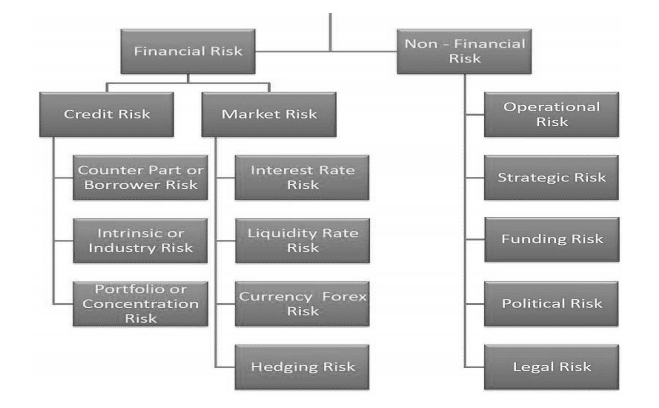

Types of Risks: Risks can be basically classified in to two types, viz. Financial and Non-Financial Risk. Financial risks would involve all those aspects which deal mainly with financial aspects of the bank.

Credit Risk:

A credit risk is the risk of default on a debt that may arise from inability of a borrower to make required payments as per commitments. In the first resort, the risk is that of the lender and includes lost principal and interest, disruption to cash flows, and increased collection costs. The loss may be complete or partial. In an efficient market, higher levels of credit risk will be associated with higher borrowing costs. Because of this, measures of borrowing costs such as yield spreads can be used to infer credit risk levels based on assessments by market participants. The recent episodes of Mr Nirav Modi, Vijay Mallya et al. is an example in this regard.

Market Risk:

Market risk is the possibility of an investor experiencing losses due to external factors that affect the overall performance of financial markets in which he or she is involved. Market risk, also called “systematic risk,” cannot be eliminated through diversification, though it can be hedged against. Sources of market risk include recessions, political turmoil, changes in interest rates, natural disasters and terrorist attacks. The 2009 sub-prime crisis of US is an example in this regards.

Operational Risk:

Operational risk is “the risk of a change in value caused by the fact that actual losses, incurred for inadequate or failed internal processes, people and systems, or from external events (including legal risk), differ from the expected losses”. This definition, adopted by the European Union Solvency II Directive for insurers, is a variation from that adopted in the Basel II regulations for banks.

In October 2014, the Basel Committee on Banking Supervision proposed a revision to its operational risk capital framework that sets out a new standardized approach to replace the basic indicator approach and the standardized approach for calculating operational risk capital, It can also include other classes of risk, such as fraud, security, privacy protection, legal risks, physical (e.g. infrastructure shutdown) or environmental risks. The study of operational risk is a broad discipline, close to good management and quality management. The behaviour of staff of Punjab National Bank, Fort Mumbai branch is an example in this regard.

Strategic Risk:

Strategic risks are those that arise from the fundamental decisions that directors take concerning an organisation’s objectives. Essentially, strategic risks are the risks of failing to achieve these business objectives.

Liquidity Risk:

A bank’s inability to meet its payment obligations as and when they are demanded is known as Liquidity risk. Deposits of banks as liabilities and loans/advances as assets of the bank are the prominent items in a bank’s balance sheet. Types of deposits held and the interest rates offered on them on the one hand and types of loans and advances sanctioned and interest rates charged on them on the other hand may not match. In view of this liquidity risk is encountered by the banks.

Political Risk:

Political risk is the risk faced by investors, corporations, and governments due to political decisions of Governments, events, or conditions. This will significantly affect the profitability of a business or the expected value of an economic move. Political risk can be understood and managed with reasoned anticipation and investment.

Legal Risk:

Legal risk is the risk of financial or reputational loss that can be caused to an organization from lack of awareness or misunderstanding of, ambiguity in, or reckless indifference to, the way law and regulation apply to a business, its relationships, processes, products and services. Some of the recent examples in the Indian context are – the Auditors of Satyam Infotech Limited had to face legal risk due to a reckless action of its personnel; Nestle India, the manufacturer of Maggi noodles faced the legal risk due to faulty product produced by them.

Recommended