AU Bank Net Banking 2022: Net Banking and Mobile Banking are the facilities that enable you to perform banking transactions at your choice of place and time. You can access Net Banking via personal computer or laptop and Mobile Banking via mobile or tab, subject to the availability of an internet connection.

Special features of AU Net Banking

Available 24 hours a day, 365 days a year and you can operate your account anytime, anywhere at your convenience

- Net Banking and Mobile Banking services are secure

- Provide dashboard view of your entire relationship with the Bank

- Allows you to view recent and past transactions (Debits & Credits)

- Allows you to book deposits online

- Transfer money through various payment modes such as Internal Funds Transfer, Own Account Transfer and other Bank Transfer via. NEFT, RTGS & IMPS.

- Helps you place stop cheque instructions

- Allows you to order for a new cheque book

To know more, please visit nearest branch of AU Small Finance Bank.

AU Net Banking Login and Register

- Click here to login at AU Bank Net Banking

- Click here to register at AU Bank Net Banking

Important Requirements

What do I need to use the Net Banking and Mobile Banking services?

For accessing the Net Banking services, you will need a browser like Internet Explorer, Google Chrome, Mozilla Firefox, or Apple Safari.

For accessing the Mobile Banking services, you have to install AU Small Finance Bank Mobile Banking application on your android based phone from Play Store.

Q4. Can I use AU Small Finance Bank’s Net Banking or Mobile Banking service if I am not an account holder?

We shall be glad to have your account with us as it is a pre requisite to avail the Net Banking or Mobile Banking facilities. Visit your nearest branch of AU Small Finance Bank or call us at or 1800 1200 1200 for further details.

Q5. Who all are eligible for Net Banking and Mobile Banking services?

Net Banking and Mobile Banking services are available to all Savings Account holders.

Q6. What services can I avail on Net Banking and Mobile Banking?

Net Banking and Mobile Banking services give you 24 x 7 accessibility to your account(s) – anytime, anywhere, and at your own comfort. You can manage all of your daily transactions online. You can view statements, order checkbooks, carry out Funds Transfer, book Term Deposits and much more.

Services

Account Details: You can view your bank account details, account balance, account status, download statements, and view the mini statements. Besides, you can also view your Deposit and Loan Account details at one place.

Term Deposit: You can book Fixed Deposits online through our Net Banking. You can also view deposit details and download statement (s).

Payment: You can do internal Funds Transfer, own Account Transfer, other Bank Transfer via NEFT, RTGS & IMPS, Peer to Peer Payment (transfer money via email / mobile number), add payee and set standing instructions. If you have set standing instructions, you can also view your upcoming payments.

Other Services:

Financial: You can place instructions for issuing checkbooks and Stop Cheque payments. You can also save transactions as favourites to make hassle-free payments in the future.

Non–Financial: You can view your profile, change your password, manage alerts for Saving Accounts and view transaction limits.

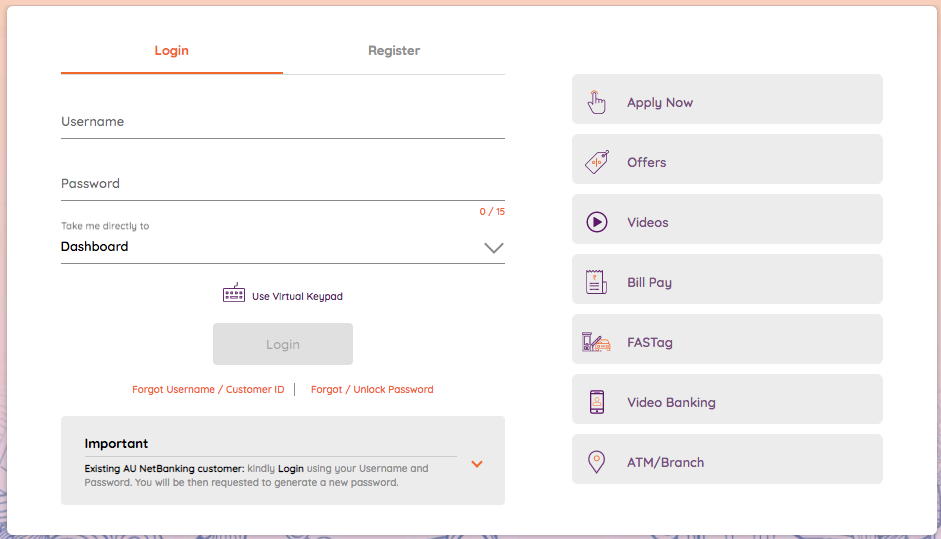

AU Net Banking Login

Q1. How do I get access to Net Banking or Mobile Banking services for the first time?

Mentioned below are the stepwise details for registering to the Net Banking or Mobile Banking facilities.

- Ensure you have your Savings/Current/Loan Account number, Customer ID, registered mobile number and Debit Card details during the registration process.

- Please select the ‘Register’ option on Net Banking and/or Mobile Banking screen.

- Please select your Account type, enter your customer ID, account number, first & last name, email ID & date of birth and click on ‘Continue’. Details provided should be as registered with the Bank.

- Post validation of the credentials entered, you will receive an OTP (One Time Password) on your registered mobile number. Enter received OTP followed by your Debit Card’s details and click on ‘Submit’ to proceed.

- Post successful authentication, you will be prompted to enter your new user ID and login password.

- Enter your new User ID and Login Password, read & accept the ‘T&C’ and ‘Submit’.

- The registration process is now complete and you can now log in to Net Banking or Mobile Banking using the newly created User ID and login password.

Please Note:

- Email ID is the registered email ID that you have provided at the time of account opening.

- If no email ID is registered with the Bank, please enter any of your valid personal email IDs.

- If account type selected is ‘Loan’, authentication will be carried out basis OTP only and the Debit Card details are not required to be filled.

Q2. How can I change my Net Banking or Mobile Banking login password?

You can change your Net Banking or Mobile Banking password at any time using the ‘Change Password’ option provided in the ‘My Profile’ section available post login.

Q3. How does one choose Net Banking or Mobile Banking login password?

Mentioned below are the guidelines for setting the AU Small Finance Bank’s Net Banking or Mobile Banking password.

- Password should be of minimum 8 characters and maximum 16 characters.

- The password should contain at least 1 number, 1 uppercase letter, 1 lowercase letter and 1 special character.

- The special characters allowed in the password are @, # and $.

Q4. What happens if I forget my Net Banking or Mobile Banking login password?

We request you to immediately regenerate your Net Banking or Mobile Banking password by entering your account details and Debit Card credentials in the ‘Forgot Password’ link available at the login screen.

Q5. What if I forget my user-id?

You can call our customer care at or 1800 1200 1200. Or you can visit the nearest branch of AU Small Finance Bank. They will guide you on further course of action.

Q6. Are user IDs and passwords case sensitive?

Your user id is not case sensitive. However, passwords are case sensitive.

Q7. What are the charges for using Net Banking or Mobile Banking services?

Currently AU Small Finance Banks’ Net Banking and Mobile Banking services are available free of cost.

AU Bank Net Banking Fund Transfer

Q1: What is Funds Transfer?

Funds transfer means the transfer of money from one bank to another bank or within the same bank under the RBI guidelines.

Q2. Which type of funds transfer can I do through Net Banking or Mobile Banking?

You can do the following types of Funds Transfer through Net Banking or Mobile Banking:

- Between your own linked accounts

- Within the bank accounts

- To Other Bank’s Accounts via NEFT,RTGS and IMPS

- Peer to Peer payment (transfer money via email / mobile number)

Q3. What is National Electronic Funds Transfer (NEFT)?

NEFT is a RBI service network which allows participating banks and their branches to transfer funds within the network in a relatively short period of time. We have extended this service to our customers through Net Banking and Mobile Banking interface. With this service you can transfer funds to various branches of most of the banks across the country as per RBI guidelines.

Q4. What is Real Time Gross Settlement System (RTGS)?

RTGS is an electronic form of funds transfer where the transmission takes place on a real time basis. In India, transfer of funds with RTGS is done for high value transactions, the minimum amount being Rs. 2 lacs.

Q5. What is Immediate Payment Service (IMPS)?

Immediate Payment Service (IMPS) is an instant inter bank electronic fund transfer service through Net Banking and Mobile Banking. This service is available 24×7, throughout the year including Sundays and any other bank holidays.

Q6. How can I do Funds Transfer transaction (NEFT, RTGS or IMPS) through Net Banking or Mobile Banking?

You will first need to register the beneficiary online to initiate a Funds Transfer transaction (NEFT, RTGS or IMPS).

Detailed steps for initiating Funds Transfer transaction are as below.

STEP-1: Login to your Net Banking or Mobile Banking

STEP-2: Addition of Beneficiary.

Please keep the following details with you during the addition of beneficiary:

- Name of the beneficiary bank and nName of the beneficiary customer

- Beneficiary account number

- IFSC code of the receiving bank branch

Stepwise details for addition of beneficiary are as below:

- Go to ‘Payments’ section and click on ‘Manage Payees’

- In ‘Manage Payees’ section, go to ‘Add New Payee’ tab

- Select type of payee as ‘Bank Account’

- Select Account Type as ‘Domestic’

- Enter the following details of the Payee

- Payee name, account number, account name, account type, IFSC code and nick name (for easy reference in future)

- Post entering the details, click on ‘Add’ to proceed further

- You will receive OTP (One Time Password) on your registered mobile number

- Post validation of the OTP, your beneficiary payee will be added

STEP-3: Initiate Funds Transfer transaction

Stepwise details for initiating Funds Transfer transaction are as below:

- Go to ‘Payments’ section and click on ‘Transfer Money’

- Select ‘Transfer Type’ as ‘Existing Payee’

- Select ‘Payee nickname’ to whom you want to transfer funds

- Select your account from which amount is to be debited under ‘Transfer From’ field

- Select type of mode from NEFT, RTGS or IMPS under ‘Pay Via’ field

- Enter transfer amount

- Enter ‘Remarks’ and click on ‘Transfer’

- You will receive OTP (One Time Password) on your registered mobile number

- Post successful validation of OTP, your funds transfer instruction will be initiated

Please note, for the safety of your account, Funds Transfer to any new beneficiary will be enabled only after 30 minutes of successful beneficiary addition. You can use IMPS service for Funds Transfer up to 30 minutes of beneficiary addition, subject to the transaction limits.

Q7. What is IFSC Code?

The Indian Financial System Code (IFSC) is an RBI issued code to uniquely identify every bank’s all branches that are participating in NEFT, RTGS and IMPS system. While selecting the payee’s branch, please make sure that the IFSC code mentioned against the branch is the same as the IFSC code of the branch you want your funds to be transferred to

Q8. What are the transaction limits post beneficiary addition?

| Type Of Transaction | Upto 30 minutes (INR) | 30 minutes to 1 day (INR) | Daily Transaction Limit post 1 day of beneficiary addition (INR) | Maximum transactions per day | Maximum Per Transaction value (INR) |

| IMPS | 5,000 | 10,000 | 10,000 | 99 | 10,000 |

| Internal FT | 10,000 | 50,000 | 10,00,000 | 99 | 10,00,000 |

| NEFT | – | 50,000 | 10,00,000 | 99 | 10,00,000 |

| RTGS | – | – | 10,00,000 | 5 | 10,00,000 |

Note: Daily Cumulative Transaction Limit of the channel is upto INR 10 Lacs.

Q9. Are there any charges levied for Funds Transfer?

There are no charges levied for using the Funds Transfer facility through Net Banking or Mobile Banking.

Q10. What are the Funds Transfer transaction timings?

Funds Transfer transaction timings are as below:

NEFT (National Electronic Funds Transfer)

From Monday to Saturday (except 2nd and 4th Saturday of the month):

- At Branch : 9:30 hrs to 17:30 hrs

- Net Banking : 8:00 hrs to 17:30 hrs

IMPS (Immediate Payment Service)

- IMPS service is available 24 x 7

Q11. Which are the declared bank holidays for the calendar year 2018?

The declared bank holidays besides Saturdays (2nd and 4th Saturday of the month) and Sundays in the Funds Transfer System (NEFT & RTGS) for the calendar year 2018 are as under:

- Friday, January 26, 2018 – Republic Day

- Friday, March 30, 2018 – Good Friday

- Wednesday, August 15, 2018 – Independence Day

- Wednesday, August 22, 2018 – Id-Ul-Zuha (Bakri Id)

- Tuesday, October 2, 2018 – Mahatma Gandhi Jayanti

- Tuesday, December 25, 2018 – Christmas

Recommended