Understanding Reverse Mortgages: You own a house, have retired & wish fervently that there was some additional cash flow coming in, to face the twin demons of inflation & health-care costs. Your children offer to help, but you & your spouse have decided to remain self-reliant & independent.

There is hope; the Reverse Mortgage Loan. What follows is a brief introduction to the RML & its features. Caveat: As with all medicines, RML may not be right for everyone & it is certainly not a commitment to be entered into lightly.

A Reverse Mortgage Loan is just that: reverse mortgage. In a conventional mortgage, the borrower receives a loan, using her house as collateral, & pays back the loan + interest over the life of the contract.

In a Reverse Mortgage, the borrower uses the house as collateral, & receives the loan (usually in monthly instalments), but has no liability to pay off the loan + interest during its tenure.

Why RML?

- Senior Citizens comprise a substantial portion of our society

- Longevity is increasing

- As are inflation & medical expenses

- There is inadequate, if any, social security net to support them

- Income streams typically dwindle (when needed most)

- A house is usually the major asset in the individual portfolio

- With rising prices of residential accommodation, the “home equity” wealth of senior citizens is increasing

- RML is a facility to monetize this home equity & deliver a stream of cash flows to supplement their income

Features:

(as applicable in India, as per guidelines of the NHB, National Housing Bank)

- Only senior citizens (above the age of 60 years) can avail this loan

- The house is mortgaged to the lender, in exchange for periodic payments during the contracted life of the loan

- No loan servicing is required from the senior citizen (neither principal nor interest)

- On death of the borrower, or when she leaves the property permanently, the loan plus accumulated interest is repaid, by selling the property.

- Repayment can happen either by: the property vesting with the lender, disposal by the lender, recovery of loan + interest & return of excess, if any, to the borrower(s) or legal heir(s); or the borrower(s)/legal heir(s) repaying or prepaying all amounts outstanding; & the mortgage being released, without the home being sold

- NHB permits only Primary Lending Institutions (PLIs1) to extend RMLs

Who Can Borrow?

- Senior Citizen (above 60 years)

- Married couples can be joint borrowers. At least one should be above 60 years & the younger should not be below 55 years of age.

- Only residential properties, located in India, with a minimum residual life of 20 years are eligible

- The house or flat must be self-acquired & self-occupied

- The title must be clear & the property free from encumbrances

- The property in question must be the permanent primary residence of the prospective borrower

How Much?

- The loan amount will depend on market value, residual life & prevalent interest rates

- Some banks offer total loan amount up-to Rs. 2 crore (subject to full compliance)

- An overarching consideration will be that the EVR2 (Equity to Value Ratio) does not fall below 10% at any time during the tenor of the loan.

- The PLIs will re-value the property at least once every five years & the quantum of loan may change as a result of this valuation.

- The maximum monthly payment is currently capped at Rs. 50,000/- (subject to revision by the Government of India) Payment can also be quarterly, half-yearly or annually

- Lump-sum may be considered in medical emergency

- Maximum lump-sum payment cannot exceed 50% of total eligible loan amount, subject to a maximum of Rs.15 lakh (subject to revision by the Government). This amount is only to be used for medical treatment for self, spouse & dependants.

- A special feature of the RML is the non-recourse guarantee, or no negative equity. The loan + interest keep compounding & there are no repayments. Instead, cash payments are paid to the borrower periodically, as per the loan covenant.

- It could happen that over time (whether before or after the payments stop) the amount outstanding is in excess of the value of the property. To prevent distress to the senior citizens & their heirs, RML typically comes with the non-recourse guarantee.

- The borrower(s)/heir(s) are not liable for any amount, other than the market value of the house. They cannot be called on to make any additional payment, even if the outstanding amount exceeds the market value of the house.

- At most, the house can be taken over by the lender (even that, only after death of the borrowers), or when the borrower permanently shifts residence (aided nursing home or relative or another house)

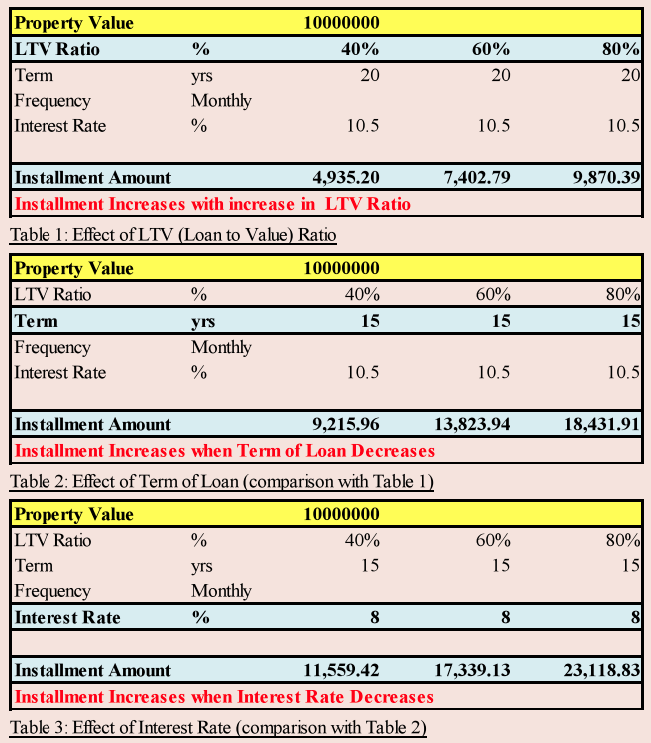

- Hence, the LTV or Loan to Value is generally about 40% & not more than 80%.

Use of Funds:

RML is a unique financial facility for a particular requirement & its end use can be only for:

- Upgradation, renovation & extension of residential property

- Home improvement, maintenance, insurance

- Medical emergencies (see lump-sum payment terms above)

- Supplementing income

- Other bona-fide needs

- Use of RML for speculative, trading & business purposes is not permitted

Interest Rate

Can be fixed or floating. Floating is generally decided as the sum of: MCLR4 + Strategic Premium + Fixed %age (usually, about 1.5% to 2%)

MCLR & Strategic Premium will also vary from lender to lender.

Rates are higher than for normal housing loans, because of the additional risks discussed above. The range is from 9.40% to 11.90% (indicative)

Other Charges

- Insurance is a must

- Processing Fees

- Service Charges & other charges as applicable

Term

Maximum 20 years (some PLIs offer maximum of 15 years in India)

Term 20 years implies that the cash flows will stop being paid to the borrower at the end of 20 years. If however, the borrower outlives the term & decides not to repay yet, the loan continues to grow with interest accumulating, without any requirement of settlement on part of the borrower.

Taxation

- All payments received under the RML are exempt from income tax u/s 10(43) of the Income Tax Act, 1961

- Capital Gains on Transfer. Section 47(16) of the Income Tax Act, 1961, excludes the act of mortgaging property for reverse mortgage, from the definition of transfer. Hence, there is no tax implication on mortgaging the property to avail of the RML.

- However, if the property is subsequently sold, either by the PLI to clear the loan, or by the borrower/heir(s), capital gains will be applicable as per the Income Tax Act, 1961.

Right to Rescission

A special feature of RML is that even after the documents have been executed & the loan disbursed, borrowers may cancel the transaction within three business days.

Closing

The PLIs will provide comprehensive documentation along with detailed benefits & obligations of the product.

Closing costs include customary fees & charges, including:

- Origination, appraisal & inspection fees

- Verification charges & Title examination fees

- Legal fees & other charges

- Valuation, Stamp Duty & Registration charges

Settlement of Loan

The loan is payable only when the last surviving borrower dies, or wishes to sell the house, or permanently moves out; which means that none of the borrowers has lived there continuously for one year.

Before selling the house to recover the outstanding loan amount, the PLI will give first right to the borrower(s)/ heir(s), with a reasonable time to clear the loan. If they do, then the property reverts back to them.

Prepayment

- Can be done anytime

- No prepayment penalty

Foreclosure

The PLI can foreclose the loan if any one or more of the following events occur. The borrower:

- has not stayed in the property for a continuous period of one year

- fails to pay property taxes, or to maintain the property

- does not insure the home

- declares bankruptcy

- effects material adverse changes, or rents out the house or part thereof

- perpetrates fraud or makes a misrepresentation

- is called upon by the government under statutory provisions, to relinquish the residential property for public use

- is served notice by the government, condemning the property (e.g. for health or safety reasons)

Important

RML is a special financial instrument, new & as yet, not fully tested by market pressures.

Counselling of the borrower is essential (in fact, in several countries, it is mandatory)

Caution

- Most people do not realize how powerful compound interest is. The loan + interest outstanding can soon become much more than the borrowers anticipated, resulting in far lower (or zero), residual equity value than they originally planned for.

- Often, the risks are not explained at the outset, or the fact that the loan amount & cash payments can change

- Floating interest rates may appear attractive, but if the interest cycle turns upward, it will create difficulties for the borrower

- A combination of falling house prices & rising interest rates can be potentially dangerous to both parties.

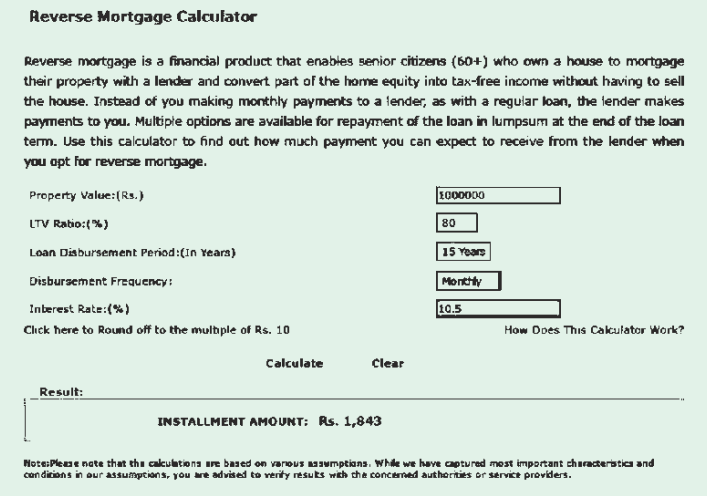

The Calculations & Logic

Conclusion

Reverse Mortgage Loan is a niche product, not for everyone. Even those who decide to opt for it must make every effort to understand the product & the possible downside.

Parting Thought: Caveat Emptor1

Actually, the full phrase is, “Caveat emptor, quia ignorare non debuit quod jus alienum emit” (“Let a purchaser beware, for he ought not to be ignorant of the nature of the property which he is buying from another party.”) In this case, the buyer is not buying property, but taking a loan. Nevertheless, the legal jargon & fine print can make life difficult for even the alert & the educated customer.

PLEASE,PLEASE, BE CAREFUL & FULLY INFORMED BEFORE PLEDGING YOUR MOST SUBSTANTIAL ASSET

ELSE, AN IMAGINED BOON CAN BECOME A CURSE. (a la Dr. Jekyll & Mr. Hyde)

Disclaimer The author makes no attempt to recommend or otherwise, any product or service mentioned here. The sole objective of this article is to share concepts & ideas, with caution always being the watchword.

Recommended