Mutual Funds Risk and return: Mutual funds, irrespective of their categories, cannot generate common returns on investments or have an equal degree of risk. Higher risks are usually involved in equity funds compared to debt or bond funds. At the same time, there’s no specific class or type of mutual fund, which is universally suited for all investors. A simplified risk-return profile can be prepared (table 2) on the basis of long-term and short term capital gains taxation norms. An investor can always modify the holding period of investment subject to the norms set for that specific fund or scheme. Now check more details about “Mutual Funds Risk and return” from below…

Mutual Funds Risk and Mutual Funds return

Generalized risk-return profile

An investor is always the best judge for his/her own risk tolerance. The trade-off between risk and return is based on the principle that the potential return increases with increased risk. Higher risk doesn’t imply a better return; rather it only gives you a probability to get higher returns. Inversely, low-risk investments can generate only low or moderate return because these are not exposed to market volatilty (diagram 3).

Must Read – What is Mutual Fund

Diagram 3: Risk-return trade-off

In the current context, an investor may want to know the concept of risk-free return. The return generated by 10-year government securities is considered as risk-free return because these instruments have no default risk

Must Read – Tax Implications of Mutual Funds on NRIs Full Guide

The Reserve Bank of India (RBI) often increases the repo-rate (the rate at which banks pay it for short-term borrowing) to combat inflation. It leads to a higher yield to maturity for the benchmark G-Sec for the shortterm. A higher yield lowers the price and leads to lower return to investors. So, the risk-free return with well protected capital is not the ultimate solution to achieve growth, especially when the stock market generated an average 19 percent annual return for the last 25 years (table 2). But more significantly, although the stock market generated higher returns, consistency was not achieved.

The return was more than 72 percent in 2003, as against a meagre 3.52 percent in 2002. The same trend returned in 2009 where the gain was a massive 81 percent, against the devastating 52.45 per cent loss in 2008 because of the worldwide financial crisis. Negative returns were noticed in seven out of the 25 years. During the last six months of the 2014-15 fiscal, the stock index gained fresh momentum, courtesy a clear political verdict.

Must Read – Types or Classification of Mutual Funds

Growth of BSE-SENSEX

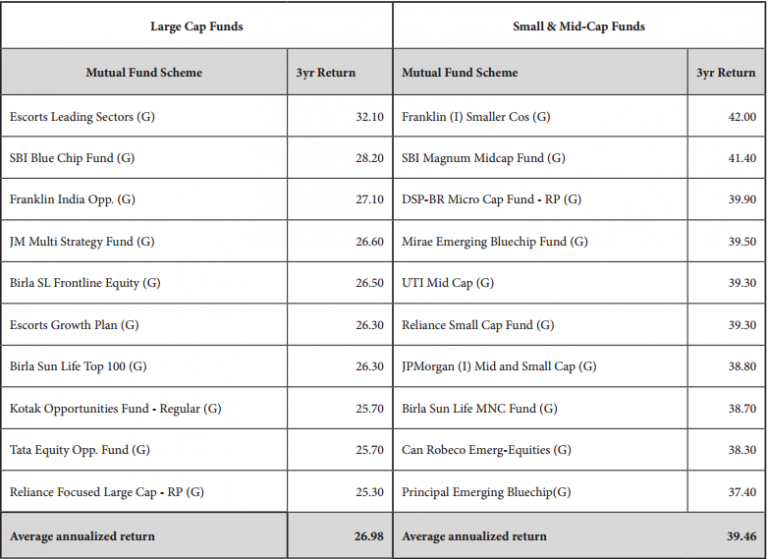

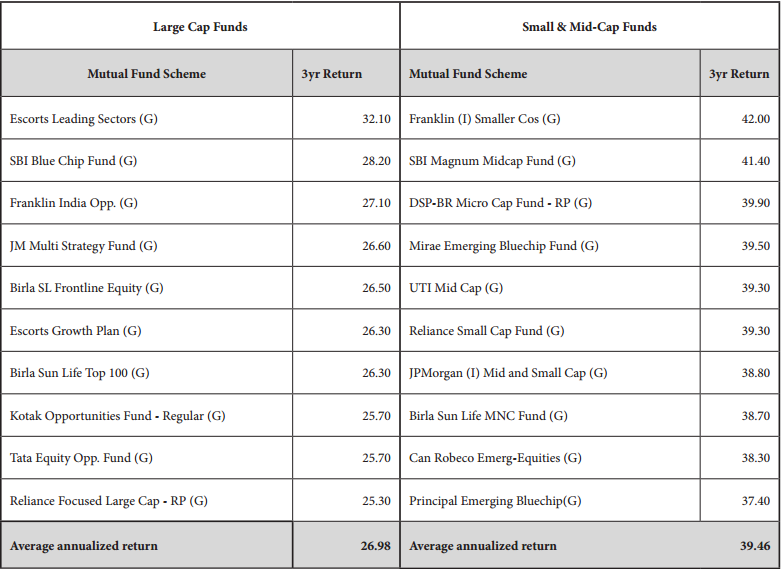

Equity investors have wider choices in large-cap, mid-cap or small-cap fund families. A comparison (table 3) for the last three years return perspective (up to July-2015) shows that the annualised average return generated by the top 10 funds in small and midcap category is higher than their large-cap peers. The three-year annualised average return generated by the top 10 fund schemes in small and mid-cap category is 39.46 percent, which is higher than the 26.98 percent generated by large-cap funds.

Must Read – Mutual funds – Pros and Cons

The analysis throws up two major challenges; a return that is more risk-free, and a stable and riskadjusted return. The ultimate solution will be to balance the portfolio.

Comparison of return between fund sub-families

Recommended Articles

- History of Mutual Funds

- Best SIP Mutual Funds

- Mutual Funds

- 7 Golden Rules

- Profitability Index (PI)

- Retail Investors and Mutual Funds

- Interest Rate of NSC, PPF, KYP, SSY, SCSS

- EPFO Mobile App

- Sectoral Mutual Funds

- Best Long Term Investment Plans

- KVP, PPF, NSC Which is best?

- National Savings Certificate (NSC)

- Startup Companies