Treasury bills are the short term liquid financial instruments issued by the central government of India to raise funds for temporary requirements. There are no treasury bills raised by state governments.

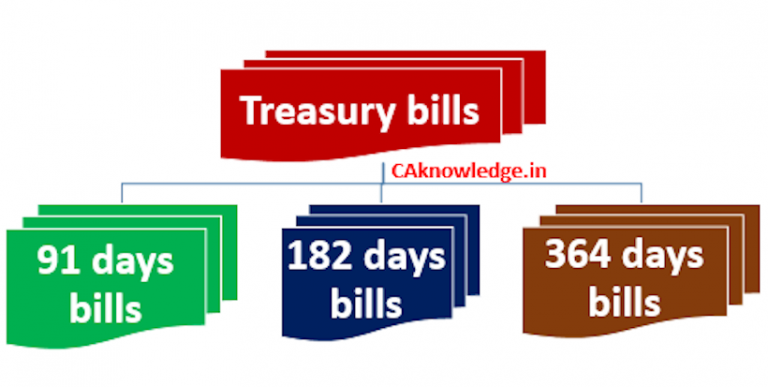

Types of treasury bills in India at present:

At present there are 3 types of treasury bills in India as:

- 91-day bills

- 2. 182-day bills and

- 364-day bills.

Issuance:

Treasury bills are issued at a discounted price where the holder gets its face value soon after it gets matured. Here the difference between the face value and issue price is the return to the purchasers of these instruments. They are very helpful to the government in managing the short term liquidity. And they are issued through auctions which make them completely reflect the current economic conditions in the country.

Amount of bills:

Minimum amount of treasury bills issued by the government are for Rs 25,000 and so on in multiples of Rs 25,000. Since they are issued at discounted price it may have an edge over other kind of instruments which are issued at par and redeemed at above par in terms of wider accessibility.

Where can be bought:

Treasury bills are auctioned on the Negotiated Dealing System (NDS).In this system the members submit their bids electronically where the system route the non-competitive bids trough respective custodians.

Auctions:

The Reserve Bank of India issues a quarterly calendar of Treasury bill auctions. This is available at the bank’s websites. And prior to every auction RBI releases a press note stating the exact date and amount to be auctioned along with the payment dates. Normally 91 days bills are auctioned every Wednesday and the 182 day bills are auctioned on Wednesday preceding the non-reporting Friday and 364 day treasury bills are auctioned on Wednesday preceding the Reporting Friday.

| S.NO | Bills | Auctioned on |

| 1 | 91 days bills | Wednesday |

| 2 | 182 days bills | Wednesday of non-reporting week |

| 3 | 364 days bills | Wednesday of reporting week |

Competitive VS non-competitive bidders:

- Those who quote their price at which they are willing to buy these bills are competitive bidders. They will be allotted these instrument if their price is the best to government

- Non-competitive bidders do not need to quote their bid and hence the RBI allots bids to the non-competitive bidders at the weighted average price of the competitive bids accepted in the auction.

With respect to the purpose of issuance treasury bills are 2 types:

(a) Adhoc bills:

These are the treasury bills which are issued for a particular purpose in hand. They are not issued to the general public. The purpose of these bills is to act as an investment outlet to the various government agencies and foreign central banks to manage their temporary surpluses.

(b) Ordinary bills:

They are sold to the ordinary public and hence marketable. Mostly commercial banks invest a portion of their surplus in these instruments.

Advantages:

1. No risk for ever:

Since they are issued by the central government no risk will arise in terms of redemption, discounting and unstable market forces. These are “0” % risky instruments. So every planning to mobilize their savings in a zero risk investment outlets can go for these.

2. Highly liquid:

Treasury bills are short term instruments used to raise the funds for temporary purposes. So they possess high liquidity compared to other market players in the short tenure.

3. High marketability:

As they are issued by government and possess good liquidity in the market, treasury bills have the high marketability.

Related Articles