SBI’s virtual card: It is virtual card that can be generated using internet banking on the SBI’s website. The card so generated can be used only one time for making any online payments that accept Visa cards / MasterCard Debit Cards. No amount will be debited to your bank account when the card is created. Amount is debited only when the card is used successfully.

State Bank of India virtual card

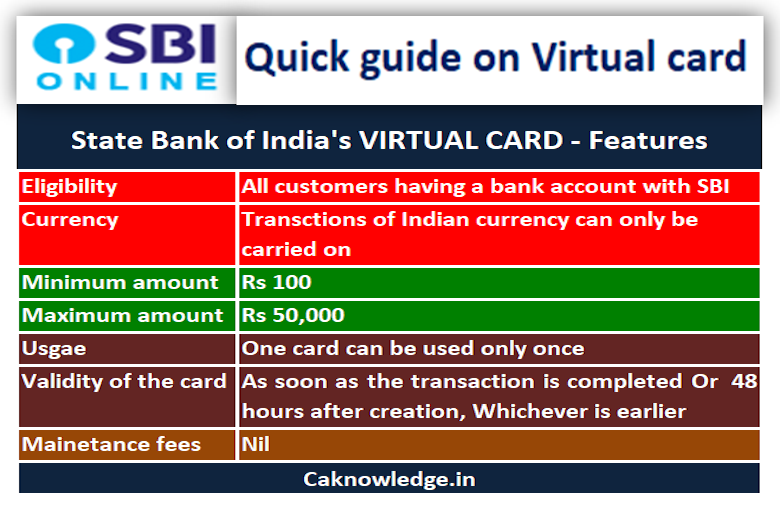

| Description | Features |

|---|---|

| Eligibility | All INB Customers with Transaction Rights having PAN registered with the Bank can avail this facility. |

| Card Type | Visa (may be extended to Master Card Platform) |

| Currency of Issue | Indian Rupee only. |

| Minimum amount of Issue | Rs.100/- |

| Maximum amount of Issue | Rs.50,000/- |

| Frequency of usage (Single / Multi) | Single-transaction Card |

| Card Acceptability | At any merchant outlet that has facility for Online purchase. |

| Domestic / International | Domestic use only. (Valid for payment in INR in India, Nepal & Bhutan) |

| Card Validity | “As soon as transaction is completed. Or If the card is cancelled. Or Card is not used for 48 hours after creation. (whichever is earlier)” |

| No of cards per customer per day | No limit |

| Issuance / Maintenance Fee | NIL |

| Refund / Cancellation | Once card is cancelled or expired, the lien marked shall be lifted and the unspent /unutilized amount will automatically be available to the customer for use. |

Features SBI virtual card:

Secured and easy:

- A virtual card contains a unique card number, CVV that can be used only once. Once the CVV is used for one transaction, the card becomes unusable. Card is valid up to a maximum of 48 hours or till the transaction is complete, whichever is earlier. It expires automatically after 48 hours of time if not used

- So, nowhere while transacting, your primary card details are communicated. Hence the exposure of your account to online vulnerability is almost not possible.

- Also, it is very easy to create and use the card. Anyone who is familiar with internet banking can use this.

Flexibility:

- Customers while creating a card can set the amount as per their wish subject to a minimum Rs 100 and maximum Rs 50,000

- Also, there is no limit on number of cards that can be created. So, can create any number of Cards as he wants subject to sufficient balance in his bank account and with a maximum limit of Rs. 50,000 per card.

- Also there is a flexibility that one can use the Virtual Card for partial amount, provided the amount is below the card value. Only to the extent of usage the amount will be debited to your bank account.

No additional charges:

This is just an add-on facility that is associated with your existing cards/account. So, the banks do not charge any service charges for this facility.

No need to worry about stealing:

Even if you suspect that someone has seen your virtual card details, he/she cannot make use of the card as it requires them to enter the OTP sent to your registered number while attempting to make payment through it. So, the chances of fraudulent use are very low.

- Any customer having a bank account in SBI with internet banking being activated can create virtual cards online. There is no need to approach the bank to enable this option before you start creating one.

How to create SBI Virtual cards?

- First of all, you must login to your account on SBI’s online banking website. You can on the horizontal bar located on the top showing features such as my account, payments, bill payments and so on till e-Cards. Click on the e-cards.

- Then you will a section called state bank virtual card. There, click on generate virtual card.

- Next select the account and enter the amount you want to set for your virtual card.

- Then the bank will send a highly secured one-time password (OTP) to your registered mobile number.

- Enter the OTP and click on confirm. Then the bank successfully process your request, you can see a virtual card displayed with your name, card number, card limit, CVV and expiry date.

Limitation:

The virtual card offered by SBI is a domestic card and can be used for online payment in India Rupee (INR) in India, Nepal and Bhutan only. So, it is not possible to use the same to make international purchases by paying in currency other than Indian rupee.

Demo: You can see the demo provided by SBI on how to create a virtual card by accessing the following Click Here

Recommended Articles