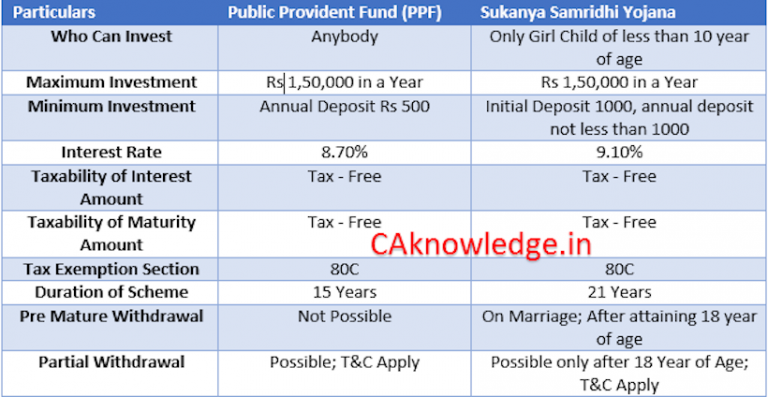

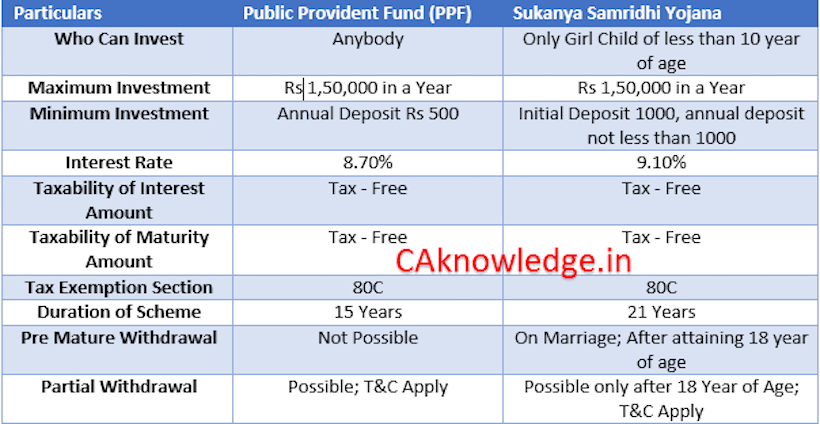

Sukanya Samridhi Yojana vs PPF. Here we provide Difference Between Sukanya Samridhi Yojana vs PPF. find our complete information regarding Sukanya Samridhi Yojana vs PPF. Find full details of Sukanya Samridhi Yojana and PPF (Public Provident Fund) Account like Eligibility, Location of opening the account etc. now you can scroll down below and check difference between Sukanya Samridhi Yojana vs PPF.

Eligibility Criteria?

- Sukanya Samriddhi yojana allows to open the account on a girl child’s name by her natural parents or legal guardian.

- Any Indian Citizen can open Provident Fund account.

If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely “

Rate of interest 2020

- In sukanya samridhi scheme From 1-4-2020 , rate of interest is 7.6%.

- In PF account from 1-4-2020 rate of interest is 7.10%.

Sukanya Samridhi Yojana vs PPF

Non resident Indians

1. Sukanya Samriddhi scheme is governed by Post Office Savings Account Rules 1981. As per RBI guidelines, a Non-Resident Indian (NRI) may not be eligible to invest in Small Savings schemes unless he opened that account while in India.

2. An NRI can not open PPF account. However, If one had already opened a PPF account when you were a resident of India and subsequently became an NRI, you may continue to deposit the monies in PPF a/c,till it matures without any facility of further extensions.

Must Read – National Pension Scheme

Location of opening the account

- One can open sukanya samridhi yojana account in authorized commercial bank branches and Post offices.

- One can open PF account in post offices and nationalized banks .And can even open PF account in Private banks like Axis bank.

Age limitation :

- An account under Sukanya samridhi yojana can be opened in the name of a girl child from the birth of the girl child till she attains the age of 10 years. As per the government’s notification, account can be opened on girl child’s name who has already attained 10 years within 1 year from now.

- No age limit for PF.

Must Read – Sukanya Samriddhi Yojana in Hindi

Required documents :

- Sukanya samridhi Account opening application form, girl child’s birth certificate under the name of whom the account is being opened, Depositor’s address & ID proofs.

- PF account requires Form – A for account opening , Nomination form, Passport size photo, Pan card copy, ID proof & address proof.

Minimum deposit :

- One has to deposit Rs 1000 as initial account opening deposit.And the annual contribution should not be less than 1000.

- The minimum annual deposit is Rs 500.

Maximum deposit :

- One can deposit more than Rs 150000 in a FY.

- Same as above.

Multiple accounts

- A depositor can open and operate only one account in the name of a girl child under this scheme. There is an exception to this rule. The natural or legal guardian can open two or three accounts if twin girls are born as second birth or triplets are born in the first birth itself

- No multiple accounts are allowed.

For latest interest rates visit – Interest Rate of NSC

Maturity

- The account will be matured after 21 years from the date of account opening or on marriage of girl child under the name of whom the account is opened, whichever is earlier.

- For PF 15 years is the tenure of maturity in case no extension is made.

Pre maturity – withdrawal :

- For Sukanya samridhi scheme 50% of the accumulated amount can be withdrawn when girl attains 18 years of age.

- partial withdrawal is allowed from 6th year onwards ,that too for some specific purposes only.

Must Read –