HDFC Bank Personal Loan: There are plenty of features that make a personal loan better than any other loan. Also, if you are taking a personal loan from HDFC Bank, you expect an excellent and reliable deal. HDFC bank is one of the most trustworthy and dependable. The Bank gives some extra benefits to its earlier customers while providing personal loans. If you have been a member of the Bank for a long time, you can get the loan within 10 seconds. They don’t ask a lot of questions, and the process is also very smooth.

Although, if you are not a member of the Bank previously, you can still apply for HDFC Bank personal loan without any worries. In this article, we have discussed in detail HDFC bank personal loan scheme.

Features Of HDFC Bank Personal Loan

Many features make HDFC Bank personal loan better than any other. Some of the features are described below:

- The loan process is completely hassle free and for old people’s they have separate services.

- The flexibility which they provide with the funds is very helpful. With that, you can use the loan amount for any purpose.

- No need of any security or collateral, which is the best thing of a personal loan.

- Repayment is very easy and the rate of interest is also quite acceptable.

- Instant disbursement is the best, but this feature is only available for the exclusive members of the bank.

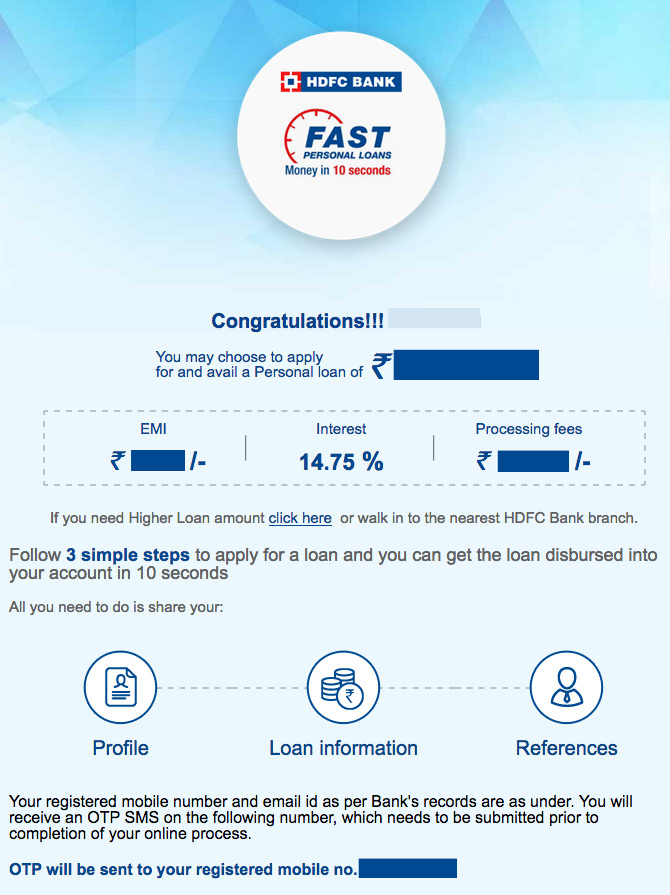

| Interest rate | 10.75 % to 20.00 % |

| Processing fee | Up to 2.50 % of the loan amount |

| Features | Completely hassle-free loan process. And if you are an HDFC Bank customer from the beginning, you can get a loan within ten seconds. You can use the loan for any purpose. |

| Eligibility criteria | You can get a maximum of 40 lakhs of personal loan whose repayment tenure is up to 5 years. |

| Application process (Online/Offline) | The process is not only offline and online, but you can also apply through the ATM. The process is hassle-free and convenient. |

| Documents Required | Identify proof, such as driving license, Aadhaar card etc. Address proof and income proof |

Eligibility Criteria

There are few eligibility criteria that you must know before applying for an HDFC personal loan. There aren’t many criteria, but still, they play a vital role in passing your loan. Without being eligible for the loan, you can’t’ take it. This is the fundamental thing, and you must know about it:

- The maximum amount of credit which you can take is 40 lakhs.

- You have to repay the amount under 5 years, otherwise some strict action will be taken against you.

- Your CIBIL score defines a lot about your credibility. If you don’t have a good CIBIL score, then forget about taking the personal loan.

- Every kind of person can apply for the loan, whether they are self employed or salaried employee, it doesn’t matter.

- Although you must have to have a good past with loan and it’s repayment. Your repayment capacity will be very important.

Documents required

There are few documents that you must have with you while filling a form for a personal loan. Without these documents, you can’t’ take any loan. These are some of the essential documents which every citizen must-have. These documents are:

- Identify proof – Aadhaar card, pan card, voter ID card, passport, etc.

- Address proof, for which you can use Aadhaar card, passport, driving license, etc.

- Two passport size photograph or scanned image of your photo.

- Income proof, which proves that you are capable of returning the loan.

- If you are a salaried employee, then you must carry the most recent salary slip.

- If you are a self employed person, then you must have the bank statement of last 6 months.

Application process (Offline/Online)

The application process for a personal loan is straightforward, and in the case of HDFC Bank personal loan, it is even easier. You don’t have to worry even a bit about your loan until you possess all the relevant documents and clear all the eligibility criteria. The fork filling is straightforward, and later documentation is also very convenient and hassle-free.

Steps for the application process of HDFC bank personal loan is:

Step I – first of all, you need to look for the HDFC Bank branch closest to your house. You can also find it on its official website or fill out the form from ATM.

Step II – once you reach the desired destination, follow the instructions and fill the form carefully.

Step III – You will have to attach some documents with your form or upload the scanned copy of your documents.

Step IV – a personal loan is unsecured, so it doesn’t need any collateral or security. So you don’t’ need to submit any as well. You have to choose the tenure and amount which you want. You also have to check the interest rate very carefully.

Step V – all your documents will now be put under surveillance, and once they are proven correct, your loan will be sanctioned within few days or even hours.

Frequently asked questions

Why would we choose HDFC personal loan when there is a lot of other options available?

Well, it’s ultimately the choice of an individual to opt for any personal bank loan, but HDFC Bank provides a lot of other benefits which can’t’ be ignored. The process is hassle-free, and the after service is phenomenal. The interest rate is relatively low as compared to others. You can also check other benefits by visiting the Bank or their official website.

Do we need to visit the Bank, or we can apply from our house?

Yes, you can apply online as well as offline. The Bank provides that much flexibility in its service.

What are the personal loan requirements?

Personal loans require minimal documentation such as income proof and ID and address proof. While the process becomes easier if you are an existing customer of the bank.

Will I be able to pay the EMIs

Personal loans generally have high interest rates and short tenures due to which there are chances that it increases your monthly EMI. Hence, use the HDFC bank EMI calculator to find out your monthly EMI payment amount.