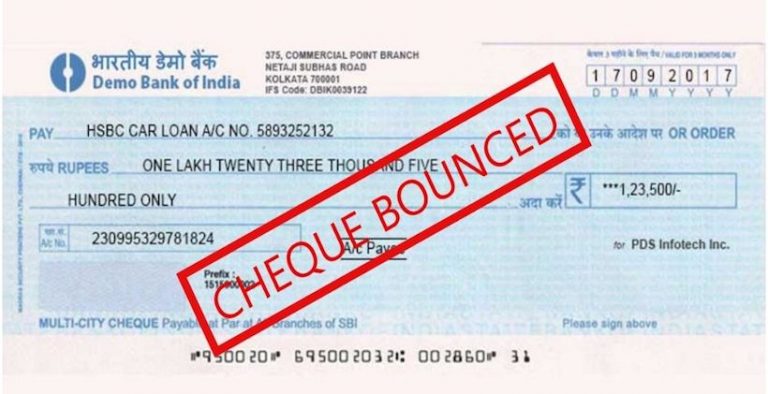

Bouncing or Return of Cheques: When a banker dishonours a cheque of a customer, appropriate reason in writing, duly signed by its official must be given. Such cheque may either be returned across the counter or through the clearing. Following are common reasons for which the cheques are returned.

Bouncing or Return of Cheques and It’s Implications

- (a) Refer to drawer – In the past, banks used to return cheques with this reason when there was no sufficient balance in the drawer’s account to honour the cheque. However, after addition of section 138 in NI Act, it is now expected that no such reason for insufficiency of funds be given. Some authors are of the opinion that when the drawer of the cheque becomes insane, the cheque signed by him should be returned with the reason “refer to drawer”. Except this situation, the reason should not be used.

- (b) Not arranged for – basically it means, the drawer has not arranged funds in the account to honour the cheque.

- (c) Effects not clear, present again – where drawer has deposited cheque/(s) which is(are) sent for the clearing but not yet realized.

- (d) Funds expected, present again – where the drawer has submitted some bills for collection, the payment of which is expected to be received.

- (e) Exceeds arrangements – when the over draft / cash credit facility sanctioned to the drawer will exceed the limit, if the cheque is honoured.

- (f) Payment countermanded (stopped) by the drawer.

- (g) Drawer’s signature differs / required.

- (h) Cheque is outdated (stale) / post dated.

- (i) Amount in words and figures differs. – although in such cases NI Act says that amount stated in words should be honoured, the general practice followed amongst bankers is to return such cheques.

- (j) Cheque crossed to two banks (unless the presenting bank is acting as an agent for another bank, whose crossing appears on the cheque.)

Offence of Cheque Bouncing – Essential Ingredients

Bouncing of a cheque invites criminal prosecution under section 138 of NI Act. Punishment for the offence under section 138 of NI Act is imprisonment up to two years or fine which may extend to twice the cheque amount or both. The offence is bailable, compoundable and non-cognizable. Essential ingredients of an offence under the section can be summed up as follows:

- A person must have drawn a cheque on a bank account maintained by him.

- The cheque should have been issued in discharge, in whole or in part, of any debt or other liability.

- The cheque has been presented to the bank within the period of its validity (3 months from the date of the cheque).

- The cheque is returned by the bank unpaid, either because of funds insufficient or it exceeds the amount arranged to be paid.

- The payee makes a demand for the payment by giving a notice in writing, within 30 days of the receipt of information by him from the bank.

- The drawer fails to make payment of the said amount of money within 15 days of the receipt of the said notice.

- Complaint is made within one month of the date on which the cause-of-action arises.

The following exception is notable:

When action is not taken against first dishonor and cheque is presented twice and complaint is filed against second dishonor, complaint is maintainable. However, the prosecution is only for the last time the cheque bounced and there cannot be multiple prosecutions for various times the cheque is returned.

The following special points need to be also considered:

- An offence in terms of section 138 is committed even if the cheque is returned on the ground of “closure of the account”.

- Return of cheque unpaid with the advice “account operation jointly, other Director’s signature required”, amounts to dishonor of the cheque within the meaning of sec. 138.

- A cheque is issued on an account which is a joint account of two individuals (say A and B). A has signed the cheque which bounces. B has not signed the cheque. Action can be taken under section 138 only against A and not against B.

- In case a cheque is returned with the comments “Refer to drawer” it will be a matter of evidence to prove that the drawer had sufficient funds at the time of return of cheque and that the bank returned the cheque for some reason other than lack of funds.

- If a cheque is returned due to its payment being stopped by the drawer, it will be necessary to prove that the drawer had sufficient funds in his account at the time of return of cheque and the stoppage was for some other justifiable reason (Discussed in more detail below).

- Absence of Mens rea (criminal intent) is not a permissible defense in bouncing of cheque.

- Even though action has been initiated under the NI Act, the holder of bounced cheque can also file an First Information Report (FIR) with a police station or can file a criminal complaint before a magistrate under sections 406, 420 and other relevant sections of Indian Penal Code, 1860 (IPC). Proceedings under the NI Act and under IPC are independent and can proceed simultaneously. This may often be a debatable point and the Honourable Supreme Court has often taken conflicting views on the subject depending on the facts of each case. The following extract from Sangeetaben Mahendrabhai Patel vs. State of Gujarat and Anr (MANU/SC/0321/2012 dated 23rd April 2012) illustrates the view of the Honourable Supreme Court in the matter.

FORGED INSTRUMENTS

Forged instrument means signature of a person fraudulently put by somebody else. A negotiable instrument containing the forged signature of its drawer, maker or acceptor is totally ineffective and the holder cannot enforce payment on them. If A forges B’s signature on a cheque and gives to C, who accepts it for consideration; acquires no title.

In case such a holder obtains payment, the true owner can sue for recovery. In the absence of genuine signature of the drawer, maker or acceptor, the instrument is totally worthless and not even the holder in due course acquires any title thereto. The forged signature cannot be ratified because the forger does not have authority to act on behalf of the person whose signature is forged.

A negotiable instrument with forged signature of endorser does not pass on valid title to the endorsee even if he is bonafide holder for value. The true owner will remain entitled to it and payment made to wrong person will not discharge the drawee, acceptor or the maker of the instrument. The paying banker however gets statutory protection against payment of cheques with forged endorsement but not with forged signature of the drawer.

Recommended