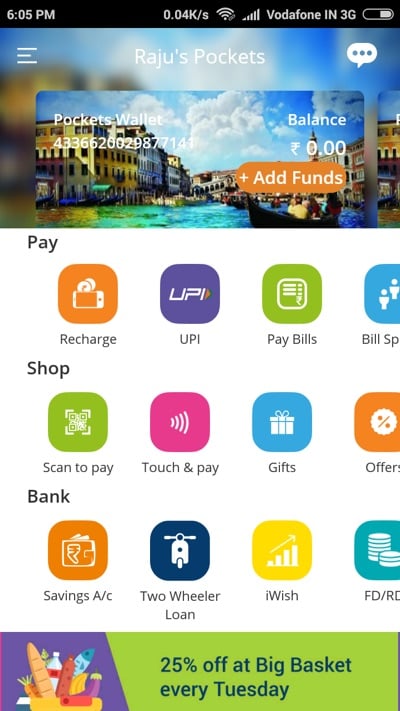

ICICI UPI App 2022: Pockets by ICICI Bank – The most comprehensive mobile wallet to (1) Pay Anyone, (2) Shop Anywhere and (3) Bank with ease for any bank’s customer. Pockets is the first app in India to offer UPI, NFC and Bharat QR code payments.

Pockets by ICICI Bank – The most comprehensive mobile wallet to (1) Pay Anyone, (2) Shop Anywhere and (3) Bank with ease for any bank’s customer. Pockets is the first app in India to offer UPI, NFC and Bharat QR code payments. With Pockets wallet, you instantly get a free virtual VISA card that can be used for shopping at all online websites/apps. You can even request for a physical card that can be used at stores.

Moreover, you can recharge your prepaid mobile or DTH connection and pay your utility bills from within the app. You can send money securely to bank accounts, your contacts or virtual payment addresses using Unified Payment Interface (UPI). That’s not all, you can upgrade to a Pockets Savings Account right from the app to get a debit card and create deposits.

Click Here to Download All Banks UPI App

ICICI UPI App 2022

By Using ICICI Pockets App you can Make payments easier using Virtual Payment Address(VPA) Pay & collect Payments Very Easily. On 23rd November 2016 ICICI Launched his UPI Apk, Many other banks already launched UPI App and ICICI Bank launched his UPI App on 23rd November 2016.

| ICICI UPI App | Click Here to Download ICICI Pockets UPI App (Direct Link Play Store) |

Steps to Download ICICI UPI App

- Step 1 – Visit on Play Store Site – https://play.google.com

- Step 2 – Now in Search Box, Please write ICICI UPI App

- Step 3 – Now you can see various Apps on Search Page, Please click on “ICICI Pockets” (ICICI Pockets is Official UPI App of ICICI Bank)

- Step 4 – Now Please click on “Install” Button

- Step 5 – Now Your app is successfully installed, Your App is Ready to Use for UPI Transactions

Click Here to Download ICICI Pockets UPI App (Direct Link)

New Features

New: Introducing Bharat QR code standard supporting Visa, MasterCard and Rupay cards.

New: Introducing payments through UPI. You can now transact (send and collect money) using UPI and manage your Virtual Payment Address or VPA from Pockets. You can also use UPI to pay merchants.

How to Use ICICI UPI App

- Every Customer will need to have a bank account and a smart phone to use ICICI UPI App

- Now Please Download ICICI UPI UPI app from Play Store or Using Above Procedure

- Now Install UPI App in Your Smartphone

- After Install UPI APP, Please Open your app

- Now your App is asking for Send a SMS for Confirm your mobile number

- After Confirmation of your Mobile Number, UPI App is started and Show all Menus of ICICI Pockets App

- Now Please Create your account on ICICI UPI App by Entering Following details – Name, Email, Gender, Mobile number, DOB etc..

- Now you will require to set your unique Virtual ID and Generate MPIN by using your Debit Card

- Now your ICICI UPI App is ready to pay, collect and Check your bank balance

How ICICI UPI App is Working

- To send money to someone, you need to know only their UPI ID – a virtual identity like an email address. This could be your name, or your phone number, so for example, if your phone number is 1234567890, then your virtual address could be 1234567890@icici (if your bank is ICICI) or 1234567890@axis (if you’re an Axis bank customer), and so on.

- By Using UPI app not need of knowing the recipient’s name, their bank account number, and IFSC code (or bank branch).

- UPI is built on top of the IMPS, which you may have used to transfer money between bank account. Like IMPS, UPI is immediate, and works 24×7, through the year, unlike NEFT or RTGS services, which have specific working hours.

- The UPI can also be used for shopping online – instead of entering your debit card number, expiry date, and CVV code, followed by waiting for the OTP, you’d just enter your UPI ID, and get an alert on your phone to verify the transaction.

Recommended Articles