Credit Score: Lenders receive multiple loan applications daily. So it becomes necessary that credits are disbursed to individuals with good credit worthiness. The question arises how to evaluate credit worthiness? Credit worthiness is evaluated by Credit Bureaus by awarding credit score to an individual after considering various factors. The system has helped to improve the functionality and stability of the Indian financial system.

Meaning of the term Credit Score

A credit score is a numerical expression to define the credit worthiness of an individual. The score is given after analyzing the credit report received from credit bureaus. It is a three digit number ranging from 300 to 900.

Now the question arises, what is credit report? Just like our school report card, which contains details regarding performance in various subjects, credit report contains individual’s credit history, personal information, with detailed information about different credit accounts such as limits and outstanding balances, late payments etc. along with list of financial institutions which have made an enquiry regarding individuals credit report.

Credit Bureaus operating in India

Calculation of Credit Score

Each credit bureau uses different scoring model to derive credit score after analyzing the credit report. And hence an individual with same credit history would have different credit score as awarded by different bureaus. Each bureau will have its own formula to generate credit score depending on factors such as borrowing and repayment patterns, number of credit cards, number of loan applications, credit utilization and so on.

Must Read – How is Credit Rating Done?

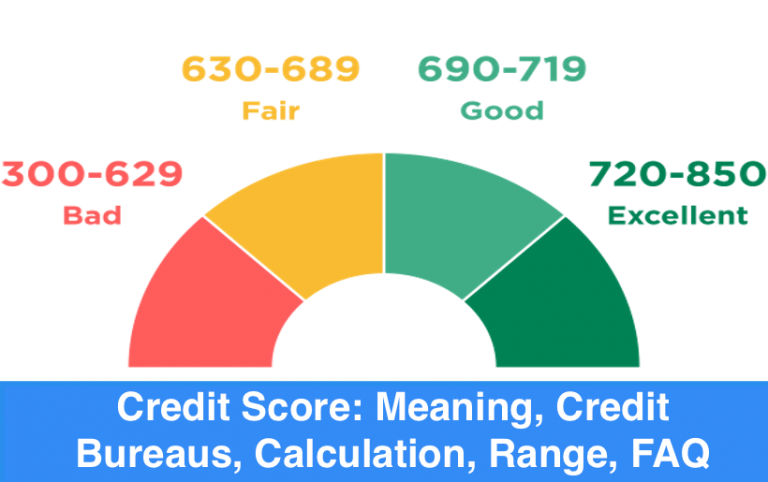

Range of Credit Score

- Excellent: 800-850;

- Very Good: 740-799;

- Good: 670-739;

- Fair: 580-669;

- Poor: 300-579

Factors affecting Credit Score

Credit score is derived after analyzing various and hence factors affecting the credit score are:

1) Lack of Credit History: The data used for defining credit score are, information about credit accounts, limit, outstanding balances, borrowing and repayment patterns, number of credit cards etc. In case an individual has never taken a loan, the above information cannot be analyzed and hence it becomes difficult for the bureaus to award a score.

2) Repayment History: Repayment patterns are analyzed while awarding the credit score. In case an individual is frequently missing the due date of payment of EMI’s and credit card amounts, timely repayment of loans, it’s going to affect his/her credit score.

3) Loan Applications: In case an individual has made several loan applications to different lenders, it reflects how much such an individual is depending credit. Credit score will be adversely affected in case several loan applications are made to different lenders.

4) Credit Utilization: It means dependence on credit. Credit utilization ratio is credit amount utilized divided by credit limit. If the ratio is high, it implies burden on repayment, which affects the credit score badly and in case ratio is low, there is low repayment burden and reflects higher credit worthiness. Similarly if credit card limits are increased frequently and simultaneously utilization is also increased, it implies excess dependence on credit which again leads to excess repayment burden and affects credit score adversely.

5) Credit Portfolio: It is said that if amounts are invested in diversified funds, there is risk minimization. Similarly if credit portfolio consists of secured and unsecured loan in right mix, credit score won’t be affected. In case credit mix consists of more percentage of unsecured loans such as personal loan and credit cards, it will affect credit score adversely.

Benefits of Maintaining Good Credit Score

Credit score is not only the factor but one of the factors considered by lenders while disbursing the credits. So it becomes essential to have a good credit score and hence the benefits of having a good credit score are:

- Good credit score indicates good credit worthiness and hence increases the possibility of approval of loan application.

- Quick and easy approval of loans.

- Credits can be availed at better terms as individuals with good credit score can negotiate in respect of processing charges, rate of interest, tenure of loan etc.

- Avail higher credit card limit with better rewards and benefits.

Frequently Asked Questions:

What credit score is considered to be a good credit score?

The range of credit score is from 300 to 900, and credit score close to 900 is considered good, because it usually reflects the greater credit worthiness of an individual.

What is CIBIL?

CIBIL is one of the four credit bureaus licensed by Reserve Bank of India to operate in India. CIBIL provide the credit report and credit score.

How credit score is calculated?

Each credit bureau uses different scoring model to derive credit score after analyzing the credit report. And hence an individual with same credit history would have different credit score as awarded by different bureaus. Each bureau will have its own formula to generate credit score depending on factors such as borrowing and repayment patterns, number of credit cards, number of loan applications, credit utilization and so on.

How does excess credit dependence affect credit score?

Excess credit dependence leads to excess burden towards repayment. And if repayment due dates are frequently missed, it affects credit score adversely.

Recommended