Vijay Bank RTGS: The RTGS system is primarily meant for large value transactions. The minimum amount to be remitted through RTGS is Rs 2 lakh. Vijay Bank RTGS Form, Rules, Timing, Charges & How to do RTGS?: Real Time Gross Settlement System (RTGS) is an Electronic Payment System – set up, operated and maintained by Reserve Bank of India, for use by the all participating Indian Bank Branches, to enable funds transfer and settlement, on real-time basis. Vijaya Bank is a member of RTGS.

What is RTGS?

Vijay Bank Real Time Gross Settlement (RTGS) is a nation-wide payment system facilitating one-to-one funds transfer. Under this Scheme, individuals can electronically transfer funds from any bank branch to any individual having an account with any other bank branch in the country participating in the Scheme

- Click here to know more details for RTGS or Check RTGS FAQ’s

In what way it is beneficial to the Customers

Customer can remit funds to the account of another bank branch and The funds are transferred instantaneously at nominal charges

What is the Benefits of Vijay Bank RTGS

- Vijay Bank RTGS is Available to all – All our Net banking (existing & new) users are eligible to utilize this on-line facility.

- Vijay Bank RTGS Facility is simple, convenient, quick and secure – Users can transfer funds to the beneficiaries in other banks in a simple, convenient and seamless manner. Funds transfer to other banks is faster, secure and safe

- Customers can use Vijay Bank RTGS Anytime, anywhere… Simple and easy to operate – from home / office anytime, anywhere, Save time and energy

- Get more for less – Vijay Bank RTGS cost less than the conventional modes of remittance such as DD/MT

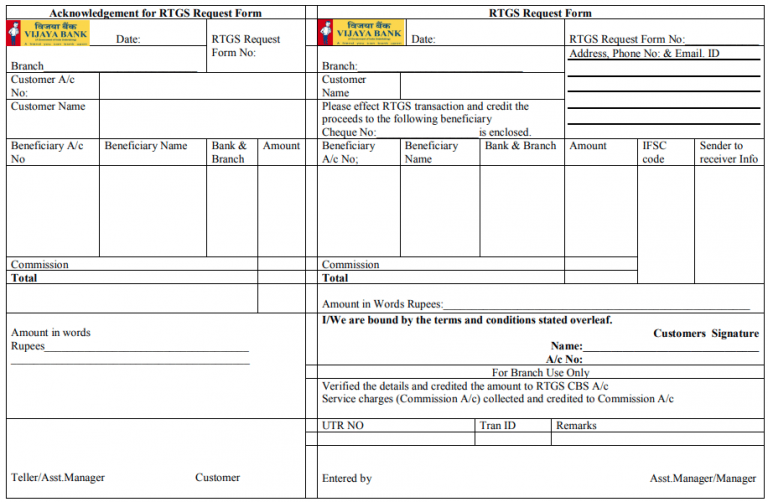

Vijay Bank RTGS Form

Minimum and Maximum Amount for Transfer

- Minimum: Rs. 200000

- Maximum: No Limit

Vijay Bank RTGS Fees

Please Note New RBI news on 7th June 2019 – RBI has removed charges for payments via NEFT and RTGS and asked banks to pass on the benefits to customers. This means that payments via NEFT and RTGS would become either free or charges would be drastically reduced. This was announced in the Statement on Developmental and Regulatory Policies, which was released today by the central bank as part of its monetary policy review.

OLD RTGS Charges

- Rs.2.00 lakh to less than Rs.5.00 lakhs : Rs. 34.00

- Rs. 5.00 lakh and above : Rs.63.00

Please click the links below for details /downloads

- List of Branches of all other Banks’ in India where RTGS facility is enabled [link from RBI website]

How to Send Payment via RTGS in Vijay Bank

There are two ways to send payment via Vijay Bank RTGS and one of them is 1. RTGS via Online Internet Banking and 2nd is RTGS via Bank Branch.

RTGS via Bank Branch : If you want to make RTGS in Vijay Bank via offline mode i.e from Bank Branch then you need to visit your nearest Vijay Bank Branch and Request for RTGS Form or Slip and Fill all the require details asked in RTGS Form and submit to Cashier, Now you bank brach send payment to another person within 2 working hours

RTGS Via Internet Banking : You may also send money via RTGS by using your Vijay Bank Internet Banking Service, for using Internet banking, you need to login at Vijay Bank Website and then you will require to add new Beneficiary and then you are able to make payment via RTGS. Online RTGS is enabled for all customers of Vijay Bank (Internet Banking) with full transaction right. If you would like to avail Vijay Bank RTGS Facility then please download the application form or visit to your Vijay Bank Brach and submit the duly filled form to your base branch. If you are already a Vijay Bank Connect customer with “view right” and would like to avail full transaction right, please resubmit your application form (can download from above URL) to you base branch.

- Login to Vijay Bank Retail NetBanking

- On the left hand side navigation bar, click on “Other Bank Transfer – RTGS” under the Funds Transfer section.

- Fill in all details like transfer amount, destination account number, IFSC Code, beneficiary name & payment details. After these details are filled in correctly, a unique transaction confirmation number would be generated. This number is to be quoted for any query related to this particular transaction.

Timings for RTGS

- from 8.00. am to 4.30 pm. – on working days

- 2nd and 4th Saturdays – Holiday.

When is the amount credited in the beneficiary account?

- Vijay Bank RTGS is open 24×7, 365 days.

- Transactions, once confirmed will be immediately debited from the source account and taken up for processing. Transactions initiated before the cut off time shall be processed on the same day.

- All transactions initiated outside the RTGS hours and on RTGS holidays will be processed (for onward transfer to beneficiary bank) only on the next working day. Please ensure that there are sufficient funds in your account to process the transaction. In case you are retrying, please check the status of your previous transaction

- Please note that once the amount is debited and processed from Vijay Bank, the credit into the beneficiary account is completely dependent on the destination bank

Cut off time for remittance through Vijay Bank RTGS

Under normal circumstances the beneficiary branches are expected to receive the funds in real time as soon as funds are transferred by the remitting bank. The beneficiary bank has to credit the beneficiary’s account within 30 minutes of receiving the funds transfer message.

Information Required For Transfer Of Funds

- Amount to be remitted

- Account no. to be debited

- Name of the beneficiary bank

- Name of the beneficiary customer

- Account no. of the beneficiary customer

- Sender to receiver information, if any

If An RTGS Transaction Is Not Credited To A Beneficiary Account, Does The Remitter Get Back The Money?

Yes. If the beneficiary`s bank is unable to credit the beneficiary`s account for any reason, the former will return the money to the remitting bank within 2 hours. Once the amount is received by the remitting bank, it is credited to the remitter`s account by the branch concerned.

What is the difference between RTGS and NEFT?

- Both RTGS (Real Time Gross Settlement) & NEFT are facilitated by RBI for doing online funds transfer between various member banks.

- Effective 15th November 2010, as per RBI guidelines, RTGS (Real Time Gross Settlement) is available only for transactions of Rs.2,00,000/- and above. For any transaction below Rs.2,00,000/- NEFT should be used

Recommended Articles