8 personal loan mistakes one should avoid: It is an unsecured loan taken by individuals from banks and financial institutions to meet their personal financial needs. A personal loan requires no collateral while availing it. It is sanctioned by the banks on the basis of certain criteria such as income level, credit score, repayment history, and employment history, etc.

It gives the individuals the freedom to spend it as per their convenience and financial needs. Thanks to its easy and hassle-free availability make a personal loan is an easy answer to your immediate financial needs. However, while taking a personal loan, one should be cautious enough to avoid certain mistakes that may result in big financial trouble in the future. know more…

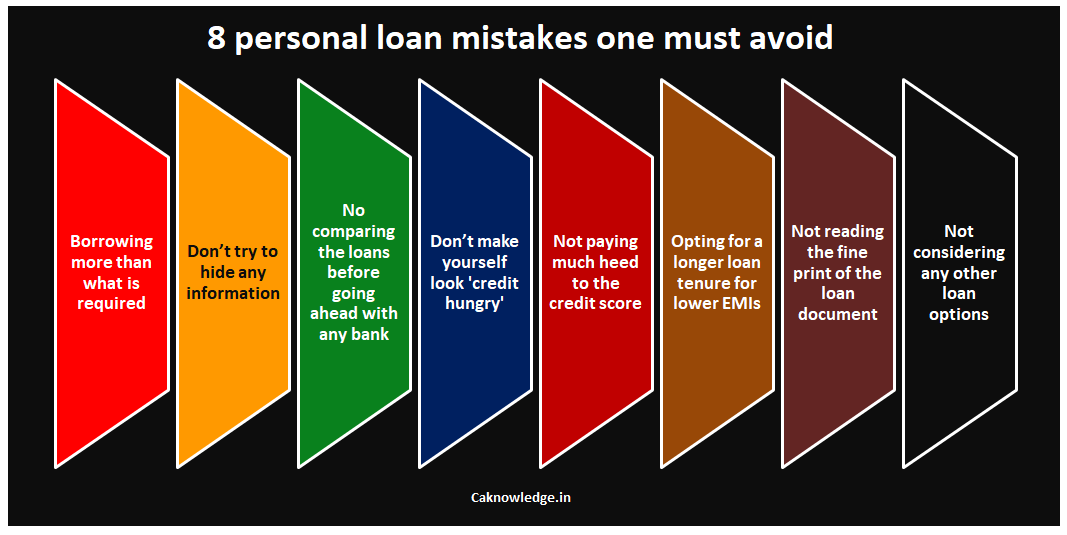

Here is a list of most commonly made mistakes while going for a personal loan:

8 personal loan mistakes one should avoid

1. Borrowing more than your financial requirement:

Nowadays, applying for a personal loan has become so easy that it never had been so in the past. It is just a click away, thanks to the online applications and pre-approved personal loan plans. And on the other side the banks and other personal loan providers keep on ringing your phone trying to get you lured by their seemingly wonderful offers. In times as easy as such, the chances of getting carried away by all these are very high.

So, this makes the most of the applicants ending up borrowing way more than their financial requirements. Consider your income levels and the installments to be paid. Can you survive buy paying out almost the entire amount of your salary as installment? So, it’s very important to consider the right amount to be borrowed, purely based on your monetary needs rather than on luring offers.

2. No comparing the loans before going ahead with any bank:

Never apply for a personal loan without comparing it with across different banks and lenders. Studying various loans available in the market helps you in deciding the best possible lender that is most suitable to you. Utilize online comparison tools. Don’t just go by interest rate. Consider the other terms such as loan tenure, processing fee and other repayment conditions.

3. Don’t try to hide any information:

It will not work with your lending bank, no matter how hardly you try to hide certain financial information. Bankers are likely to find it out it anyway. Information such as existing loans, other financial obligations should be disclosed to the bank to avoid any possible rejections because all your credit history will be recorded by your credit rating agency. And the rejections may eventually result in lower credit rating or may give the lenders a chance to charge higher interest rates.

4. Not reading the fine print of the loan document:

After discussing with the bank’s loan officials, it is highly possible that one may sign the loan documents without thoroughly reading the information contained in it. Don’t assume that the loan document is exactly same as the oral discussion with the banker. If there is a future dispute in interpreting any terms and conditions then no one can help you. So, ensure that you read and understand every detail out there in the loan document. Even in the cases of emergency requirements, don’t ignore this.

5. Opting for a longer loan tenure:

Banks and financial institutions offer personal loans ranging from different repayment tenures. Do not offer for a long tenure just because the EMI appears to be low. Remember that longer the tenure, more the total outflow. Though the EMI seems to be pocket-friendly, eventually you end up paying very high amount in total. So, opt for a tenure considering your monthly income and other financial obligations. Try to choose as shorter as possible.

6. Not paying much heed to the credit score:

Credit score is imperative while applying for a personal loan. It’s one of the important things the banker will check when you know his door. So, ensure that you have a reasonably good credit score. In case any of your credit card dues or other installment due that are still pending clear them before you approach the bank with personal loan application.

7. Don’t make yourself look credit hungry:

Applying for relatively more loans in shorter period results in a reduced credit score making you look like ‘credit hungry’. This may give the bankers a chance to exploit by charging higher interest rates when you take a personal loan from them. So, don’t apply for loans in several banks at a same point of time. And try to avoid making multiple loan applications even in case of emergency

8. Not considering any other loan options:

Personal loans require no collateral security from the borrowers. So, they come with interest rates that are usually higher than other financial products such as secured loans or loan against fixed deposit etc. So, before taking a final call, list out all the variety of offers available out there and evaluate which one is best for your set of requirements.

Related Articles