Reverse Mortgage : Soon after retirement one may have to think about the available resources to lead his rest of the life. Those having good amount of retirement benefits and a financial supporter don’t need to worry too much at this point of their time. There are many plans offered by various banking institutions to fund the needs of this kind. One of those plans is reverse mortgage.

Living in a house owned by you rather in a rented accommodation would definitely stand as a security in the times of no financial inflows. One may encounter many struggles when he is young to build an own house. An own house symbolizes the social status but no one thinks of the house as a property of mortgage to result financial inflows.

Reverse mortgage meaning:

A reverse mortgage is a loan facility available to homeowners of above certain age that allows them to convert part of the ownership in their homes into cash. Through this facility one can avail periodical cash flows to meet the financial needs without losing the ownership on the house. One can also get benefited from the increase in the price of the house over the time.

Why it is called as “Reverse” mortgage?

In case of normal loan the loan recipient has to make the periodical payments to the lender to discharge the loan. But in case of Reverse mortgage the lender makes periodical payments to the borrower. So it is termed as reverse mortgage.

Features of Reverse Mortgage

- Those who want to go for a reverse mortgage can approach the banker or financial institution and fulfill all the procedural aspects involved to get it activated on his house.

- Soon after the bank activates the plan you will receive periodical payments from the bank. This will be continued till the property is sold.

- Since no servicing is involved as in case of a loan no requirement of assessing the creditworthiness and repaying capacity and other traits.

- At the time of death or borrower leaving the house permanently the house will be sold the balance of the proceeds after deducting the amount paid by the banks along with the accumulated interest, will be paid to the legal heirs of the borrower.

- Otherwise the borrower or legal heir can discharge the accumulated liability to avoid the sale of house.

- Some bankers disburse the payments even in lump sum at the request of the borrower.

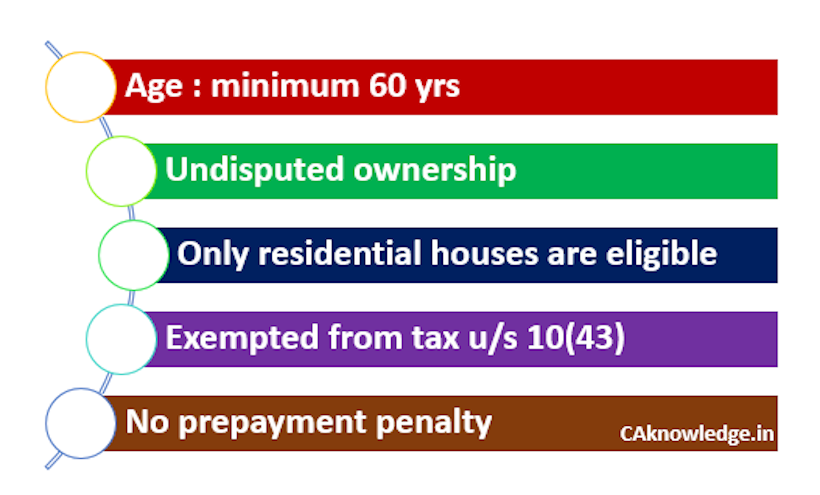

Eligibility for Reverse Mortgage

- Depends upon the banker the eligible age varies from 60 to 62 and above

- The ownership of the house should be absolute and undisputed

- Banks accept only the residential houses as eligible property for reverse mortgage.

Taxation:

Since the main objective of this plan is to provide enough cash flows to the needy senior citizens. Section 47(xvi) of the income tax act provides that the gains arising on the transfer of capital asset under a reverse mortgage are not taxable. And section 10(43) of the income tax says that the amount of loan received either in lump sum or installments is not taxable.

Benefits:

1. No need to sell the house in case of urgent financial necessity:

In case of the urgent requirement for money, one may force himself to sell of the house. But reverse mortgage enables the borrower either to sell the house at the end of the mortgage period or to discharge the loan liability along with accumulated interest.

2. No servicing cost

3. Tax free

4. No penalty for prepayment:

The borrower can repay the loan at any time during the tenure of loan without any penalty.

Must Read –