Sukanya Samridhi Yojana – Sukanya Samridhi Account Scheme is a small deposit scheme for girl child, as part of ‘”Beti Bachao, Beti Padhao”’ campaign, which would fetch yearly interest rate of 8.5 percent and provide income tax deduction Under section 80C of the Income Tax Act,1961. we also provide some details for Sukanya Samriddhi Yojana in Hindi & Sukanya Samriddhi Yojana vs PPF – Complete Details. Sukanya samriddhi Account Yojana Scheme, Find Everything you want to Know About Sukanya Samridhi Account. Check complete details for Sukanya Samridhi Yojana from Below.

Prime Minister Narendra Modi has Launched “SUKANYA SAMRIDHI YOJANA” (girl child prosperity scheme) with the vision to provide for Girl Child Education and Her Marriage Expense

Sukanya Samridhhi yojana changes 2021

- Changes in the rules of the default account – If you do not deposit the amount of 250 rupees in a year, then your account will be considered as default and the interest on it will be the same as fixed for the scheme. Earlier this interest was equal to the interest rate of the post office. The thing to keep in mind here is that the interest rate of Sukanya Samriddhi Yojana is 2 times the post office rate.

- New rules to close the account- According to the new rule, if you want, you can close this account before maturing. The account can be closed on the basis of sympathy in the event of the demise of the child or the account holder suffering from a dangerous disease or the death of the child’s parents.

- The girl, who has an account in her name, can operate her account only when she is 18 years old and for this, the guardian will also have to submit her documents.

Sukanya Samriddhi Yojana Interest Rates

Interest rates revisions

| FY | Date Range | Interest Rate |

|---|---|---|

| 2014-15 | 1 April 2014 to 31 March 2015 | 9.1% |

| 2015-16 | 1 April 2015 to 31 March 2016 | 9.2% |

| 2016-17 | 1 April 2016 to 30 Sep 2016 | 8.6% |

| 2016-17 | 1 Oct 2016 to 31 Mar 2017 | 8.5% |

| 2017-18 | 1 Apr 2017 to 30 June 2017 | 8.4% |

| 2017-18 | 1 July 2017 to 31 Dec 2017 | 8.3% |

| 2018-19 | 1 Jan 2018 to 30 Sep 2018 | 8.1% |

| 2018-19 | 1 Oct 2018 to 31 Dec 2018 | 8.5% |

| 2018-19 | 1 Jan 2019 to 31 March 2019 | 8.5% |

| 2018-19 | 1 July 2019 | 8.4% |

| 2019-20 | 1st April 2020 to continue | 7.6% |

(1) Interest at the rate, to be notified by the Government, compounded yearly shall be credited to the account till the account completes fourteen years.

(2) In case of account holder opting for monthly interest, the same shall be calculated on the balance in the account on completed thousands, in the balance which shall be paid to the account holder and the remaining amount in fraction of thousand will continue to earn interest at the prevailing rate.

| Type of Account | Minimum Deposit | Maximum Deposit |

|---|---|---|

| Sukanya Samriddhi Accounts | INR. 1000/- in a financial year. | INR. 1,50,000/- in a financial year. |

Subsequent deposit in multiple of INR 100/- Deposits can be made in lump-sum No limit on number of deposits either in a month or in a Financial year

If minimum Rs 1000/- is not deposited in a financial year, account will become discontinued and can be revived with a penalty of Rs 50/- per year with minimum amount required for deposit for that year.

Partial withdrawal, maximum up to 50% of balance standing at the end of the preceding financial year can be taken after Account holder’s attaining age of 18 years.

Interest will be compounded yearly and will be credited to account till the account gets matured or withdraw from the date of opening.In case of account holder opting for monthly interest, the same shall be calculated on the balance in the account on completed thousands, in the balance which shall be paid to the account holder and the remaining amount in fraction of thousand will continue to earn interest at the prevailing rate.

Benefits of Sukanya Samriddhi Yojana

- A legal Guardian/Natural Guardian can open account in the name of Girl Child.

- A guardian can open only one account in the name of one girl child and maximum two accounts in the name of two different Girl children.

- Account can be opened up to age of 10 years only from the date of birth. For initial operations of Scheme, one year grace has been given. With the grace, Girl child who is born between 2.12.2003 & 1.12.2004 can open account up to 1.12.2015.

- Account can be closed after completion of 21 years.

- Normal Premature closure will be allowed after completion of 18 years provided that girl is married.

Terms to be known:

1.Depositor-

For this scheme Depositor is an individual who on behalf of a minor girl child of whom he or she is the guardian and deposits amount in account opened under this scheme.

2.Guardian:

under this Scheme – In relation to a minor girl Child Guardian means

(i) either father or mother

(ii) where neither parent is alive or is incapable of acting, a person entitled under the law for the time being in force to have the care of the property of the minor.

1 for 1:

One Girl One Account means Depositor cannot open multiple or more than one account in the name of a Girl Child.

Maximum:

Natural or legal guardian of a girl child allowed to open one account each for two girl children

Sukanya Samriddhi Yojana For third Girl:

Under this scheme natural or legal guardian of the girl child shall be allowed to open third account in the event of birth of twin girls as second birth or if the first birth itself results into three girl children, on production of a certificate to this effect from the competent medical authorities where the birth of such twin or triple girl children takes place.

Age limitation for Sukanya Samriddhi Yojana:

The account may be opened by the natural or legal guardian in the name of a girl child from the birth of the girl child till she attains the age of ten years and any girl child, who had attained the age of ten years, one year prior to the commencement of these rules shall also be eligible for opening of account under these rules. Scheme has been commenced from 02.12.2014.

Grace Period :

It’s like a transitional period in taxation. Account can be opened up to age of 10 years only from the date of birth. For initial operations of Scheme, one year grace has been given. With the grace, Girl child who is born between 2.12.2003 & 1.12.2004 can open account up to 1.12.2015.

Related Articles

Document required for Sukanya Samridhi Account :

- Birth certificate of girl child.

- Address proof.

- Identity proof.

How to open the account :

Birth certificate of a girl child in whose name the account is opened shall be submitted by the guardian at the time of opening of the account in post office or bank along with other documents relating to identity and residence proof of the depositor. As of now, government owned banks are still in the process of completing formalities to open the Sukanya Samriddhi Yojana (SSY) Account, So you may visit any of the government banks for the purpose of opening the account ,like State Bank of India , Bank of Baroda, Punjab National Bank, Bank of India, Canara Bank, Andhra Bank, UCO Bank, Allahabad Bank, Corporation Bank

Maximum and Minimum Deposit :

The account may be opened with an initial deposit of one thousand rupees and thereafter any amount in multiple of one hundred rupees may be deposited subject to the condition that a minimum of one thousand rupees shall be deposited in a financial year but the total money deposited in an account on a single occasion or on multiple occasions shall not exceed one lakh fifty thousand rupees in a financial year.

- Minimum – Rs, 1000/- Per Year

- Maximum- Rs. 1,50,000/- Per Year

Where one can open account?

At any post office in India doing savings bank work and Branch of a commercial bank authorised by the Central Government to open an account under “Sukanya Samriddhi Account Rules, 2014”.

Maturity Period :

Deposits can be made till completion of fourteen years from the date of opening of the account. The maturity of the account is 21 years from the date of opening of account or if the girl gets married before completion of such 21 years.

Mode of Deposit :

Deposit can be made in cash or by cheque or demand draft. Where deposit is made by cheque or demand draft, the date of encashment of the cheque or demand draft shall be the date of credit to the account.

Premature closure of account .-

(1) In the event of death of the account holder, the account shall be closed immediately on production of death certificate issued by the competent authority, and the balance at the credit of the account shall be paid along with interest till the month preceding the month of premature closure of the account , to the guardian of the account holder.

(2) Where the Central Government is satisfied that operation or continuation of the account is causing undue hardship to the account holder, it may, by order, for reasons to be recorded in writing, allow pre-mature closure of the account only in cases of extreme compassionate grounds such as medical support in life- threatening diseases, death, etc.

Pre Mature Withdrawal :

To meet the financial requirements of the account holder for the purpose of higher education and marriage withdrawal up to 50% of the balance at the credit, at the end of preceding financial year shall be allowed but such withdrawal shall be allowed only when the account h

Closure on maturity

(1) The account shall mature on completion of twenty-one years from the date of opening of the account :

Provided that where the marriage of the account holder takes place before completion of such period of twenty- one years, the operation of the account shall not be permitted beyond the date of her marriage :

Provided further that where the account is closed under the first proviso, the account holder shall have to give an affidavit to the effect that she is not less than eighteen years of age as on the date of closing of account

(2) On maturity, the balance including interest outstanding in the account shall be payable to the account holder on production of withdrawal slip along with the pass book.

(3) If the account is not closed in accordance with the provisions of sub-rule (1), interest as per the provisions of rule 7 shall be payable on the balance in the account till final closure of the account.

Sukanya Samridhi Yojana Pass Book Front page

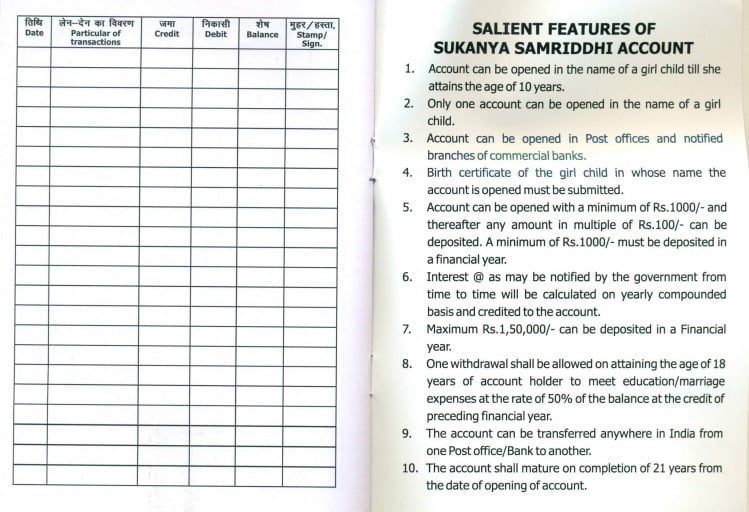

Sukanya Samridhi Yojana Pass Book Back page

Related Articles

- Sovereign Gold Bond Scheme

- Atal Pension Yojana

- Post Office Monthly Income Scheme Account

- Senior citizens savings scheme

- Jan Aushadhi Scheme

- Revised interest rates for Small Savings Schemes

- National Pension Scheme

- Pradhan Mantri Mudra Yojana

If you have any query regarding “Sukanya Samridhi Yojana – Calculation, Maturity, Interest Rate” then please tell us via below comment box…