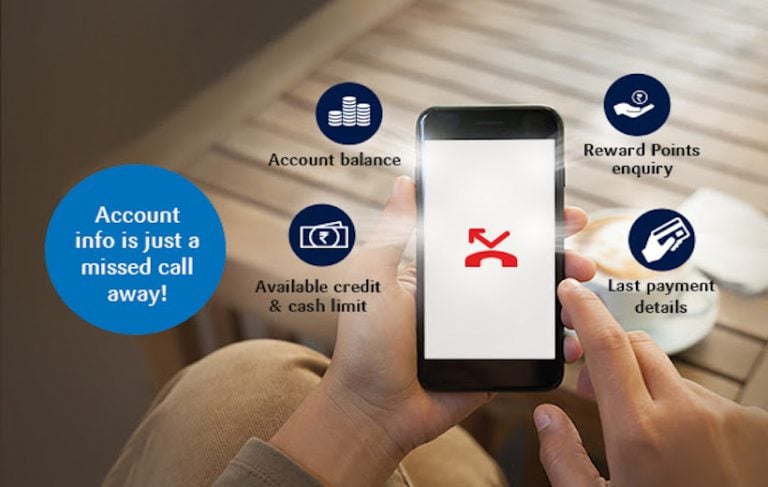

SBI Credit Card Balance by Missed Call: Your SBI Credit Card Information is just a missed call away! Introducing Missed Call Service to make your SBI Card experience even better. check out SBI Credit card balance information buy using toll free missed call number.

SBI Credit Card Online with amazing deals and rewards. Best Credit Card for shopping, travel, entertainment, etc. Just give a missed call on the numbers mentioned below & get information about your SBI Card account instantly.

SBI Credit Card Balance by Missed Call

| Account Balance | 8422845512 |

| Available Limit | 8422845513 |

| Reward Points | 8422845514 |

| Payment History | 8422845515 |

Credit cards come with legal contracts. Hence, it is important that you are aware of their terms and conditions, when you sign up for them.

Understand liabilities: If your card has multiple users, know about the liabilities shared by secondary users. Also, if you have applied for Add-on cards, understand the added responsibilities that come with them such as who will manage the cards, pay bills and debts, etc.

Tips for secure Card usage

Credit cards give you a lot of power and if you follow some crucial mantras about their usage, you can harness them well.

Ensure the safety of your Credit Card, PIN number, Card expiry date, CVV(security code) by all means. Also, Please do not share your One Time Password(OTP) with anyone. Always get your current contact number updated to ensure receipt of transaction alerts. Whenever you travel abroad, please stay informed about the benefits you can avail in case of card loss or theft, such Card Insurance plans & Emergency Card replacement services.

Be vigilant and check your credit card statements/transaction alert SMS carefully for any suspicious transaction(s). If you ever notice any unsolicited transaction, immediately report the same.

SBI Credit Card Eligibility

- Minimum per month Income of Rs.18500 required in Metro cities

- Have a Bank Account in SBI, If looking for credit card on the basis of account.

- Photo copies of ID card, income proofs and address proof should be submitted.

- You should be an earning individual and should be above 21 year and less than 60 at the time of apply.

New Updates – Yono application of State bank of India helps you in restored your credit card limit instantly. YONO stands for ‘You Need Only One’. SBI launched Special Credit card for doctor’s “Dosctor’s SBI Card. This Card offers industry-first feature of professional indemnity insurance cover of Rs. 10 lakh to protect doctors against professional risks and liabilities.

FAQs on SBI Credit Card Missed Call Service

Q1. How does SBI Card missed call service work?

SBI Card have 4 different numbers for 4 different account information. You need to give a missed call at any of the dedicated virtual no. from your registered mobile number. You will get instant information via SMS on your registered mobile number.

| Kind of information needed | Virtual mobile number |

| Balance Enquiry | Give a missed call at 8422845512 |

| Available Credit and Cash Limit | Give a missed call at 8422845513 |

| Reward Point Summary | Give a missed call at 8422845514 |

| Last Payment Status | Give a missed call at 8422845515 |

Q2. What information will you get through the missed call service?\

You will get following information:

- Balance Enquiry

- Available Credit & Cash Limit

- Reward Points Summary

- Last Payment Status

-

Do I need to register for this service?

No, all the cardholders who have updated their mobile numbers with their SBI Card account are automatically registered for this service. There is no need to register for this service separately.

-

Will I be charged to take this service?

No. This service is absolutely free

-

Will my telecom company charge me for my call given to above numbers?

No, there will be no charge. Because your call will be automatically disconnected by these numbers

-

What If I have two different primary card type and the same mobile number registered on both?

Missed call service is limited to the customers with one primary card . If you have more then one cards with same mobile number registered against them, then We recommend you to use Pull SMS channel to get response.

Click here to know more about Pull SMS channel -

Is the service available across SBI Card types?

The missed call service is available only for retail cards only.

-

Is there any limit of the number of enquiries that can be made in a day/month?

Yes, there would me maximum 50 responses to a mobile number in a day

-

Can I avail of this service from outside my city of registration or outside my telecom circle?

If you have national usage activated on your mobile, you can use SBI Card missed call serviceg from anywhere in India

Recommended