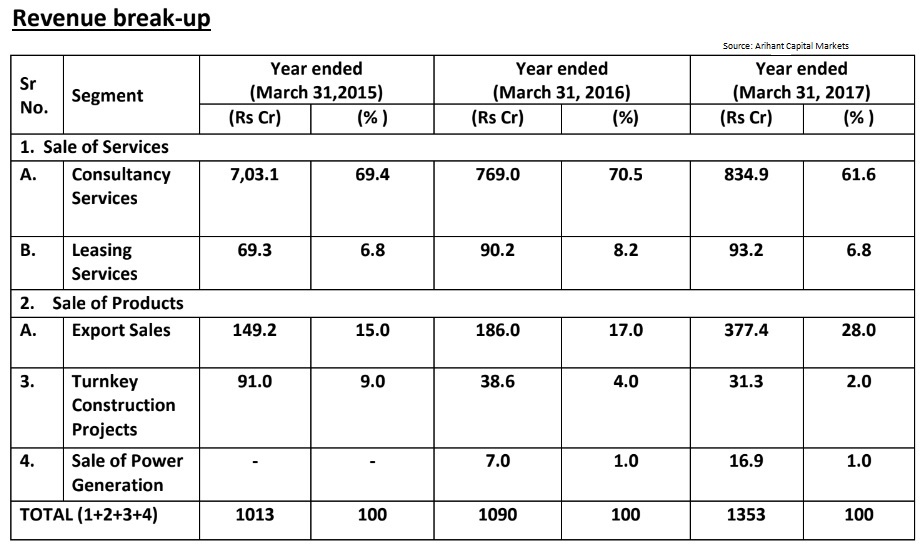

Rites Ltd IPO – RITES, a Government of India entity, is a leading player in the transport consultancy and engineering sector in India. It primarily provides consultancy (60-70% of sales) services in urban transport, roads and highways, ports, inland waterways, airports, power procurement, etc. check more details for Rites Ltd IPO Date, Prospectus, Allotment, Listing, Reviews & Status from below…

Brief Details of Rites Ltd IPO

| Particulars | Particulars |

| ISSUE OPENS | June 20, 2018 |

| ISSUE CLOSE | June 22, 2018 |

| PRICE BAND | Rs. 180-185 |

| ISSUE SIZE | Rs. 466 cr |

| PUBLIC ISSUE | 2.52 cr shares |

| BID LOT | 80 Equity shares |

Rites Ltd Revenue Details

RITES has a healthy order book of Rs.4,819cr (March 31, 2018), providing revenue visibility of ~3.5 years. Healthy cash of ~ Rs.1,380cr, foray into different businesses and strong association with Ministry of Railways (MoR) will help it capitalize on emerging opportunities.

At the upper price band, the stock is valued at undemanding P/E of 10.5xFY17 and 11.4x9MFY18 (annualized EPS). Further, IPO is more attractive for retail investors given the discount of Rs.6 per share. We recommend Subscribe for long term.

Fund Raising

The government is targetted to raise about Rs 453-466 crore through the share sale, at a price band of Rs 180-185 a share, respectively.

The paid-up share capital of RITES currently stands at Rs 200 crore.

Objects of the Issue

RITES will not receive any proceeds from the offer and all the proceeds will go to the selling shareholder which is the Government of India.

Hence, the objects of the offer are (i) to carry out the disinvestment of 2.4 crore equity shares held by the selling shareholder in the company, equivalent to 12 percent of the paid-up equity share capital of the company as part of the net offer, and 12 lakh shares that will be reserved for employee reservation portion, and (ii) to achieve the benefits of listing the equity shares on the stock exchanges.

Competitive Strengths

- The company provides the comprehensive range of consultancy services offerings and has a diversified sector portfolio in the transport infrastructure space;

- It has large order book with strong and diversified clientele base across sectors. “As of March 31, 2018, order book stood at Rs 4,818.7 crore, which includes 353 ongoing projects of value over Rs 1 crore each;

- The order book in consultancy services business stood at Rs 2,572.09 crore, leasing services Rs 140.65 crore, export sales Rs 697.74 crore and turnkey construction projects Rs 1,408.2 crore.

- It has technical expertise housed in various business divisions within the company with specialized domain knowledge across each of the market segments;

- It has experienced management personnel and technically qualified team;

- RITES is the preferred consultancy organization of the Government of India including the Indian Railways.

- It has strong and consistent financial performance supported by robust internal control and risk management system.

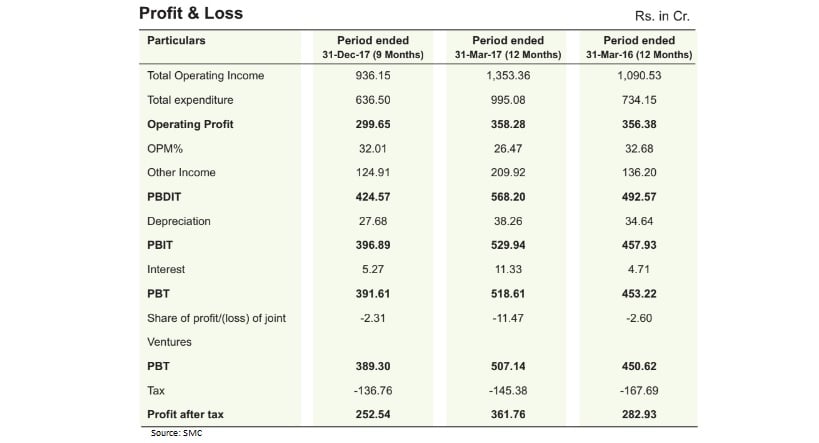

Financials

The company has been consistently profitable over the last five years and has paid dividends regularly to the equity shareholders.

As per the restated financial information, its total income has grown at a CAGR of 9.61 percent and profit grew at a CAGR of 11.61 percent during FY13-17.

About Company

RITES Ltd., a Government of India Enterprise was established in 1974, under the aegis of Indian Railways. RITES is incorporated in India as a Public Limited Company under the Companies Act, 1956 and is governed by a Board of Directors which includes persons of eminence from various sectors of engineering and management. RITES Ltd., an ISO 9001:2008 company, is a multi-disciplinary consultancy organization in the fields of transport, infrastructure and related technologies.

Recommended Articles