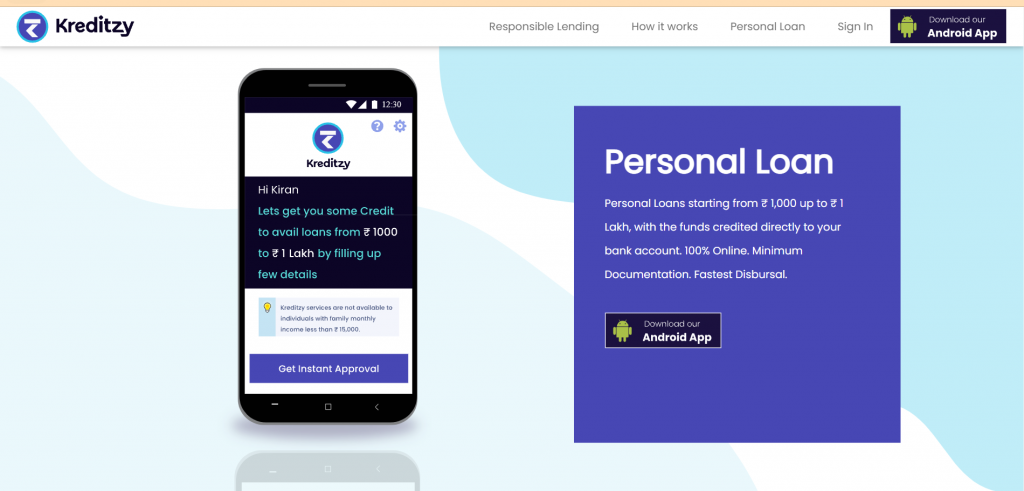

Kreditzy loan app 2022: Kreditzy loan app is a very successful platform that provides straightforward and convenient personal loans to every individual in India eligible for it. You can take a loan amount ranging from 1,000 to 1,00,000 within minutes, and the entire process is entirely online. Also, the service of the application is phenomenal, and you can be completely rest assured.

Features of Kreditzy App

Kreditzy app provides a service 24*7 throughout the country. The interest rate and processing fee depend primarily on the applicant’s salary, annual income, risk profile and credit score. The tenure is quite flexible, with a minimum of 91 days and a maximum of 365 days. You can repay the loan in this period, or else you can also repay it before time. There are no prepayment penalties on it. There are few lending partners of Kreditzy like Krazybee services Pvt. and Usha financial services Pvt. You can expect to have a lot of offers from the partner companies.

With a personal loan of up to 1 lakh, many young individuals can now dream big and do anything they want.

| Features | Kreditzy app is one of the most famous and successful loans providing platforms. With the help of the Kreditzy app, you can easily take a loan amount as high as one lakhs within minutes. With the help of Kreditzy, the entire amount gets directly transferred into your bank account without any trouble. The interest and processing fee is also minimal and depends hugely on your credit score, salary and risk profile. |

| Eligibility criteria | There are some eligibility criteria which must be looked like, you need to be a citizen of India, your age must have to be either equal to 21 or more than that, you need to have a minimum monthly salary of 10,000 INR, and a few more. |

| Application process (Online) | The application process is entirely online and hassle-free. You can apply for the loan simply by downloading the Kreditzy app from any app store. Later process is straightforward to fill. |

| Documents Required | Documents such as an Aadhaar card, passport, voter ID card, driving license, etc., are required to prove your identity and address. There are other documents needed as well, like salary proof, pan card, etc. |

| Official App | Kreditzy |

Eligibility criteria

Some eligibility criteria are available that must be looked at closely to know more about Kreditzy and its services. Also, it would help if you needed to see these eligibility criteria, as without being eligible for the personal loan, you can’t take it.

We have mentioned all the eligibility criteria below:

- First of all, you need to be a citizen of India to be able to take a personal loan from the Kreditzy app.

- You need to have a regular source of income, so that you can easily repay the loan amount.

- Your monthly income must have to be either equal to 10,000 or more than that, if you want to take a loan from Kreditzy.

- Your age must have to be either equal to 21 or more than that.

- You need to have a good credit score so that loan approval remains smooth and easy.

Application process (Online)

The application process to take a personal loan from the Kreditzy app is easy and convenient to fulfil. You need to follow a few steps to be able to fill the application form with ease. Also, as the process is entirely online, it is much easier now. You don’t have to be worried about paperwork and documentation, which makes life so easy.

To read more about: Register Mobile Number in Bank of India, boi mobile no registration

We have mentioned the steps to apply for a loan from a Credit app online:

Step I – first of all, you need to download the Kreditzy app either from the Play Store or any other app store.

Step II – For details about the loan and its eligibility and approval, you can easily visit the official website, www.kreditzy.com.

Step III – Now that you have installed the app, you need to get yourself registered by providing the app with your phone number and email id. You also need to link your bank account with the app.

Step IV – after registering, you need to fill the application form and provide all the details about your income. Later, you need to choose the loan amount, tenure and other things. You can also see the interest and processing fee there.

Step V – now, you need to upload the documents required by simply scanning them all. You can easily upload the documents and submit the application form.

Step VI – after completing the application process, you need to wait for a few minutes till the amount gets transferred.

Documents required

We have mentioned all the documents required below:

- Identity proof – Aadhaar card, passport, voter ID card, etc.

- Address proof – Aadhaar card, driving license, passport, etc.

- Income proof, for which you can either use the bank statement of the last few months or the most recent salary slip. You can also use income tax return or other relevant documents.

- A pan card is required for a successful KYC.

Frequently asked questions

What is the maximum loan amount which one can take?

You can take a maximum of 1 lakh loan from the Kreditzy app.

What is the maximum tenure to repay the loan amount?

The full term to refund the loan amount is 365 days or one year. You can quickly repay it at this time.

Is my credit score getting disturbed by it?

Yes, if you repay the loan in time and maintain a good relationship with Kreditzy, your credit score will keep increasing; otherwise, vice versa.

Is the loan amount depending on my salary?

Yes, the amount depends on salary in most cases. It’s also calculated on your stable income and risk profile.