Mutual Fund – The best tool to achieve Financial Goals: In this article we have understood the importance of financial planning in our life and the process of financial planning. In this article, we will attempt to understand why a mutual fund is a useful tool in financial planning.

Today, an investor has plenty of option to invest their money. They may go with a traditional investment product (like Bank FDs, Post office FDs, PPF, KVP, NSC, Real Estate, Gold, etc.) or invest in stocks, Bonds, Mutual funds, or a mixture of both. No matter what option they choose as an investor for their investments, each has its advantages and disadvantages, the suitability is the only matter. Therefore, it is imperative to evaluate each product on a certain parameter, before parking money in that particular product. The parameter can be a risk (safety), liquidity, return expectation from the product.

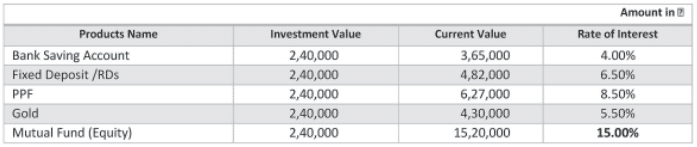

In the current economic outline, it is vital to invest money in a product that can deliver a return of FD interest rate + 5% additional earning. This is prerequisite to beat inflation. Traditional products are recognized for capital preservation and stable returns, but will not earn you wealth-enhancing returns over the long period and with increasing inflation, the real purchasing power of your money will likely decline.

Mutual Fund

A mutual fund is a type of financial vehicle made up of a pool of money collected from many investors to invest in securities such as stocks, bonds, money market instruments, and other assets. MFs are operated by professionals who manage the fund to provide best returns to the investors. Following are the types of mutual funds,

- Equity Fund: Invest in shares/stocks. Aim to grow faster than traditional products.

- Debt Fund: Invest in fixed income securities like government bonds, corporate bonds, FMPs, Gilt fund, etc…

- Liquid Fund: Invest in T-bills, dated securities, certificate of deposits, etc…

- Balanced/ Hybrid Fund: Mixture of bonds and shares/stocks bridging the gap between equity funds and debt funds.

Why Mutual Funds?

Mutual fund investment offers numerous benefits that make them the most rewarding investment option. Benefits can be summarised as below :

Expert Money Management: Mutual fund companies have fund managers to choose the company shares, sectors and debt papers in which the pooled mutual fund investment would be invested. Fund managers are highly qualified like CFA, CMA, CA, etc… and have a strong background of experience in the field of the capital market.

Diversification: Mutual funds invest across various asset classes and company shares to mitigate risk. When one asset class underperforms, gains from other asset classes will negate the loss.

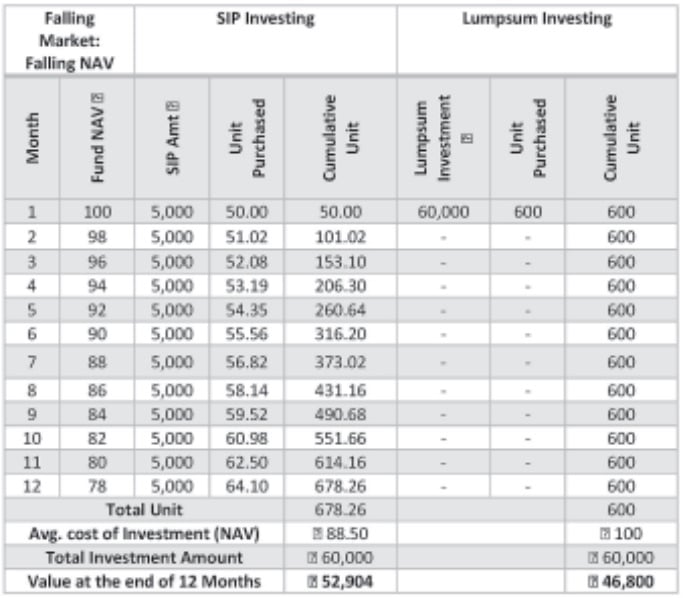

Systematic Investment Plan option: This is the best option of investing in a mutual fund which provides the benefit of average out cost of investment (result in a lower cost of investment). An investor need not have a big amount to invest in a mutual fund, they can start with a small amount of ?100 & ? 500/- monthly. It develops the habit of regular saving and help in achieving the financial goal in the long run with a small amount. The table shows the advantage of SIP investment against Lump-sum investment.

Investment safety: All mutual fund houses are under the purview of the SEBI (Securities and Exchange Board of India) and ANFI (Association of Mutual funds in India). Both bodies are government-driven. Thus, it is equally safe as bank FDs.

Liquidity: It provides a good amount of liquidity. Investors are allowed to redeem their investment at any time. No need to justify your redemption decision or searching for a buyer. An investor has to place redemption request with fund house and redemption amount will credit within 3-7 working days.

Return: A mutual fund is delivering a handsome return compare to other products in long term investment. Suppose an investor is investing ? 1,000/- monthly for 20 years in various product. At the end of the tenure, he will receive the amount mentioned in the table.

There are many more benefits such as flexible tenure, flexibility to switch funds, investment based on goals & focus sector, tax efficiency, Ease of tracking investment daily basis.

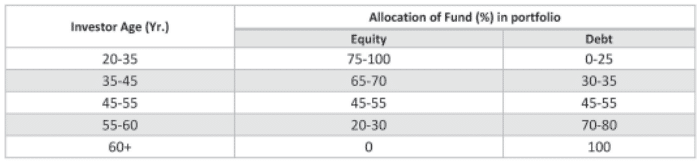

Asset allocation according to age

Proper asset allocation is key to all kinds of financial empowerment. Even the highest-returns generating asset like equity funds can be no use unless you do prudent asset allocation. An investor should know that the asset allocation changes according to their life-stages. The basic principle of behind age-based asset allocation is that your exposure to portfolio risk needs to reduce with age, especially being referred to the proportion of equity as a portfolio component. Refer the table to understand an ideal age-wise equity exposure in the portfolio.

Conclusion:

It is evident that in long term mutual fund is delivering extraordinary return compared to all other investment avenues. Thus, an investor who is looking for wealth creation through financial assets should select a mutual fund (equity fund) either through SIP option or STP (Systematic Transfer Plan). An Investor has to selfevaluate their risk appetite and return expectation from the product, and accordingly, have to develop an asset mix of equity and debt, keeping asset allocation matrix in the mind, which help in smoothly accomplishing financial goals. For e.g. Mr. Shivan is investing ? 10,000/ – per month in equity mutual fund from age of 30 years and remain invested till 60 years of age. At the time of maturity, he will receive ? 6.56 Cr. against the investment of ? 36 Lakh (if CAGR is 15%). Here CMA can play an indispensable role as a fund manager, financial/research analyst, key managerial personnel (C.I.O.) in a mutual fund house. They can be also an expert financial advisor as they are having an adequate understanding of the capital market and conceptually understand the financial activities.

Disclaimer: The contents of this article are solely for informational purpose. It does not constitute professional/ personal advice or recommendation.

Author – CMA Nikhil B. Mehta