka Bank UPI Apk (Direct Link Play Store) |

Steps to Download BHIM KBL UPI

- Step 1 – Visit on Play Store Site – https://play.google.com

- Step 2 – Now in Search Box, Please write Karnataka Bank UPI App

- Step 3 – Now you can see various Apps on Search Page, Please click on “BHIM KBL UPI App ” (Karnataka Bank is Official UPI App)

- Step 4 – Now Please click on “Install” Button

- Step 5 – Now Your app is successfully installed, Your App is Ready to Use for UPI Transactions

Click Here to Download Karnataka Bank UPI Apk (Direct Link)

Details For Karnataka Bank UPI Android App

| App Name | BHIM KBL UPI |

| Bank Name | Karnataka Bank |

| Last Updated | 21st October 2020 |

| Downloads | 5,00,000+ |

| Version of App | 1.2.6 |

| Download Link | Click Here to Download |

How to Use Karnataka Bank Bank UPI App

- Every Customer will need to have a bank account and a smart phone to use Karnataka Bank UPI App

- Now Please Download Karnataka Bank UPI UPI app from Play Store or Using Above Procedure

- Now Install Karnataka Bank UPI App in Your Smartphone

- After Install UPI APP, Please Open your app

- Now your App is asking for Send a SMS for Confirm your mobile number

- After Confirmation of your Mobile Number, Karnataka Bank UPI App is started and Show all Menus of Karnataka Bank App

- Now Please Create your account or Create your Profile on Karnataka Bank UPI App by Entering Following details – Name, Email, Gender, Mobile number, DOB etc..

- After Creating your Profile you will require to set your unique Virtual ID and Generate MPIN by using your Debit Card

- Now your Karnataka Bank UPI App is ready to pay, collect and Check your bank balance

How Karnataka Bank UPI App is Working

- To send money to someone, you need to know only their UPI ID – a virtual identity like an email address. This could be your name, or your phone number, so for example, if your phone number is 1234567890, then your virtual address could be 1234567890@KBL (if your bank is Karnataka Bank) or 1234567890@sbi (if you’re an State bank of India customer), and so on.

- By Using UPI app not need of knowing the recipient’s name, their bank account number, and IFSC code (or bank branch).

- UPI is built on top of the IMPS, which you may have used to transfer money between bank account. Like IMPS, UPI is immediate, and works 24×7, through the year, unlike NEFT or RTGS or iMPS services, which have specific working hours.

- The UPI can also be used for shopping online – instead of entering your debit card number, expiry date, and CVV code, followed by waiting for the OTP, you’d just enter your UPI ID, and get an alert on your phone to verify the transaction.

Facilities Available under BHIM KBL UPI

- Push & Pull Payments

- Single Click two factor authentication

- Customers can pay using multiple identifiers- Account No.& IFS Code, Mobile No. & MMID, Aadhhar No. or Virtual Address.

- Virtual Address-Virtual address as a payment identifier for sending and collecting money.(e.g. NRR@kbl)

- One App for all transaction needs

- Moving towards less cash society

- Innovation,Interoperability & scalability

VERSION 1.0.3 –

- A) Allowed to initiate credit collect to a card not linked account .

- B) Self help mode activated

- C) QR code generator option to generate QR Code to receive instant payments by sender using BHIM KBL UPI scan pay n pay option .

- D) Bug fixes for Android 4.1 version

- E) activation of user permission to access phone features .

- F) Enhancements in UI/UX design

What are the requirements for using UPI?

Pre-Requisites:

- Registered Mobile number with the Bank where the account is held , sim should be in primary sim Slo (case of dual SIM Mobile devices.)

- Mobile Number should be registered with Bank for receiving Transaction SMS Alerts

- Should have a Valid Debit Card

Link any of your other Bank Accounts which is mapped to your registered mobile number with valid Debit card

- You Need not to be a KBL Customer to use BHIM KBL UPI

- You Can initiate Money Collection Request ( PULL )

- You Can View your Other Bank Account Balance

- You Can Send money to Aadhaar Number, Virtual Address, Account Number & IFSC , Mobile Number & MMID (Mobile Money Identifier) .

- You can receive money from Virtual Address ( Collect / PULL )

How do I register in the Karnataka Bank UPI application?

- Customers who are acount holder of our Bank or Account holder of UPI Participating Other Banks can download the BHIM KBL UPI app from Google play Store.

- After successful download and install of KBL-UPI app,the app prompts for authorising to sending sms for identifyig the registered mobile number with the Bank and for mobile device fingerprinting binding,On successful, registered Mobilenumber is displayed to the customer creates his/ her profile by entering details like name, virtual id (payment address), password etc.

- What is Virtual Id?- Virtual Id is a unique identifier replacing of your Bank account number in furture for fund transfers/payments.It should be identifyable with your account number and can be alphanumeric without any special characters (ex:can be combination of shortform of your name,branchname,cityname,numbers related to your present account number)

- Customer profile is created successfully.

- In order to transact, customer has to go to option of “Add Bank Account”.

- In the next screen, customer has to select “Bank Name” from drop list down provided.

- After selecting the bank, customer will get account linked to that particular mobile number in the next screen.

- Customer will select the account number which he/she wish to add (should be linked to Valid debit card.)

- After selecting A/c No, the same will get added in the profile.

- Same steps can be followed for adding listed other Bank accounts linked the registered mobilenumber.

Generating MPIN for the transaction:

- In order to transact, customer need to generate the M-Pin (MPIN is different from the PIN used for opining the BHIM KBL UPI app).

- Customer selects the bank account for which he/she wants to initiate the transaction

- Customer has to select Register MBanking/Set UPI Credentials option

- On selection on the above option Debit card details screen is displayed.

- Customer will now enters last 6 digit of Debit card number and expiry date.

- Customer will now receive OTP on his/her registered mobile number

- Customer will enter OTP along with MPIN of his/her choice on NPCI Library screen and click submit.

- customer gets notification (successful or decline)

Recommended Articles