What is NIFTY Sectoral index?: Index that is constructed by the stocks that are selected and grouped together on the basis of the industry the companies belong to is a Sectoral index. NIFTY sectoral index is calculated by grouping the stocks listed on National Stock Exchange (NSE). These are computed based on free-float market capitalization method in which the market value of the share is multiplied by the number of shares that are readily available for trading in the market. Shares held by promoters are not considered in this method. Check out more details for NIFTY Sectoral indices from below…

What is a Stock index?

A stock index is a measurement that gives the information about the price movements and overall behavior of equity markets. A stock market index is constructed using selecting a group of stocks that are representative of the whole market or a specified industry or segment of the market. An index shall have base period and a base index value.

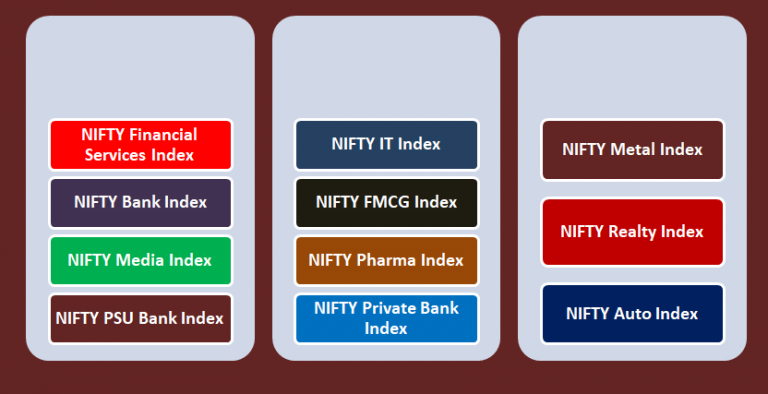

NIFTY Sectoral indices:

| NIFTY Auto Index | This index reflects the behaviors and performance of automobile sector such as manufacturers of cars & motorcycles, heavy vehicles, auto ancillaries, tyres etc. It comprises of maximum 15 stocks. |

| NIFTY Bank Index | Comprised of maximum 12 banking stocks, this index is designed to indicate the large and liquid banks. |

| NIFTY Financial Services Index | It reflects the behavior and performance of the Indian financial market which includes banks, financial institutions and housing finance and other financial services companies. It comprises maximum 15 stocks. |

| NIFTY FMCG Index | Behavior and performance of Fast Moving Consumer Goods (FMCG) is reflected by this index. The index comprises of maximum of 15 companies. |

| NIFTY IT Index | Comprising the stocks of maximum 20 IT companies, The index is designed to reflect the behavior of companies engaged into activities such as IT infrastructure, IT education and software training, networking infrastructure, software development, hardware, IT support and maintenance etc. |

| NIFTY Media Index | This is for the media & entertainment, publishing and printing industry. The index comprises of maximum of 15 companies. |

| NIFTY Metal Index | It reflects the behavior and performance of the Metals sector including mining with maximum 15 stocks considered for index construction. |

| NIFTY Pharma Index | This indicates the behavior and performance pharmaceutical companies. The index comprises of maximum of 10 stocks. |

| NIFTY PSU Bank Index | The behavior and performance of the Public sector banking companies is reflected in this index comprising of maximum 12 stocks. |

| NIFTY Private Bank Index | It is a reflection of the behavior and performance of the private sector banks. It comprises of 10 stocks having weights of each company capped at 25%. |

| NIFTY Realty Index | This is for the real estate sector. The index comprises of maximum of 10 stocks of the companies that are engaged in construction of residential & commercial real estate properties |

How are the stocks selected for construction of these indices?

Selection criteria:

- Companies which are ranked within top 800 based on both average daily turnover and average daily full market capitalization are considered. Previous six months period data is used for this ranking.

- The company’s trading frequency should be at least 90% in the last six months

- The company should have listing history for at least 6 months. However, it is relaxed to 3 months in case of a company that has newly come up with IPO and satisfies the normal eligibility criteria.

- In case of NIFTY Bank index, companies that are allowed to trade in F&O segment at NSE are only eligible to be a constituent of the index.

- In case of NIFTY IT and NIFTY Private Bank Index, a preference shall be given to companies that are available for trading in NSE’s Futures & Options segment at the time of final selection.

- The companies are sorted in the descending order of the Market capitalization computed as per Free-Float Market capitalization method

- Companies will be included if free-float market capitalization is 1.5 times the free float market capitalization of the smallest index constituent in respective index

- These will be reviewed on half-yearly basis considering 6 months data ending January and July respectively.

Recommended Articles