Investible Weight Factors (IWFs): Investible weight factor is the unit that shows how much portion of a company’s total shares is available to the investors for trading freely on the stock exchange. It is mainly used in computing the market capitalization of a company under free float methodology.

While computing IWF, stocks held by the entities having strategic interest in a company are eliminated from the total number of shares issued. This is because those stocks are generally not freely available for trading on the exchange as the purpose of holding them is not as same as that of a normal investor.

Investible Weight Factors

The IWFs for each company in the index are computed based on the public shareholding of the companies as disclosed in the shareholding pattern submitted by the companies to the stock exchanges on quarterly basis from March, June, September and December

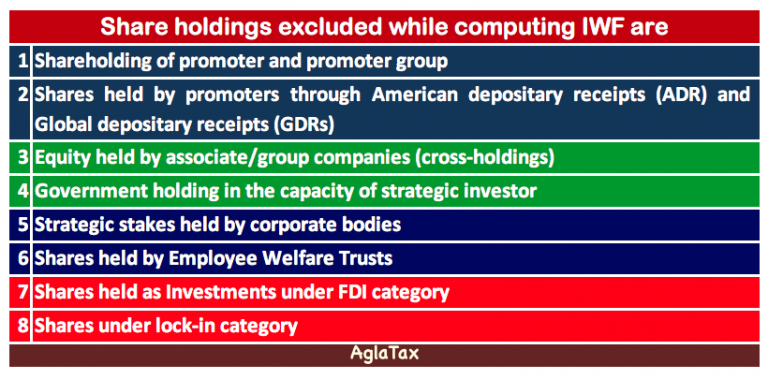

Following shareholdings are generally excluded from total issued capital to arrive at the Investible weight factor.

- Shareholding of promoter and promoter group

- Shares held by promoters through American depositary receipts (ADR) and Global depositary receipts (GDRs)

- Equity held by associate/group companies (cross-holdings)

- Government holding in the capacity of strategic investor

- Strategic stakes held by corporate bodies

- Shares held by Employee Welfare Trusts

- Shares held as Investments under FDI category

- Shares under lock-in category

Example:

PVR ltd has a total share capital of Rs 100 lakhs denominated as 1, 00,000 shares of RS. 100 each. And the shareholding pattern of PVR ltd is as follows:

| Shareholder details | Holding (no of shares) | Holding (%) |

| Equity held by state government as a strategic investor | 10,000 | 10 |

| Equity held by associate company EMR ltd | 15,000 | 15 |

| Shares held by Employee Welfare Trusts | 2500 | 2.5 |

| Shares held under FDI category | 5,000 | 5 |

| Promoters holding | 10,000 | 10 |

Investible Weight Factor (IWF) = Total free holding available for investors/Total number of shares

= [1, 00, 00 – (10,000 + 15,000 + 2500 + 5000 +10,000] / 1, 00, 00 = 0.575

What it signifies?

- A Higher IWF indicates that greater number of shares is held by the investors. Thus greater number of shares is readily available for trading on the exchange.

- It is an important factor used in determining the free float market capitalization of a company.

Free Float Market Capitalization = Shares outstanding * Price * IWF. Thus, it is major component in calculation of equity indices under free float methodology.

Must Read –