Kotak Bank Net Banking 2023: check out step by step guide for how to login at kotak bank net banking. Login at Kotak Bank by using your Kotak Bank CRN NO. Net Banking and Mobile Banking are the facilities which enable you to perform banking transactions at your choice of place and time. You can access Net Banking via personal computer or laptop and Mobile Banking via mobile or tab, subject to the availability of an internet connection.

Special features of Kotak Bank Net Banking

Time is money and we at Kotak Mahindra Bank value your time. Change the way you bank. Available 24 hours a day, 365 days a year and you can operate your account anytime, anywhere at your convenience

- Kotak Bank Net Banking and Kotak Bank Mobile Banking services are secure

- Provide dashboard view of your entire relationship with the Kotak Bank

- Allows you to view recent and past transactions (Debits & Credits)

- Allows you to book deposits online

- Transfer money through various payment modes such as Internal Funds Transfer, Own Account Transfer and other Bank Transfer via. NEFT, RTGS & IMPS.

- Helps you place stop cheque instructions

- Allows you to order for a new Kotak Bank cheque book

To know more, please visit nearest branch of Bank of India.

How to Activate Kotak Bank Net Banking Online

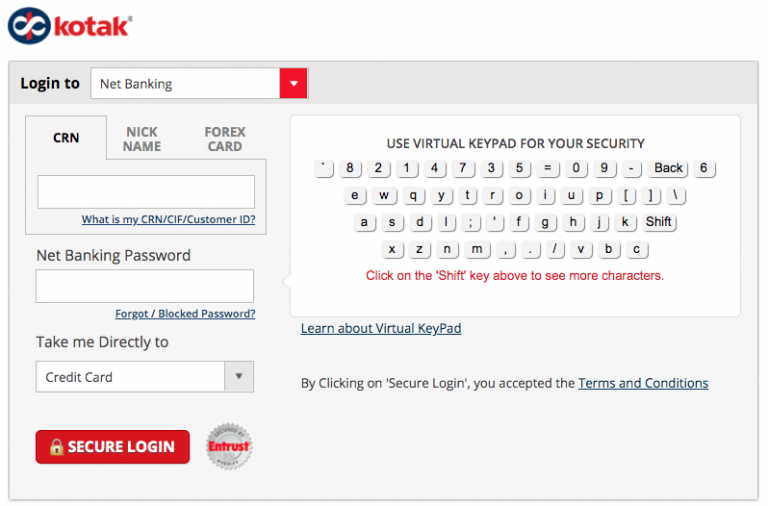

Step 1: Visit Kotak Bank official website and from the sidebar click on retail, you can find that link under internet banking. Or directly visit Kotak Bank internet banking website by following link (click here)

Step 2: From Kotak Bank net banking homepage, Enter your customer ID.

Step 3: Now Enter your Kotak Bank account number and registered mobile number. After entering captcha security text, click on continue. (Please note – Before starting the registration process, please ensure that you have the following handy: Account Number, ATM/Debit Card linked to the account number, ATM/Debit Card Credentials, Mobile number registered for the account number)

Note: Prefix country code to your mobile number without sign(+) e.g.- 9199*******33 not +9199******33.

Step 4: In the next step, you will require to enter one time password (OTP) that you will receive on your registered mobile number with Kotak Bank. enter OTP received on your mobile and then click on continue button.

Step 5: In the next step, you’ll have to enter your Kotak Bank ATM card details. After entering your Debit card credentials, hit continue button.

Step 6: Now click on Read and accept terms and conditions of using e-banking facility of the bank. Click on check-box “I agree to the above mentioned Agreement-cum-Indemnity” then press accept to proceed.

Step 7: In the next page, you will be asked to enter a password for your internet banking. Simply create a password containing special characters, alphabets, and numbers e.g.-@a2ab_12Z, and click on continue.

Step 8: Upon clicking on continue, following pop-up message will appear on your computer screen “Your request to create Internet Banking User ID is successful.” Click on “OK” and then note down your reference number, customer id, and login user id.

Important! Note down all details before pressing any key.

Step 9: This service takes one working day to activate, now you are able to access your account after 24 Hours.

Kotak Bank Net Banking Login and Register

- Click here to login at Kotak Bank Net Banking

- Click here to register at Kotak Bank Net Banking

Important Requirements

- Keep your Kotak Bank Account Number, Kotak Bank Customer ID, Kotak Bank Debit Card, Registered Mobile Number with Kotak Bank and Debit Card PIN handy during the registration process.

- Enter the received OTP (One Time Password) correctly, which you will receive on your registered mobile number.

- Please do not share your Kotak Bank Net Banking User ID and Password with anyone.

- Email ID is the registered email ID that you have provided at the time of account opening.

- If no email ID is registered with the Kotak Bank, please enter any of your valid personal email IDs.

FAQ on Kotak Bank Internet Banking

Why should I use Net Banking?

Banking on the Internet is like having a bank branch on your desktop. You can access your bank any time and from any place.

With Kotak Mahindra Net Banking, you have the advantage of viewing activities in your banking, Demat and investment accounts, transfer funds between your / third party accounts with Kotak Mahindra Bank, or with any other Bank which participates in RBI NEFT/ RTGS scheme, request a cheque book and physical statement, purchase & redeem investments online1, pay your utility bills, register for payment gateway and access many more services.

How will I know that my transaction has been completed?

The Kotak Bank NetBanking system will let you know. Depending upon the transaction you have requested, NetBanking will:

- Display the information you have requested

- Accept your instruction and show an appropriate message to that effect or give you a transaction reference number which you may use to refer to your transaction in all future communication

- Display an appropriate message on why it cannot complete your transaction or ask you to try again

How can I log in if I have forgotten my password?

In case you have forgotten your password you can re-generate it using our Instant IPIN facility online.

How do I change my password?

To change your IPIN (password), first log in to NetBanking with your Customer ID and current password. After you have logged in you can change your password using the ‘Change Password’ option. Your password should be a minimum of 6 characters and a maximum 15 characters and should be alphanumeric (have letters, numbers or both).

Am I eligible for NetBanking?

If you have an Kotak Bank Savings or Current account, then you are eligible for NetBanking and you can access your account through NetBanking.

What kind of hardware and software is recommended to use NetBanking more efficiently?

The minimum requirements to use NetBanking are:

Hardware: You need to have a Pentium PC with 32 MB RAM, 2.1 GB Hard Disk Space with 500MB free space.

Software: You need to have a browser: Internet Explorer Version 8 or higher, Google Chrome Version 24 and higher, Firefox Version 17 or higher.

Where can I open a new Fixed Deposit?

- Customer can open a Fixed Deposit in any nearest Kotak Bank branches in the country.

- Customer can also open Fixed Deposits through Kotak Bank NetBanking provided:

- You have registered for the facility with necessary online financial transaction rights

- Your PAN number is updated under your Customer Identification Number in Bank’s records

What are the charges and limits for RTGS?

From 15th November, 2010 RTGS transactions are charged according to the conditions below:

- Rs. 2 Lakhs to Rs. 5 Lakhs – Rs. 25 (inclusive of taxes) per transaction

- Above Rs. 5 Lakhs – Rs. 50 (inclusive of taxes) per transaction

Charges for RTGS transactions done through Net Banking are not applicable for Current Accounts: Apex / Max / Plus / Merchant Advantage Plus / Flexi / Trade / Merchant Advantage / Premium / Regular.

The maximum amount of funds that can be transferred per customer ID every day is Rs. 10 Lakhs. The minimum amount is Rs. 2 Lakhs.

How do I register for TPT (Third Party Transfer) services online?

You can register for TPT (Third Party Transfer) services online by following the below steps:

- Step 1# Login to NetBanking using Cust ID & password

- Step 2# Click on the TPT tab and ‘Register Now’

- Step 3# Select the Debit Card and enter the Debit Card details

- Step 4:# Confirm their mobile number and enter the OTP (One Time Password) which they have received on their registered mobile number

In case you are not registered for Secure Access you will be asked to register for it by selecting 5 Challenge Questions, Image and a Message

Recommended Articles