Its time for Equities and only Equities: The Indian economy looks promising again which is reflected through the India’s manufacturing sector activity which climbed to a near eight-year high in January 2020. It is mainly driven by a sharp rise in new business orders amid a rebound in demand conditions that led to a rise in production and hiring activity. Well the slowdown feathers are shedding down and hence the time has come not to waste just by sitting in Debt category and staying away from equity investments. It time to invest in equities. The global economy is also coming out from the trade war slowdown and other drivers which make investing into equities more compelling. So Its time for Equities.

Its time for Equities and only Equities

Fear is more contagious than the disease. Carona Virus has disrupted life and financial markets globally. There has been unprecedented lockdowns in almost all countries including India. Not only is the world worried about spread and survival but also depth and duration of economic impact it can create.

In such an uncertain fearful environment, it is imperative to reflect likely probable scenarios of this pandemic in navigating this turmoil.

With all humility, we acknowledge not knowing when this epidemic or lock-downs will end completely. However, what is required is a sense of discipline & patience in equity investing and doing the opposite of human emotions.

Equity Investing during Pandemic times

Likely scenarios –

- a) Control of Corona spread and gradual lifting of lockdowns.

- b) Spread and control taking longer than expected with extended lockdowns.

- c) Vaccine and Cure

Control of Corona and gradual lifting of lock-downs within 1-2 months

This is a base case assumption given that globally we have seen countries like China, Korea, Japan, Hongkong, Singapore doing well to fight the crisis. Few others like Europe and US has seen the worst of spread in recent times though some reflection of bending the spread curve is noted. India has rightly adopted cautionary lockdowns given adverse ratio of medical infrastructure to population density. Gradual lifting of lock-down is being adopted in non-containment zones with restricted openings in most affected areas or red zones. In this scenario, the economic and business impact though deep, will be limited to about couple of quarters with gradual pick up in 2Hfy21

Spread and control taking longer than expected with extended lockdowns – This is low probable scenario currently based on greater awareness of caution being adopted globally with social distancing. If we do not witness bending of spread curve and consequent lifting of lockdowns (though partial) over the next two months, the risk on economy will assume greater proportions in India along with recession scare in few developed large nations.

Vaccine and cure

This is a high probable but medium term event. Over 40 companies are approved for developing vaccines though clinical trial and development would take time. Some trial of existing medicine (like anti-malarial HCQ) is on trial though mass adoption and its effectiveness is awaited. Cure or Vaccine is an eventual outcome however, what matters is the “interim” survival of health, business and financial markets.

Global stimulus to aid and fight economic downfall

What comes to aid is massive and coordinated monetary and fiscal stimulus of close to $5 trillion announced by global central bankers in addition to lower interest rates. In our experience, such money always inflate all asset prices. India will have to provide more economic and financial stimulus to support business and people (specifically at lower strata of society), in addition to Rs 1.7 trillion relief package announced so far. Fall in oil prices is welcome in such a critical time and is substantial for an importing country like India to provide additional fiscal stimulus. We also wish for corporate and capital market stimulus like NIL tax on capital gains besides relaxation on dividend and buy-back taxes in such trying times. Even otherwise, we have seen many promoters enhancing their respective stake in companies to take advantage of low valuations or releasing pledge to avert losing control at the hands of lenders. This invokes confidence.

What has market discounted?

Equity market broadly had more than adequately corrected given sharp and violent declines of 30-50% to this ‘one-off’ event, before a brief rally over the last few days. The decline has been wide-spread without any major discrimination to large or mid-caps, quality or mediocre businesses. In the near term, bending of spread curve is likely to create relief rallies – a relationship of inverse correlation between spread curve and markets. If more probable scenarios of a) or c) mentioned above do play out, then such a ‘myopic’ reaction by markets is an opportunity for long term investors with much higher margin of safety than before. After all, value of many a business is far higher based on discounted cash flows it can generate over its life compared to irrational quoted price driven by pessimism and fear. Only in case of a low probable scenario like b) mentioned above, will relief rallies of markets be short lived with possible retest of previous lows.

Investment Strategy

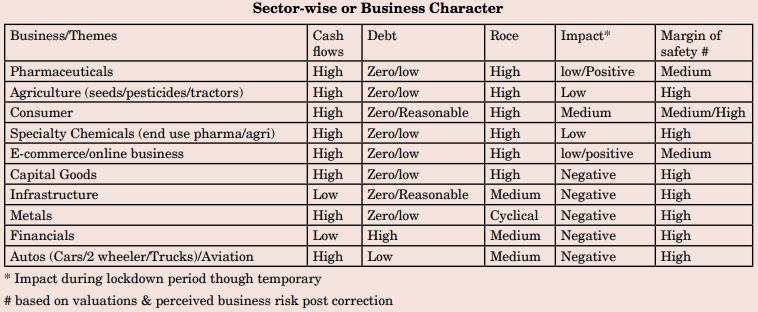

There should be undiluted quest to invest in quality businesses with cash flow & capital efficient characteristics along-with predictable growth and low leverage companies to build a long term equity portfolio. This eliminates greater degree of existential or survival threat of invested companies in such times of turmoil. Barring company specific exceptions, different businesses or sectors have different general characteristics as under –

At this stage, relative preference should be in healthcare or pharmaceuticals, agriculture, related chemicals, nondiscretionary consumer that have limited earnings impact due to lockdown. E-commerce & digital platform oriented businesses is another area that can be preferred due to scalable, asset-light & unique business model with entry barriers.

Currently, favorable value exists across several sectors. Many solid free cash flow generating, net cash companies with high ROCE are available at record low valuations. It is not about large or mid/small companies but about quality of the business model for superior and consistent returns. Investors should recognize myth of large caps being safe when several large companies in banking, telecom, real estate or metals have failed to survive or delivered poor returns in the not too distant past. As a strategy, emphasis should continue to be on cash flows, capital efficient growth oriented business. One should not be averse to participating in business that offers deep or distress values, provided respective Balance Sheet strength of companies is not compromised. For example, financial sector like Banking or NBFCs is most vulnerable in terms of their lending book/cash flows/collections. However, post sharp correction across financials, it offers deep value and highest margin of safety (selectively), provided there is access to capital and quality of book is secured.

What Should Investors do?

Fear, an emotion without facts or rationality is ruling financial markets. It is pure fear that drives people to ignore bargains when they are available in stock markets. Timing market bottoms is a futile exercise as no one can catch it precisely. Time is the best healer. Few years from now we will look at this time as a great buying opportunity. We don’t know if this panic will get worse, but can claim with certainty that this too shall pass and end like many other previous crisis. In such times, it is important to remember timeless principle by Sir John Templeton, “The point of maximum pessimism is the best time to buy” or the classic Warren Buffett quote “Be fearful when others are greedy and be greedy when others are fearful”.

Recommended