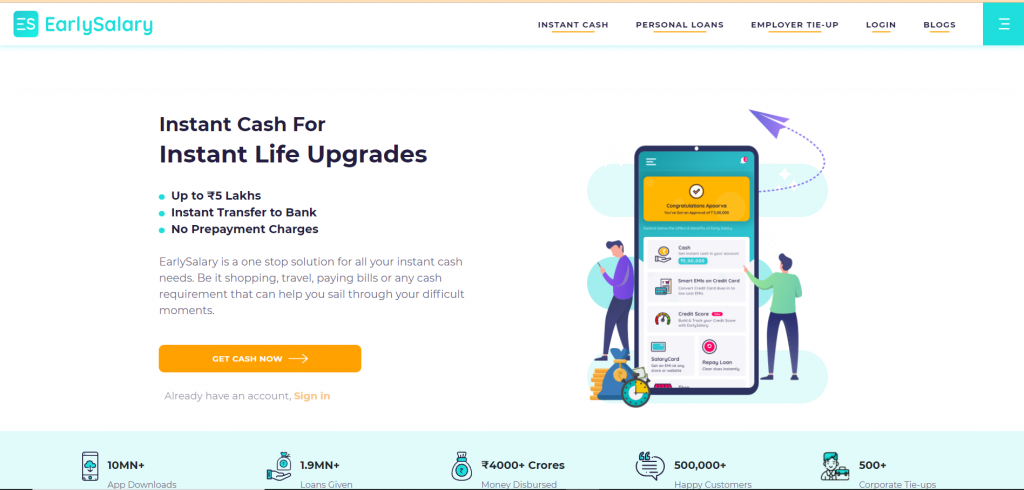

Early Salary app 2022: Benefits, How to get a loan from the app? With the help of the Early Salary app, anyone can now have access to straightforward and flexible loans. The loan given by the Early Salary app is very safe and secure, as the app is approved by RBI. There isn’t any risk in taking money from the Early Salary app. You can get a minimum of 8,000 and a maximum of 5,00,000 loans at a time.

Features of Early Salary app

Although you can also take many different loans, you also have the privilege to take as many loans as you want after repaying the previous one. The tenure is also considerable, as the minimum number of days to loan is 90 days and the maximum is 36 months. You will have enough time to repay the loan in time. However, if you still fail to repay the loan in time, you need to increase the tenure by paying an extra charge.

| Interest rate | The interest rate is 24 % to 30 % |

| Processing fee | The processing fee is meagre to begin with. You need to pay 400 rupees as the processing fee and additional taxes. |

| Features | With the help of the Early Salary app, you can take a loan of up to 5,00,000 without any paperwork and documentation. As the process is online, you don’t have to step out of your home. |

| Eligibility criteria | The applicant must have to be a citizen of India to take the benefits of the Early Salary app. You need to have a regular source of income or a specific minimum monthly salary. Your age must be either equal to 21 years or more than that, but it should not go beyond 50 years. |

| Application process (Online) | The application process runs wholly online, and anyone can apply for a loan within minutes. First of all, you need to download the app, and then you can do everything with ease. |

| Documents Required | It would help if you had either Aadhaar, passport, voter ID card, or any other document for your identity and address proof. You also need to have a pan card for KYC. |

Eligibility criteria

There are some eligibility criteria that you must need to know if you want to buy a bike. You can visit the official store, or you can also visit the official website. The eligibility criteria are nothing new for many, but beginners need to know about it.

We have mentioned all the eligibility criteria below:

- The applicant needs to be a citizen of India first to be able to take a loan from it.

- You can only take a loan from the Early Salary app if you have a regular source of income or a certain minimum monthly salary.

- You also need to have a good credit score, so that you can take a big amount at once.

- Your age must have to be either equal to 21 or more than that, but it should not go beyond 50 years.

Application process (Online)

The application process to take a loan from the Early Salary app is very simple and can be quickly filled by anyone. You don’t need to go to the bank every time, for any queries or complaints. You can do all the stuff like that directly from your home. The app provides 24*7 online services to all its customers, making it even more convenient and easy to use.

The online process is mentioned below:

Step I – first of all, you need to download the Early Salary app either from the play store or from its official website, www.earlysalary.com

Step II – after successfully installing the Early Salary app, you need to get yourself registered on it. During registration, you need to link your phone number and your bank account with the app.

Step III – once the registration is complete, you can quickly fill the application form and choose the type and loan amount you want. You can also select the tenure and interest rate for your loan.

Step IV – after filling the application form, upload the scanned image of the documents required. After uploading the documents, you can submit the appointment form.

Step V – after a few checks and document verification, your loan will be directly transferred to your bank account.

Documents required

The documents required for a loan from the Early Salary app are mentioned below:

- You need to keep an identity proof with yourself. You can have any of the identity proof like, Aadhaar card, passport, voter ID card, etc.

- Address proof is also important and you can use an Aadhaar card or driving license or any other document as an address proof.

- Income proof like, bank statement of last few months or the most recent salary slip is required.

- Pan card is also required for a successful KYC.

Frequently asked questions

Is there any penalty if I will pay the loan amount after tenure?

Yes, there is a penalty of 3 % on your pending loan amount to be paid. The fine is applied daily, so it’s better to repay the loan on time.

Can I repay the credit taken from the Early Salary app through the desired payment method?

Yes, there are plenty of payment methods available for the comfort of all the customers. You can choose to pay via any of them.

What are the additional taxes added with the processing fee?

The additional tax is the GST which is around 18 %. You need to pay the GST with the processing fee.

Can I repay the credit on EDI instead of EMI?

No, there isn’t any feature available like that. You need to repay the loan every month; you can do it daily.